Stock Markets

When inflation data released last week showed it slowing down on a monthly basis, despite still being elevated year-on-year, stocks rallied significantly in hopes that the rise in consumer prices may have seen their highest level. The market appeared optimistic that the Federal Reserve would move away from raising rates by 75 basis points (0.75%) in September as they had resorted to in the recent past, although the Fed clarified that they still had much work to do before inflation can be tamed. The consumer price index (CPI) and producer price index (PPI) inflation data for July moved down, which was a welcome development after June’s unexpected accelerated indicators.

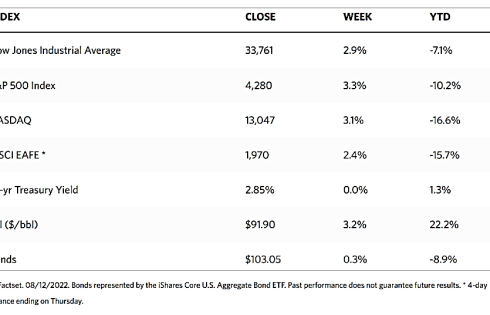

The Dow Jones Industrial Average (DJIA) rallied 2.92% for the week with a 957.58-point rise. The total stock market surged higher by 3.43% or a 1.434.21 increase. The S&P 500 Index gained 3.26% while the tech-heavy Nasdaq Stock Market Composite also rose 3.08%. the NYSE Composite likewise returned 3.48% for the week. Consumer staples underperformed the other sectors. In the weeks following, volatility may still be high, but if inflation continues to improve moderately but consistently, the markets may be poised for a sustained, longer-term rally.

U.S. Economy

While the headline CPI reported this week was lower than last month, the core CPI remained largely unchanged. The lower inflation figure was attributed to lower fuel and energy prices which impacted both the CPI and the PPI. The latter also benefitted from an improvement in the global supply chain as indicated by better delivery times, lower shipping-container rates, and a reduction in the Fed’s Global Supply Chain Pressure Index. There is some concern that changes in consumer habits may also have lowered demand for energy and fuel which in turn contributed to the reduction in fuel prices.

The lower-than-expected inflation data prompted an increase in steepening bets among investors that caused a pullback in front-end rates and a slight rise in longer-term yields. The optimism that inflation may have peaked caused a risk-on rally in investment-. grade corporate bonds. For the moment, the Fed remains committed to further increasing interest rates, citing that despite the apparent slowdown, inflation figures remain at historic highs. Chicago Fed President Charles Evans opined that the central bank may need to raise rates to as high as 4% by the end of 2023.

Metals and Mining

On Friday, gold closed with a fourth straight weekly gain, Analysts were expecting gold to rally significantly after inflation figures slowed down, since gold is a non-yield asset that tends to fall when fixed-income rates increase following a Fed rate hike. When colder weather kicks in, however, there is a chance that energy and fuel prices may once again ascend which may prompt inflation to once more increase. Some speculate that if gold cannot close around the $1,820 per ounce price level, the much-anticipated breakout summer rally may be out of the question, implying that the precious metal may even pull back to $1,700 per ounce.

Over trading last week, gold rose 1.52% above its prior week’s close at $1,775.50 to end the week at $1,802.40 per troy ounce. Silver, which closed the previous week at $19.90, ended the just-concluded week at $20.82 per troy ounce, a rise of 4.62%. Platinum began at $936.26 but closed on Friday at $965.33 per troy ounce, gaining 3.10%. Palladium previously closed at $2,129.29 but ended the week at $2,224.95 per troy ounce, increasing week-on-week by 4.49%. The three-month futures prices for base metals likewise ended the week on a higher note. Copper increased by 2.81% from its previous week’s close of $7,870.50 to its recent close at $8,091.50 per metric tonne. Zinc ended the prior week at $3,488.50 but closed this week at $3,589.00 per metric tonne for a gain of 2.88%. Aluminum, which was previously pegged at $2,416.00, closed Friday at $2,434.50 per metric tonne for a slight increase of 0.77%. Tin began at $24,455.00 and ended at $25,177.00 per metric tonne to lock in a gain of 2.95%.

Energy and Oil

The recently concluded week was a volatile one for oil markets. It was dominated by a gloomy sentiment although, by the week’s end, oil prices still registered a gain. Accounting for the late-week recovery was the flat U.S. month-on-month inflation data and pipeline supply disruptions in Europe. The increasingly divergent world views of the Organization of Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA) also contributed to market speculation. OPEC was reducing further its demand forecasts for 2022; it brought down its estimated this week by another 260,000 barrels per day (b/d) due to recessionary pressures. The IEA, on the other hand, has increased its outlook by 380,000 b/d to 2.1 million b/d, arguing that elevated gas prices will be incentivizing higher crude utilization and demand. The IEA was optimistic that gas-to-oil switching will provide a boost to the recessionary-wary oil markets.

Natural Gas

For the report week from August 3 to August 10, 2022, the Henry Hub spot price increased by $0.06 from $7.83 per million British thermal units (MMBtu) at the start of the week to $7.89/MMBtu by the week’s end. As for the Henry Hub futures prices, the price of the September 2022 NYMEX contract descended $0.06, from $8.266/MMBtu on August 3 to $8.206/MMBtu on August 10. The price of the 12-month strip-averaging September 2022 through August 2023 futures contracts fell by $0.02 to $6.032/MMBtu for the report week. Regarding international futures prices, the weekly average futures prices for liquefied natural gas (LNG) cargoes in East Asia rose by $0.65 to a weekly average of $44.61/MMBtu, while natural gas futures for delivery to the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas spot market in Europe, dipped by $0.38 to a weekly average of $59.16/MMBtu.

World Markets

European shares made gains for the week as concerns abated that central banks will further hike interest rates. The pan-European STOXX Europe 600 gained 1.18% for the week, in local currency terms. Major indexes likewise advanced. France’s CAC 40 Index rose by 1.26%, Germany’s DAX Index climbed 1.63%, and Italy’s FTSE MIB Index ascended 1.70%. The UK’s FTSE 100 Index added 1.80%. The core eurozone government bond yields likewise ascended higher. The UK and the peripheral eurozone government bond yields broadly tracked the core markets. Some of the major European countries proclaimed that they would make more emergency funds available to support the slowing economies and to enable citizens to keep up with the rising cost of living. For instance, German Finance Minister Christian Lindner announced that the government would provide EUR 10 billion in tax relief. The French Parliament also recently passed a support package of EUR 44 billion, which includes nearly EUR 10 billion for nationalizing the power company, Électricité de France. Industrial production in the euro area rose for a third consecutive month in June, while output increased more than expected due to a large uptick in capital goods.

Japan’s stock markets rose over the week. The Nikkei 225 Index and the broader TOPIX Index similarly increased by about 1.3%. Investment appetite strengthened mainly due to the weaker-than-expected U.S. inflation data, supporting hopes that the Fed will temper its currently aggressive monetary policy. A reshuffling of Japan’s Cabinet suggested that monetary policy will continue to be dovish by retaining top figures in key positions, boosting investor sentiment. The yield on the 10-year Japanese government bond rose to 0.19% from the previous week’s 0.16%. The yen gained strength against the U.S. dollar to end at approximately JPY 133.4 (from what was previously JPY 135.0).

China’s bourses ended the week mixed. Encouraging news of a record trade surplus last month and a central bank report that signaled support for growth were offset by a flare-up in coronavirus cases that coincided with the announcements. The broad, capitalization-weighted Shanghai Composite Index gained 1.5% while the blue-chip CSI 300 Index, which tracks the largest listed companies in Shanghai and Shenzhen, rose by 0.8%. A continued slowdown in the housing market and the coronavirus case spike that coincided with it were deemed serious risks to China’s recovering economy in the short term. Chinese coronavirus cases accelerated to a three-month high, half of which took place in the southern coastal island of Hainan which was widely locked down in the past week. The 10-year Chinese government bond yield slipped to 2.755% from the previous week’s 2.7652% as interbank money rates remained below policy rates, hovering at two-year lows.

The Week Ahead

Among the economic news to be released in the coming week are the building permits and housing starts, industrial production, retail sales, and jobless claims.

Key Topics to Watch

- Empire State manufacturing index

- NAHB home builders’ index

- Building permits (SAAR)

- Housing starts (SAAR)

- Industrial production

- Capacity utilization rate

- Retail sales

- Retail sales ex-motor vehicles

- Real retail sales

- Fed Gov. Michelle Bowman speaks

- Business inventories

- Federal Open Market Committee minutes

- Fed Gov. Michelle Bowman speaks

- Initial jobless claims

- Continuing jobless claims

- Philadelphia Fed manufacturing index

- Existing home sales (SAAR)

- Leading economic indicators

- Kansas City Fed President Esther George speaks

- Minneapolis Fed President Neel Kashkari speaks

- Richmond Fed President Tom Barkin speaks

- Advance report on selected services

Markets Index Wrap Up