Paycom Software (NYSE:PAYC – Get Rating) had its price target boosted by stock analysts at Stifel Nicolaus from $375.00 to $400.00 in a research note issued on Wednesday, The Fly reports. Stifel Nicolaus’ target price points to a potential upside of 13.36% from the company’s current price.

Several other analysts also recently weighed in on the stock. KeyCorp lifted their target price on shares of Paycom Software from $340.00 to $390.00 and gave the company an “overweight” rating in a report on Wednesday. TheStreet downgraded shares of Paycom Software from a “b-” rating to a “c+” rating in a research note on Monday, May 2nd. Piper Sandler boosted their price target on shares of Paycom Software from $361.00 to $387.00 and gave the stock an “overweight” rating in a research note on Wednesday. Credit Suisse Group boosted their price target on shares of Paycom Software from $350.00 to $375.00 and gave the stock a “maintains” rating in a research note on Wednesday. Finally, Jefferies Financial Group restated a “buy” rating and issued a $335.00 price target on shares of Paycom Software in a research note on Wednesday. Six equities research analysts have rated the stock with a hold rating and six have given a buy rating to the company’s stock. Based on data from MarketBeat, the company presently has an average rating of “Moderate Buy” and a consensus target price of $386.14.

Paycom Software Trading Up 4.4 %

Shares of NYSE PAYC traded up $14.99 during midday trading on Wednesday, reaching $352.85. 36,166 shares of the stock were exchanged, compared to its average volume of 403,572. The company has a 50 day simple moving average of $298.90 and a 200 day simple moving average of $311.65. The stock has a market capitalization of $21.26 billion, a P/E ratio of 91.89, a PEG ratio of 3.09 and a beta of 1.50. The company has a debt-to-equity ratio of 0.03, a quick ratio of 1.08 and a current ratio of 1.08. Paycom Software has a twelve month low of $255.82 and a twelve month high of $558.97.

Paycom Software (NYSE:PAYC – Get Rating) last announced its quarterly earnings results on Tuesday, May 3rd. The software maker reported $1.56 earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of $1.42 by $0.14. The business had revenue of $353.52 million during the quarter, compared to the consensus estimate of $343.20 million. Paycom Software had a net margin of 19.64% and a return on equity of 25.12%. The business’s revenue was up 29.9% compared to the same quarter last year. During the same quarter last year, the firm earned $1.10 EPS. As a group, equities analysts expect that Paycom Software will post 4.3 earnings per share for the current year.

Paycom Software declared that its Board of Directors has initiated a stock repurchase plan on Tuesday, June 7th that permits the company to buyback $550.00 million in outstanding shares. This buyback authorization permits the software maker to reacquire up to 3% of its shares through open market purchases. Shares buyback plans are typically a sign that the company’s board believes its stock is undervalued.

Insider Activity at Paycom Software

In related news, CEO Chad R. Richison sold 9,611 shares of the company’s stock in a transaction that occurred on Wednesday, May 11th. The shares were sold at an average price of $275.24, for a total transaction of $2,645,331.64. Following the transaction, the chief executive officer now owns 4,727,444 shares of the company’s stock, valued at $1,301,181,686.56. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. In other Paycom Software news, insider Bradley Scott Smith sold 1,625 shares of the stock in a transaction that occurred on Wednesday, May 11th. The shares were sold at an average price of $275.24, for a total transaction of $447,265.00. Following the transaction, the insider now owns 3,600 shares of the company’s stock, valued at $990,864. The transaction was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Also, CEO Chad R. Richison sold 9,611 shares of the stock in a transaction that occurred on Wednesday, May 11th. The stock was sold at an average price of $275.24, for a total transaction of $2,645,331.64. Following the transaction, the chief executive officer now directly owns 4,727,444 shares in the company, valued at approximately $1,301,181,686.56. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 19,721 shares of company stock valued at $5,441,538. Company insiders own 15.20% of the company’s stock.

Institutional Investors Weigh In On Paycom Software

Several large investors have recently made changes to their positions in the business. BlackRock Inc. grew its holdings in Paycom Software by 11.5% during the 1st quarter. BlackRock Inc. now owns 5,967,962 shares of the software maker’s stock worth $2,067,181,000 after acquiring an additional 615,839 shares in the last quarter. Capital Research Global Investors grew its holdings in Paycom Software by 21.8% during the 4th quarter. Capital Research Global Investors now owns 1,988,938 shares of the software maker’s stock worth $825,787,000 after acquiring an additional 356,545 shares in the last quarter. Goldman Sachs Group Inc. grew its holdings in Paycom Software by 47.8% during the 1st quarter. Goldman Sachs Group Inc. now owns 877,824 shares of the software maker’s stock worth $304,061,000 after acquiring an additional 283,892 shares in the last quarter. Alyeska Investment Group L.P. grew its holdings in Paycom Software by 156.4% during the 1st quarter. Alyeska Investment Group L.P. now owns 456,317 shares of the software maker’s stock worth $158,059,000 after acquiring an additional 278,342 shares in the last quarter. Finally, Eagle Asset Management Inc. acquired a new position in Paycom Software during the 1st quarter worth $91,207,000. Institutional investors and hedge funds own 87.12% of the company’s stock.

About Paycom Software

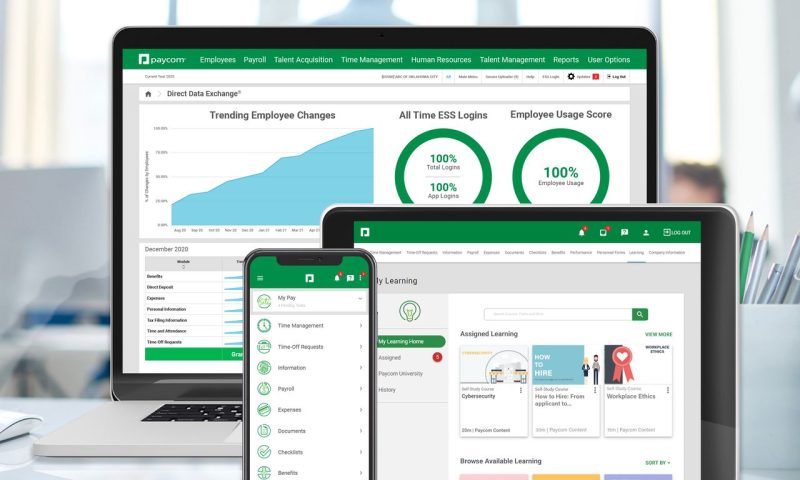

Paycom Software, Inc provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States. It offers functionality and data analytics that businesses need to manage the employment life cycle from recruitment to retirement.