Critical information for the trading day

Hopes that the Federal Reserve may be less aggressive in hiking borrowing costs than previously feared have rippled swiftly across markets in the past week. Stocks have rallied as bond yields have dropped. And it has brought the dollar’s rampage to a juddering halt.

The dollar index DXY, which hit a 20-year high above 108.5 in July, is now near 105.5.

“Risks to dollar dominance may be rising,” says Evercore, and investors should position for the benefit a softer buck may bring to certain parts of the stock market.

There are two factors that will weigh on the greenback, one short term and the other long term, reckons the investment bank.

More immediately, softening inflation expectations could allow the Fed to slow the pace of monetary tightening, or even pause. Thus the interest-rate differentials with other major economies that have been supporting the U.S. currency will moderate.

This should also feed into equities more broadly. “A pause — or the end of the hiking cycle, only known in hindsight (which investors may have overzealously discounted this past week) — has tended to see stocks rally, albeit with elevated volatility,” says Evercore.

Looking further ahead, Evercore warns that U.S. government debt service costs are expected to rise to record levels, affected by quantitative tightening, “and the secular move to higher interest rates and the ever-ballooning debt, prospectively pressuring the ‘World’s Reserve Currency.’”

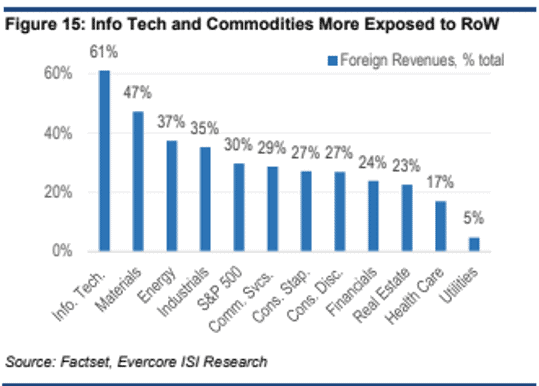

So, how best to benefit in stocks? Choose those with the highest international revenue exposures and for whom a weaker buck provides a competitive advantage. And it is also good if the rest of the world growth improves relative to the U.S.

Evercore has dubbed this group the ‘Dollar Down Dominators’ and they can be found within the technology, energy, industrials communication services, consumer staples and discretionary sectors. Even better if many in the market have been betting against them.

“Names from these dollar-sensitive sectors with greater than 70% foreign revenue exposure and high short interest, underperforming their peer group in 2022…could outperform,” says Evercore.

Conversely, stocks from these sectors with less than 30% foreign revenue exposure, low short interest, which have outperformed their peer group year-to-date — and which Evercore calls ‘Falling Dollar Falling Angels’ — could underperform. These include Lockheed Martin LMT, Devon Energy DVN and Kraft Heinz KHC.

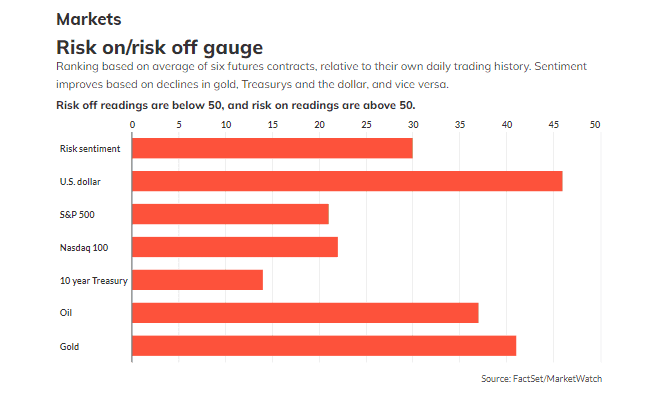

S&P 500 futures ES00 slipped 0.5% to 4,100 early Tuesday, easing back from near two-month highs. WTI crude futures CL dropped 1% to $93.07 a barrel ahead of the latest meeting of the Organization of the Petroleum Exporting Countries on Wednesday. Gold GC00 fell 0.1% to $1,787 an ounce and bitcoin BTCUSD lost 0.8% to $22,841.

The buzz

Markets are jittery, with Asian bourses notably weak, as traders worry about deteriorating relations between the U.S. and China over House Speaker Nancy Pelosi’s visit to Taiwan. Hong Kong’s Hang Seng Index HK:HSI dropped 2.4% on Tuesday.

Pinterest PINS shares are surging 19%, after activist investor Elliot Management said it had become the group’s biggest investor.

Uber UBER stock is also rallying, gaining 13.6% after results revealed the ride-hailing group is cash-flow positive for the first time.

The yield difference between U.S. 10-year Treasurys and 3-month notes has shrunk to just 9 basis points. An inversion of this spread would be seen as another market confirmation of recession in the world’s biggest economy.

After the close comes another big batch of corporate earnings, including Advanced Micro Devices AMD, Starbucks SBUX, PayPal PYPL, Airbnb ABNB and MicroStrategy MSTR.

U.S. economic data on Tuesday include JOLTS job openings for June, due at 10 a.m. Eastern.

Best of the web

Internal Revenue Service shift on individual retirement accounts causes confusion and pushback.

How war, climate change and energy costs upended the wheat market.

The Inflation Reduction Act is anything but.

A hotter planet will expose divides in the world of work.

The chart

Remote work for millions of workers during the COVID-19 pandemic meant fewer visits to coffee shops near offices, notes Bank of America. And despite the end of lockdowns and other restrictions, surveys suggest workers still spend one third of all paid work days working from home. BofA has crunched its own merchant transaction data and found that: “while coffee shop sales volume rebounded significantly since the initial lockdown in 2020, it has plateaued in recent months and is still below prepandemic levels. This highlights the continuing structural change in the nature of work.”