TransMedics Group (NASDAQ:TMDX – Get Rating) had its target price boosted by research analysts at Cowen from $39.00 to $45.00 in a report released on Tuesday, The Fly reports. Cowen’s price target points to a potential upside of 30.62% from the stock’s previous close.

Several other equities research analysts also recently issued reports on the stock. Morgan Stanley boosted their price objective on shares of TransMedics Group from $25.00 to $34.00 and gave the stock an “equal weight” rating in a research note on Wednesday, June 29th. Canaccord Genuity Group boosted their price objective on shares of TransMedics Group from $39.00 to $46.00 in a research note on Wednesday, May 4th. Two research analysts have rated the stock with a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat.com, TransMedics Group currently has an average rating of “Moderate Buy” and an average price target of $35.20.

TransMedics Group Price Performance

TransMedics Group stock opened at $34.45 on Tuesday. TransMedics Group has a 1 year low of $10.00 and a 1 year high of $35.38. The firm has a 50 day moving average price of $30.19 and a 200 day moving average price of $23.76. The company has a market cap of $963.91 million, a price-to-earnings ratio of -20.26 and a beta of 1.54. The company has a debt-to-equity ratio of 0.59, a quick ratio of 4.40 and a current ratio of 5.22.

TransMedics Group (NASDAQ:TMDX – Get Rating) last released its earnings results on Tuesday, May 3rd. The company reported ($0.38) earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of ($0.35) by ($0.03). TransMedics Group had a negative net margin of 119.88% and a negative return on equity of 63.47%. The company had revenue of $15.88 million during the quarter, compared to analysts’ expectations of $10.22 million. During the same quarter in the previous year, the firm posted ($0.29) earnings per share. Sell-side analysts predict that TransMedics Group will post -1.42 earnings per share for the current year.

Insider Transactions at TransMedics Group

In other news, insider Tamer I. Khayal sold 13,504 shares of the business’s stock in a transaction on Tuesday, July 5th. The shares were sold at an average price of $35.06, for a total transaction of $473,450.24. Following the transaction, the insider now directly owns 46,076 shares of the company’s stock, valued at $1,615,424.56. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. In related news, VP John F. Carey sold 1,500 shares of the company’s stock in a transaction on Wednesday, July 20th. The shares were sold at an average price of $34.57, for a total value of $51,855.00. Following the sale, the vice president now directly owns 379 shares of the company’s stock, valued at $13,102.03. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider Tamer I. Khayal sold 13,504 shares of the company’s stock in a transaction on Tuesday, July 5th. The shares were sold at an average price of $35.06, for a total transaction of $473,450.24. Following the completion of the sale, the insider now directly owns 46,076 shares in the company, valued at $1,615,424.56. The disclosure for this sale can be found here. Over the last three months, insiders have sold 132,811 shares of company stock valued at $4,360,095. Corporate insiders own 8.70% of the company’s stock.

Institutional Trading of TransMedics Group

Institutional investors have recently added to or reduced their stakes in the stock. FNY Investment Advisers LLC acquired a new stake in TransMedics Group in the second quarter valued at $31,000. Amalgamated Bank acquired a new stake in shares of TransMedics Group during the first quarter worth $114,000. Ensign Peak Advisors Inc acquired a new stake in shares of TransMedics Group during the fourth quarter worth $97,000. Allspring Global Investments Holdings LLC acquired a new stake in shares of TransMedics Group during the fourth quarter worth $99,000. Finally, Captrust Financial Advisors raised its holdings in shares of TransMedics Group by 738.8% during the first quarter. Captrust Financial Advisors now owns 5,788 shares of the company’s stock worth $156,000 after purchasing an additional 5,098 shares during the period. 71.75% of the stock is owned by institutional investors and hedge funds.

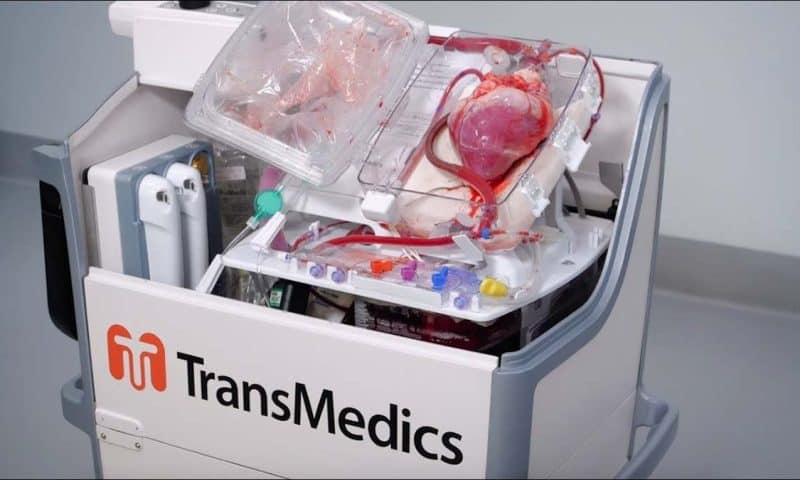

About TransMedics Group

TransMedics Group, Inc, a commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally. The company offers Organ Care System (OCS), a portable organ perfusion, optimization, and monitoring system that utilizes its proprietary and customized technology to replicate near-physiologic conditions for donor organs outside of the human body.