U.S. stock-index futures were firmer but trading was wary on Tuesday as investors assessed mixed earnings reports amid fears of an economic downturn, following reports of slowing spending at Apple on Monday.

How are stock-index futures trading

- S&P 500 futures ES00 rose 27 points, or 0.7%, to 3860.75.

- Dow Jones Industrial Average futures YM00 rose 161 points, or 0.5%, to 31,207.

- Nasdaq-100 futures NQ00 gained 91.25 points, or 0.8%, to 11,998.25.

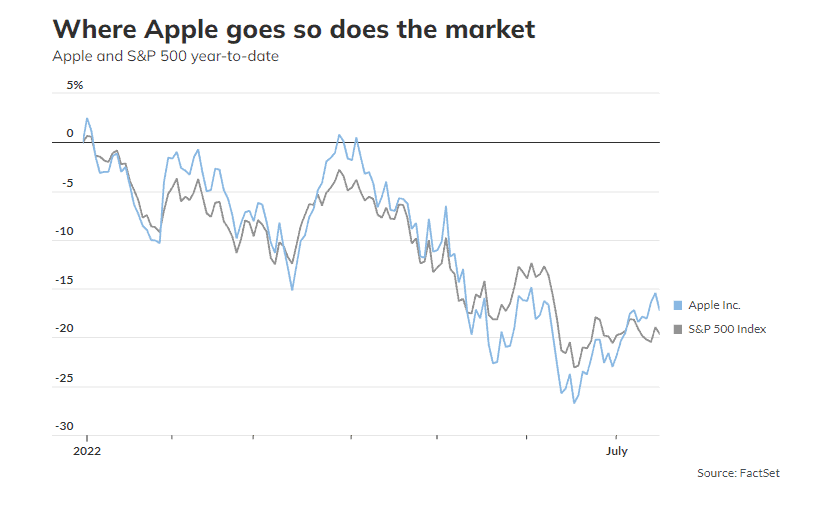

On Monday, the Dow Jones Industrial Average DJIA fell 216 points, or 0.7%, erasing an earlier gain of more than 350 points. The S&P 500 SPX and Nasdaq Composite COMP each fell 0.8%. The S&P 500 has fallen six of the last seven sessions and has shed 19.6% year-to-date.

What’s driving markets

Trading is positive but wary Tuesday amid mixed corporate earnings reports after a report Monday suggested Apple AAPL was slowing hiring and spending which revived concerns that higher borrowing costs and rampant inflation were damping corporate confidence.

The fears are reflected in the U.S. bond market, too. As the Federal Reserve has tightened monetary policy, investors have pushed 2-year yields BX:TMUBMUSD02Y above 10-year yields BX:TMUBMUSD10Y, an inversion of the yield curve that is deemed a harbinger of potential recession.

The Apple news Tuesday highlighted a dispiriting trend, noted Ipek Ozkardeskaya, senior analyst at Swissquote Bank. “Elon Musk recently announced he would cut 10% of jobs in Tesla TSLA, because he has a bad feeling about the economy. Alphabet GOOG GOOGL, Amazon AMZN, Meta META, Snap SNAP and even Goldman GS announced they would need less people to work for them as businesses would slow.”

The reversal in Monday’s session left the S&P 500 index below its 50-day moving average for the 60th consecutive day. That’s its longest such run since 2008 and suggests the market’s downtrend remains intact.

Underpinning sentiment, however, and helping deliver gains on Tuesday, is a mostly positive second-quarter earnings reporting season, where 57% of those companies to have reported so far have beaten earnings per share and revenue expectations, according to S&P Global Market Intelligence.

Pre-market trading suggests IBM IBM results were not well-received, however. The tech company beat expectations, but worries about how a strong dollar may impact future earnings pushed the stock lower by 4.8% $131.50. Investors continued to monitor earnings, with results from streaming giant Netflix Inc. NFLX due after the closing bell.

Data showed U.S. housing starts fell 2% in June, while building permits were down 0.6%.

Companies in focus

- Shares of Johnson & Johnson JNJ rose 0.7% in premarket trade after the pharmaceutical and consumer health products company reported second-quarter profit and sales that beat expectations, offsetting a reduced full-year earnings outlook.

- Aerospace and defense contractor Lockheed Martin Corp. LMT on Tuesday reported second-quarter results that missed analysts’ profit and sales estimates. Shares fell more than 3%.

- Shares of Arista Networks Inc. ANET rose after a Needham analyst upgraded the stock to buy from hold Tuesday, citing the company’s comparatively low international exposure and strong financial position.

How are other assets faring

- U.S. crude futures CL fell 0.4% to $102.21 a barrel, losing early gains that came after news that Russia’s Gazprom had claimed force majeure on some buyers highlighted tensions in the energy space.

- The ICE Dollar index DXY fell 0.6% to 106.71, as the euro EURUSD jumped on reports the European Central Bank was considering a 50 basis point rate hike on Thursday.

- Bitcoin BTCUSD advanced 1.9% to $21921.

- Asia markets were mixed following Wall Street’s overnight reversal. Hong Kong’s Hang Seng HK:HSI fell 0.9% and the Shanghai Composite CN:SHCOMP was flat. Japan returned from a day off to play catch-up, the Nikkei 225 JP:NIK adding 0.65%. In Europe, the Stoxx 600 XX:SXXP fell 0.7%.

- Growth concerns pushed copper futures HG00 down 1.3% to $3.025 a pound.