Apyx Medical Co. (NASDAQ:APYX – Get Rating) saw a large drop in short interest during the month of June. As of June 30th, there was short interest totalling 775,000 shares, a drop of 58.8% from the June 15th total of 1,880,000 shares. Based on an average daily trading volume, of 773,400 shares, the short-interest ratio is presently 1.0 days. Approximately 2.7% of the shares of the company are short sold.

A number of research analysts have commented on the company. Lake Street Capital increased their target price on Apyx Medical from $12.00 to $14.00 in a report on Monday. Colliers Securities reaffirmed a “buy” rating on shares of Apyx Medical in a report on Tuesday, March 22nd. Finally, Piper Sandler reduced their target price on Apyx Medical from $12.00 to $6.00 in a report on Thursday, May 12th.

Shares of Apyx Medical stock opened at $7.09 on Friday. The business’s 50 day simple moving average is $5.46 and its 200-day simple moving average is $7.57. The stock has a market capitalization of $244.41 million, a price-to-earnings ratio of -15.09 and a beta of 1.12. Apyx Medical has a twelve month low of $3.01 and a twelve month high of $17.50.

Apyx Medical (NASDAQ:APYX – Get Rating) last announced its quarterly earnings results on Thursday, May 12th. The company reported ($0.17) earnings per share for the quarter, missing analysts’ consensus estimates of ($0.13) by ($0.04). The company had revenue of $12.49 million for the quarter, compared to analyst estimates of $11.60 million. Apyx Medical had a negative return on equity of 30.00% and a negative net margin of 30.96%. During the same quarter in the previous year, the company posted ($0.14) earnings per share. As a group, research analysts forecast that Apyx Medical will post -0.58 EPS for the current year.

Institutional investors have recently made changes to their positions in the company. Dorsey Wright & Associates acquired a new stake in shares of Apyx Medical during the 4th quarter worth approximately $51,000. First Quadrant L P CA acquired a new stake in shares of Apyx Medical during the 4th quarter worth approximately $62,000. Amalgamated Bank acquired a new stake in shares of Apyx Medical during the 1st quarter worth approximately $33,000. FNY Investment Advisers LLC acquired a new stake in Apyx Medical in the 2nd quarter valued at approximately $48,000. Finally, Perkins Capital Management Inc. acquired a new stake in Apyx Medical in the 1st quarter valued at approximately $67,000. Institutional investors and hedge funds own 61.03% of the company’s stock.

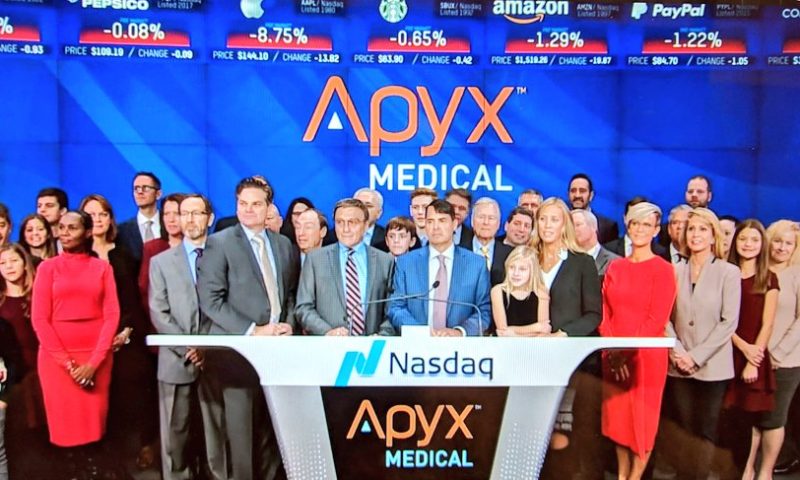

Apyx Medical Company Profile (Get Rating)

Apyx Medical Corporation, an energy technology company, develops, manufactures, and sells medical devices in the cosmetic and surgical markets worldwide. The company operates in two segments, Advanced Energy and Original Equipment Manufacturing (OEM). It offers Helium Plasma Generator for delivery of RF energy and helium to cut, coagulate and ablate soft tissue during open and laparoscopic surgical procedures.