Photronics (NASDAQ:PLAB – Get Rating) had its price target raised by analysts at Northland Securities from $25.00 to $26.00 in a report issued on Thursday, The Fly reports. The brokerage currently has an “outperform” rating on the semiconductor company’s stock. Northland Securities’ price target points to a potential upside of 33.13% from the company’s current price.

A number of other equities research analysts have also issued reports on the company. StockNews.com started coverage on Photronics in a research note on Thursday, March 31st. They issued a “strong-buy” rating for the company. DA Davidson increased their price target on Photronics from $26.00 to $30.00 in a research note on Thursday. Stifel Nicolaus increased their price objective on shares of Photronics from $21.00 to $23.00 in a report on Wednesday. Finally, Zacks Investment Research downgraded shares of Photronics from a “strong-buy” rating to a “hold” rating in a report on Wednesday, April 27th. One equities research analyst has rated the stock with a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, Photronics presently has an average rating of “Buy” and a consensus target price of $25.00.

Shares of NASDAQ:PLAB traded up $1.67 during midday trading on Thursday, hitting $19.53. The company had a trading volume of 12,372 shares, compared to its average volume of 598,801. The company has a debt-to-equity ratio of 0.08, a current ratio of 3.13 and a quick ratio of 2.80. The company has a market cap of $1.21 billion, a price-to-earnings ratio of 16.38 and a beta of 0.98. Photronics has a 12-month low of $11.65 and a 12-month high of $20.30. The company has a fifty day moving average of $15.97 and a two-hundred day moving average of $16.70.

Photronics (NASDAQ:PLAB – Get Rating) last posted its quarterly earnings data on Wednesday, May 25th. The semiconductor company reported $0.49 EPS for the quarter, topping the consensus estimate of $0.35 by $0.14. The firm had revenue of $204.50 million during the quarter, compared to analyst estimates of $192.37 million. Photronics had a return on equity of 6.66% and a net margin of 10.05%. Photronics’s revenue was up 28.0% on a year-over-year basis. During the same period in the prior year, the business posted $0.17 EPS. Research analysts expect that Photronics will post 1.49 earnings per share for the current fiscal year.

In related news, EVP Christopher J. Progler sold 11,481 shares of Photronics stock in a transaction that occurred on Monday, April 4th. The shares were sold at an average price of $16.54, for a total transaction of $189,895.74. Following the transaction, the executive vice president now directly owns 159,593 shares of the company’s stock, valued at $2,639,668.22. The sale was disclosed in a filing with the SEC, which is accessible through this link. Also, Director Mitchell G. Tyson sold 2,000 shares of Photronics stock in a transaction that occurred on Monday, May 2nd. The shares were sold at an average price of $15.00, for a total transaction of $30,000.00. Following the transaction, the director now directly owns 72,379 shares in the company, valued at $1,085,685. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 27,481 shares of company stock worth $470,276. Corporate insiders own 3.70% of the company’s stock.

A number of institutional investors and hedge funds have recently made changes to their positions in PLAB. Morgan Stanley boosted its stake in Photronics by 91.0% in the second quarter. Morgan Stanley now owns 406,506 shares of the semiconductor company’s stock valued at $5,370,000 after acquiring an additional 193,669 shares in the last quarter. Advisor Group Holdings Inc. boosted its stake in Photronics by 211.9% in the third quarter. Advisor Group Holdings Inc. now owns 4,432 shares of the semiconductor company’s stock valued at $60,000 after acquiring an additional 3,011 shares in the last quarter. Barclays PLC boosted its stake in Photronics by 82.1% in the third quarter. Barclays PLC now owns 86,792 shares of the semiconductor company’s stock valued at $1,184,000 after acquiring an additional 39,118 shares in the last quarter. Teacher Retirement System of Texas acquired a new stake in shares of Photronics during the third quarter worth $139,000. Finally, Goldman Sachs Group Inc. lifted its stake in shares of Photronics by 48.6% during the third quarter. Goldman Sachs Group Inc. now owns 423,251 shares of the semiconductor company’s stock worth $5,769,000 after buying an additional 138,461 shares during the period. Institutional investors own 88.49% of the company’s stock.

About Photronics (Get Rating)

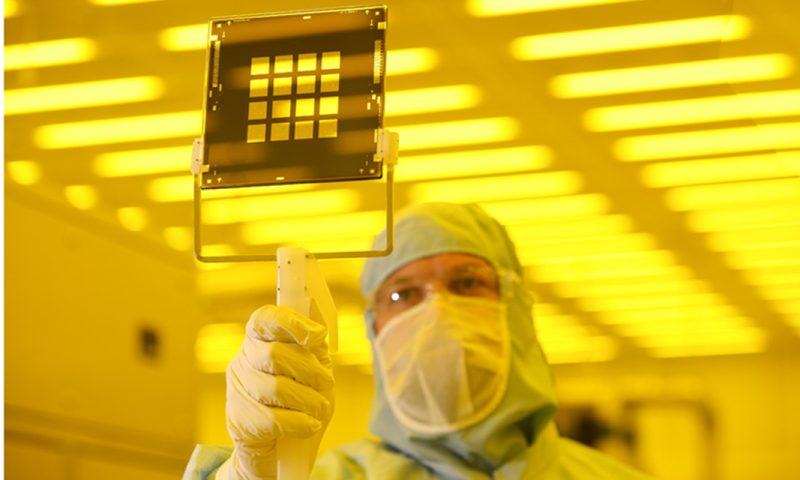

Photronics, Inc, together with its subsidiaries, engages in the manufacture and sale of photomask products and services in the United States, Taiwan, Korea, Europe, China, and internationally. The company offers photomasks that are used in the manufacture of integrated circuits and flat panel displays (FPDs); and to transfer circuit patterns onto semiconductor wafers, FDP substrates, and other types of electrical and optical components.