Hello! It’s been a brutal week for consumer-sector stocks while the S&P 500 index is edging closer to bear market territory.

“My indicators suggest that the bear-market move can keep its hold through the summer months,” says Katie Stockton, founder and managing partner of Fairlead Strategies, in this week’s ETF Wrap. She also says her recently launched Fairlead Tactical Sector ETF may help “protect downside in this type of environment.”

In a brutal week for retail stocks, the defensive consumer-staples sector was not spared.

The Consumer Staples Select Sector SPDR Fund XLP fell 6.4% Wednesday, while the Consumer Discretionary Select Sector SPDR Fund XLY dropped 6.5%, according to FactSet data.

The carnage came within a broader stock-market slump, with the S&P 500 SPX falling 4% Wednesday, for its biggest daily drop since June 2020. The S&P 500’s consumer-staples and consumer-discretionary sectors on Wednesday booked their biggest percentage drop since March 2020, according to Dow Jones Market Data.

“We’re in a bear-market move,” with sharp relief rallies presenting “better selling opportunities until you get a long-term bottom,” said Katie Stockton, founder and managing partner of Fairlead Strategies, in a phone interview. “My indicators suggest that the bear-market move can keep its hold through the summer months.”

Stockton is the portfolio manager for the recently launched Fairlead Tactical Sector ETF TACK, an active U.S. equity fund that uses a systematic strategy and is rebalanced monthly. The fund, which began trading March 23, is so far faring better than the S&P 500 index.

Shares of the Fairlead Tactical Sector ETF are down 1.8% this month through Wednesday, after falling 3.3% in April, FactSet data show. That compares with the S&P 500’s 8.8% drop last month and a decline of 5% in May through Wednesday.

“Over the course of the fund’s life, it’s gotten increasingly risk off,” said Stockton, partly through a more defensive sector positioning that includes exposure to consumer staples. She said the ETF can help “protect downside in this type of environment” where stocks are selling off.

The S&P 500 was trading down Thursday afternoon, nearing bear market territory, which it would enter with a close of about 3,837, according to Dow Jones Market data.

The Fairlead Tactical Sector ETF, which invests in SPDR ETFs, has shifted to a 50% position in short-term Treasuries SPTS, long-term Treasuries SPTL and gold GLD, Stockton said, while the fund’s sectors exposures are “fairly defensive,” including consumer staples XLP, utilities XLU, real estate XLRE and energy XLE.

Consumer staples is considered a defensive sector but it has taken a beating this week, as earning misses reported by Target Corp. TGT and Walmart Inc. WMT have increased investors’ recession fears amid concern that high inflation may be squeezing Americans’ spending.

The Vanguard Consumer Staples ETF VDC, Invesco S&P 500 Equal Weight Consumer Staples ETF RHS and Fidelity Covington Trust MSCI Consumer Staples Index ETF FSTA all fell more than 6% Wednesday, according to FactSet data.

Walmart, a retail giant in the S&P 500 index’s consumer-staples sector, is down around 19% this week, based on Thursday afternoon trading levels, FactSet data show, at last check. And Target, a department-store chain in the S&P 500’s battered consumer discretionary sector, has this week tanked around 30%, based on Thursday afternoon trading.

So far this year, the Consumer Discretionary Select Sector SPDR Fund has plunged 30% through Wednesday, far exceeding the nearly 7% decline for the Consumer Staples Select Sector SPDR Fund over the same period, FactSet data show.

“Inflation always hits the lower income cohorts hardest and first,” according to a May 18 markets note from The Sevens Report. Walmart’s earnings results “imply that’s starting to happen now,” the report says, warning that “a further economic slowdown” risks weighing more broadly on the Consumer Discretionary Select Sector SPDR Fund.

The Sevens suggested that Walmart’s results “somewhat refutes the ‘defensive’ nature of consumer staples, at least partially,” while also pointing to the consumer shift that the retailer saw toward brand names instead of “private label” as a sign of inflation weighing on consumers.

“The shift from brand names to generic is a potential threat” to Procter & Gamble Co. PG, which is the biggest holding in the Consumer Staples Select Sector SPDR Fund (XLP), according to the Sevens Report. “We don’t think it invalidates Consumer Staples as a defensive play, but it does imply an equal-weight ETF might be better than XLP to diversify the risk a bit more.”

The Invesco S&P 500 Equal Weight Consumer Staples ETF RHS “equal weights the consumer staples in the S&P 500, providing more diversification against changing consumer trends,” according to the report. Shares of the Invesco S&P 500 Equal Weight Consumer Staples ETF are down around 3% this year through Wednesday, FactSet data show.

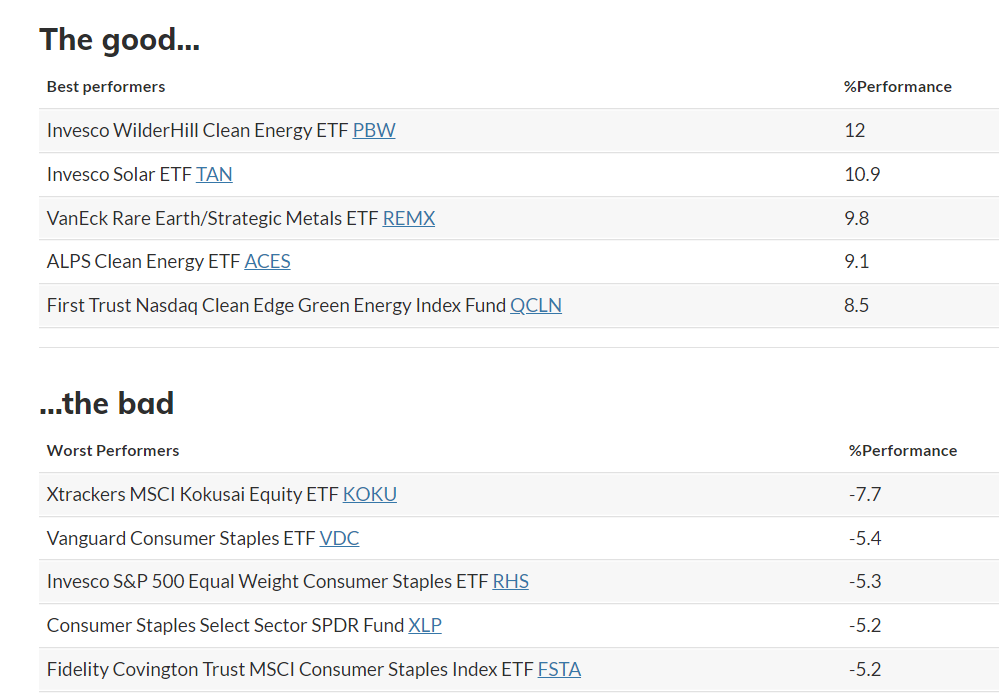

As usual, here’s your weekly look at the top and bottom ETF performers over the past week through Wednesday, according to FactSet.

Source: FactSet, through Wednesday May 18, 2022 excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater

A couple ETF launches:

Simplify Asset Management said May 17 that it was launching the Simplify Macro Strategy ETF FIG, a fund that aims for “equity-like returns with lower volatility” by investing in equity, fixed income, alternative ETFs and derivatives.

Teucrium Trading announced May 17 that the Teucrium Agricultural Strategy No K-1 ETF TILL would begin trading on the New York Stock Exchange. The actively managed fund provides futures price exposure to corn, wheat, soybean and sugar markets using a “long only” strategy.