‘Our house view is for a mild U.S. recession,’ Peter Hooper, Deutsche Bank’s global head of economic research, told MarketWatch. ‘What surprises us is that our house call hasn’t become consensus.’

Deutsche Bank, the first major Wall Street bank to call for a U.S. recession during the current elevated-inflation era, is now going farther out on a limb: It sees downside risks to its own outlook, given the likelihood of persistently elevated price gains and continued upside surprises.

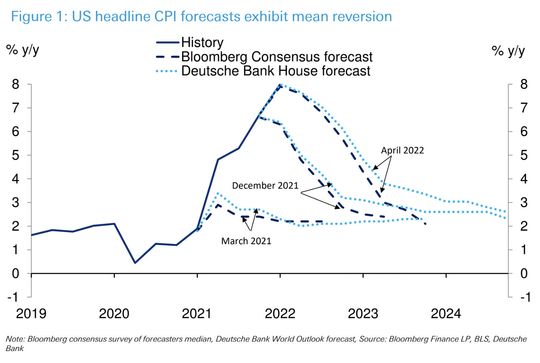

Describing themselves as “the extreme outlier on the street,” researchers at the German bank have an official house call for a “mild” U.S. contraction by late next year, as the Fed pushes forward with hiking rates and shrinking its balance sheet to combat inflation — putting Deutsche Bank at the pessimistic end of 75 forecasters surveyed by Bloomberg. However, they say, an even deeper recession may be needed to bring inflation under control.

Contributing to the likelihood of continued upside surprises to inflation, already at the highest levels in more than four decades, are developments which were already under way before the pandemic, like climate change and a reversal of globalization, Deutsche Bank’s researchers said in a note released on Tuesday. They also said that wages are likely to keep climbing considering the tight labor market, and that inflation expectations should significantly rise in the year ahead.

On top of all this is a dramatically shifting inflation psychology in which those selling goods and services are willing to pass on cost increases and buyers are willing to accept them, and the notion that even an aggressive Federal Reserve policy response will not be enough, according to Deutsche Bank. Its researchers said they would not be surprised to see the core personal-consumption expenditures price index, the Fed’s preferred measure, at 4% to 5% well into next year before receding when a recession hits.

“Our house view is for a mild U.S. recession that is a couple of quarters of negative growth, and unemployment going up 1 to 1.5 percentage points,” said Peter Hooper, global head of economic research. “A severe recession, which we saw in 2008 and in the early 1980s, is a very different animal: something that lasts a year, a year and a half, and has unemployment going up by 5 to 6 percentage points.”

“The recession we have in mind in this alternative risk scenario to our house call is somewhere between the two: something lasting several quarters, with a substantial drop in GDP and unemployment going up by 3 percentage points, but enough to turn the inflation psychology,” Hooper told MarketWatch in a phone interview on Tuesday.

Broadly speaking, professional forecasters and policy makers alike have proven consistently wrong by underestimating the persistency of inflation — particularly as measured by the headline annual rate of the consumer-price index, which hit 5% last May and has been climbing ever since. A survey by the National Association for Business Economics, conducted earlier this month, found that almost half of the 84 respondents saw just a 25% or lower probability of a U.S. downturn in the next 12 months.

Some economists see a recession as likely, though perhaps not until 2024 or beyond. Jefferies LLC noted that all 10 U.S. recessions in the last 70 years were preceded by Fed rate hikes, but sometimes took a few years to materialize.

The chart below shows how far Deutsche Bank’s CPI forecast, as reflected in the light blue dotted line, is from the rest of the pack.

Now, policy makers are assuming they’ll be able to achieve a “soft landing” in which inflation comes down and unemployment holds steady even as they begin to raise the fed-funds rate target by a larger-than-normal 50 basis point increment, starting in May, from its current level between 0.25% and 0.5%. Activist investor Carl Icahn is one of those who have pushed back against the safe-landing assumption.

The most important factor behind Deutsche Bank’s view is the likelihood that inflation will be persistently elevated for longer than expected, according to the note by David Folkerts-Landau, chief economist and head of research; Hooper; and Jim Reid, head of thematic research. They wrote that the only way to minimize the economic, financial and societal damage of prolonged inflation is for the Fed “to err on the side of doing too much.”

‘It’s rare that we have this much advance warning: We have a substantial inflation problem and historically the Fed has not been able to deal with this kind of inflation problem without a significant downturn in the economy.’

— Peter Hooper, Deutsche Bank

They see the Fed’s main policy-rate target going above 3.5%, with a shrinking balance sheet contributing the equivalent of another half percentage point in tightening, and a U.S. recession occurring “in late 2023/early 2024.” Moreover, the researchers see the euro area slowing near recession in early 2024, with the European Central Bank also needing to raise rates to deal with an inflation problem “that is not far behind that in the U.S.”

“What surprises us is that our house call hasn’t become consensus,” Hooper told MarketWatch. He says that one reason for it may be that persistently high inflation is a “fairly recent and sudden development.”

Two more possible reasons, he said, are that “the Fed has yet to acknowledge the potential risks to unemployment, and calling the timing of a recession is never easy and is often not done until it’s on top of you.” Still, “it’s rare that we have this much advance warning: We have a substantial inflation problem and historically the Fed has not been able to deal with this kind of inflation problem without a significant downturn in the economy.”

Deutsche Bank became the first bank to predict a recession during the current inflationary era earlier this month, when it revised its global growth forecasts significantly down partly due to the war in Ukraine.

While shutdowns in parts of China are likely to add to inflation pressures, Hooper said he expects the country to perform better into next year once it gets past its current COVID-19 disruptions — which should, in turn, diminish the likely impact on the U.S.

On Tuesday, U.S. stocks DJIA, -2.38% SPX, -2.81% fell sharply. with the Nasdaq Composite COMP, -3.95% down more than 3% during the final hour of trading. Treasury yields were also broadly lower with the 10-year rate TMUBMUSD10Y, 2.760% hovering below 2.76%.