Micron Technology (NASDAQ:MU – Get Rating) had its price target lifted by research analysts at Mizuho from $110.00 to $113.00 in a note issued to investors on Wednesday, The Fly reports. Mizuho’s target price indicates a potential upside of 37.72% from the stock’s current price.

A number of other research firms also recently commented on MU. Bank of America boosted their price target on shares of Micron Technology from $100.00 to $118.00 and gave the stock a “buy” rating in a research report on Monday, January 10th. Sanford C. Bernstein raised Micron Technology from a “market perform” rating to an “outperform” rating and set a $94.00 target price on the stock in a report on Wednesday, March 16th. Credit Suisse Group increased their price target on Micron Technology from $110.00 to $130.00 and gave the company an “outperform” rating in a research note on Tuesday, December 21st. Summit Insights raised Micron Technology from a “hold” rating to a “buy” rating in a research note on Monday, December 20th. Finally, JPMorgan Chase & Co. raised their target price on Micron Technology from $100.00 to $115.00 and gave the company an “overweight” rating in a research note on Tuesday, December 21st. Five investment analysts have rated the stock with a hold rating, twenty-three have given a buy rating and one has assigned a strong buy rating to the company’s stock. According to data from MarketBeat, the company presently has an average rating of “Buy” and an average price target of $113.86.

NASDAQ MU opened at $82.05 on Wednesday. The company has a debt-to-equity ratio of 0.15, a quick ratio of 2.36 and a current ratio of 3.10. Micron Technology has a one year low of $65.67 and a one year high of $98.45. The company has a 50-day simple moving average of $83.26 and a 200-day simple moving average of $81.13. The firm has a market capitalization of $91.88 billion, a PE ratio of 12.66, a price-to-earnings-growth ratio of 0.38 and a beta of 1.17.

Micron Technology (NASDAQ:MU – Get Rating) last released its quarterly earnings data on Tuesday, March 29th. The semiconductor manufacturer reported $2.14 earnings per share (EPS) for the quarter, beating the Zacks’ consensus estimate of $1.98 by $0.16. Micron Technology had a return on equity of 19.01% and a net margin of 24.86%. The business had revenue of $7.79 billion during the quarter, compared to analyst estimates of $7.53 billion. During the same quarter in the previous year, the firm posted $0.90 EPS. The business’s revenue for the quarter was up 25.6% compared to the same quarter last year. Equities analysts forecast that Micron Technology will post 8.78 earnings per share for the current year.

In other news, SVP Michael W. Bokan sold 20,000 shares of the firm’s stock in a transaction dated Tuesday, January 11th. The shares were sold at an average price of $93.83, for a total transaction of $1,876,600.00. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, SVP April S. Arnzen sold 5,600 shares of the company’s stock in a transaction dated Thursday, March 24th. The shares were sold at an average price of $76.00, for a total transaction of $425,600.00. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 222,973 shares of company stock worth $21,367,995. Insiders own 0.32% of the company’s stock.

Institutional investors and hedge funds have recently bought and sold shares of the company. OLD Mission Capital LLC bought a new position in shares of Micron Technology in the third quarter valued at approximately $251,000. Great Valley Advisor Group Inc. increased its holdings in Micron Technology by 44.0% during the 3rd quarter. Great Valley Advisor Group Inc. now owns 3,594 shares of the semiconductor manufacturer’s stock valued at $255,000 after purchasing an additional 1,099 shares in the last quarter. NEXT Financial Group Inc increased its holdings in Micron Technology by 19.2% during the 3rd quarter. NEXT Financial Group Inc now owns 6,061 shares of the semiconductor manufacturer’s stock valued at $431,000 after purchasing an additional 978 shares in the last quarter. Meridian Wealth Management LLC bought a new position in Micron Technology in the 3rd quarter valued at $230,000. Finally, Intersect Capital LLC boosted its stake in Micron Technology by 21.8% in the third quarter. Intersect Capital LLC now owns 3,001 shares of the semiconductor manufacturer’s stock worth $213,000 after purchasing an additional 537 shares in the last quarter. 76.07% of the stock is currently owned by institutional investors and hedge funds.

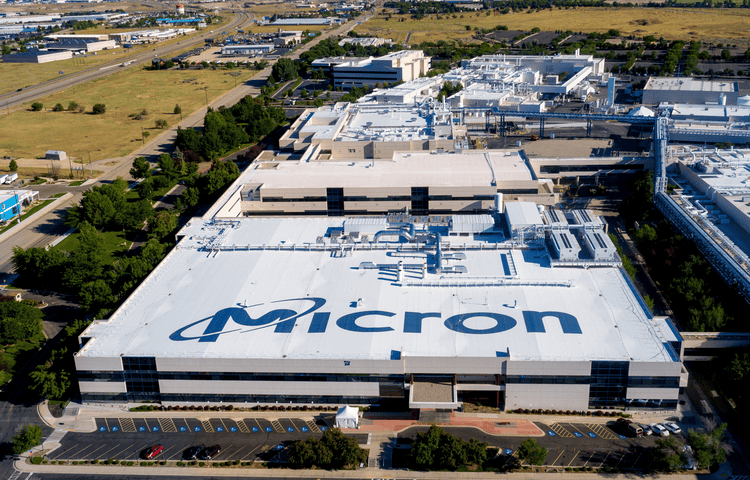

Micron Technology Company Profile

Micron Technology, Inc designs, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Storage Business Unit, and Embedded Business Unit. It provides memory and storage technologies comprises DRAM products, which are dynamic random access memory semiconductor devices with low latency that provide high-speed data retrieval; NAND products that are non-volatile and re-writeable semiconductor storage devices; and NOR memory products, which are non-volatile re-writable semiconductor memory devices that provide fast read speeds under the Micron and Crucial brands, as well as through private labels.