Alteryx (NYSE:AYX – Get Rating) had its price objective reduced by equities researchers at Truist Financial from $90.00 to $85.00 in a research note issued on Thursday, Benzinga reports. The brokerage presently has a “buy” rating on the stock. Truist Financial’s price target indicates a potential upside of 21.90% from the stock’s previous close.

A number of other analysts have also issued reports on the stock. Zacks Investment Research lowered shares of Alteryx from a “hold” rating to a “sell” rating in a research report on Monday, February 21st. JPMorgan Chase & Co. increased their target price on shares of Alteryx from $65.00 to $70.00 and gave the stock a “neutral” rating in a research report on Wednesday, February 16th. Bank of America cut shares of Alteryx from a “buy” rating to a “neutral” rating and lowered their price target for the company from $84.00 to $65.00 in a report on Tuesday, February 1st. JMP Securities cut their price objective on Alteryx from $159.00 to $127.00 and set an “outperform” rating for the company in a report on Wednesday, February 16th. Finally, Berenberg Bank began coverage on Alteryx in a report on Thursday, January 27th. They set a “buy” rating and a $66.00 price objective for the company. One research analyst has rated the stock with a sell rating, four have assigned a hold rating and ten have given a buy rating to the stock. According to MarketBeat.com, Alteryx currently has a consensus rating of “Buy” and a consensus price target of $87.79.

AYX stock traded down $0.03 during mid-day trading on Thursday, reaching $69.73. 1,053,302 shares of the stock traded hands, compared to its average volume of 985,291. Alteryx has a 52-week low of $49.67 and a 52-week high of $90.57. The stock’s fifty day moving average is $57.58 and its 200-day moving average is $64.82. The company has a market cap of $4.72 billion, a P/E ratio of -26.02 and a beta of 0.65. The company has a current ratio of 2.28, a quick ratio of 2.28 and a debt-to-equity ratio of 1.70.

Alteryx (NYSE:AYX) Stock a Buy: Big Data and Big Growth Potential

Alteryx (NYSE:AYX – Get Rating) last released its quarterly earnings results on Tuesday, February 15th. The company reported ($0.28) earnings per share (EPS) for the quarter, beating the Zacks’ consensus estimate of ($0.41) by $0.13. Alteryx had a negative net margin of 33.51% and a negative return on equity of 29.89%. The business had revenue of $173.81 million for the quarter, compared to analyst estimates of $165.36 million. During the same quarter in the previous year, the business earned $0.36 earnings per share. Equities research analysts expect that Alteryx will post -2.32 earnings per share for the current year.

In other news, Director Dean Stoecker sold 20,000 shares of the firm’s stock in a transaction dated Friday, March 11th. The stock was sold at an average price of $61.87, for a total value of $1,237,400.00. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director Jeff Horing purchased 320,601 shares of the stock in a transaction dated Tuesday, February 22nd. The stock was acquired at an average cost of $54.69 per share, for a total transaction of $17,533,668.69. The disclosure for this purchase can be found here. Corporate insiders own 12.50% of the company’s stock.

Several large investors have recently modified their holdings of the company. Capital World Investors grew its position in Alteryx by 17.1% during the third quarter. Capital World Investors now owns 6,399,122 shares of the company’s stock worth $467,776,000 after buying an additional 933,897 shares in the last quarter. Mackenzie Financial Corp grew its position in Alteryx by 101.2% during the third quarter. Mackenzie Financial Corp now owns 1,778,931 shares of the company’s stock worth $130,040,000 after buying an additional 894,582 shares in the last quarter. Wishbone Management LP acquired a new stake in Alteryx during the fourth quarter worth about $49,610,000. Washington Harbour Partners LP acquired a new stake in Alteryx during the third quarter worth about $51,750,000. Finally, Norges Bank acquired a new stake in Alteryx during the fourth quarter worth about $31,545,000. 67.66% of the stock is currently owned by institutional investors.

About Alteryx

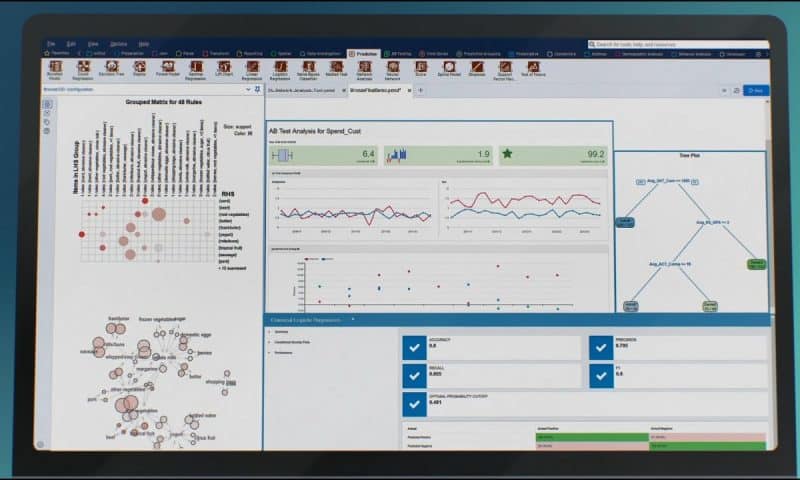

Alteryx, Inc engages in the provision of self-service data analytics software. Its subscription-based platform allows organizations to prepare, blend, and analyze data from a multitude of sources and benefit from data-driven decisions. The company was founded by Dean A. Stoecker, Olivia Duane-Adams, and Edward P.