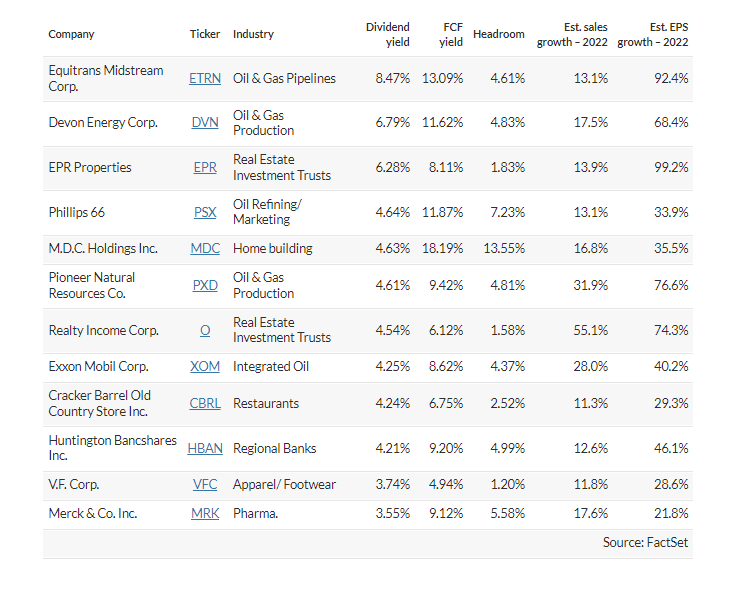

These companies are expected to produce rapid growth for sales and earnings, and have high dividend yields well-covered by cash flow

Investors may have turned for a moment from Russia’s aggression in Ukraine to energy and supply shortages in the U.S. that are producing high inflation.

With purchasing power crumbling, patient investors might be well-served by seeking out stocks with attractive dividend yields of companies that are expected to grow sales and earnings quickly while also generating free cash flow in excess of the dividend payouts. A screen of 12 of those stocks is below.

On March 10, the Bureau of Labor Statistics said the consumer price index in February was up 7.9% from a year earlier, for a new 40-year inflation high.

Some consumers (and investors) won’t be affected by every aspect of price increases incorporated in the CPI. For example, your housing expense may not increase this year and you might not spend much on clothes. Then again, your personal inflation rate may well be higher than 7.9% when you factor in rising expenses for fuel and insurance.

Regardless of how you are affected by inflation, you might find stocks with dividend yields of 3.5% or more attractive, especially when the companies have enough expected cash flow to cover even higher payouts. That 3.5% threshold compares favorably with a yield of about 2% on 10-year U.S. Treasury notes BX:TMUBMUSD10Y.

Stock screen

According to weighted aggregate consensus estimates compiled by FactSet, the S&P 500 SPX is expected to increase sales by 10.9% and earnings per share by 20% in 2022.

For an expanded base of companies for a screen, we looked at the S&P Composite 1500 Index XX:SP1500, which is made up of the S&P 500, the S&P 400 Mid Cap Index MID and the S&P 600 Small Cap Index SML.

We then limited the list to companies expected to increase sales and EPS more quickly than the S&P 500 during calendar 2022, with dividend yields of at least 3.5% that are well-covered by estimated free cash flow.

We did the last part of the screen by comparing current dividend yields to estimated free cash flow yields for the next 12 months. A company’s free cash flow is its remaining cash flow after capital expenditures. It is money that can be used for expansion, to increase dividends, repurchase shares or for other corporate purposes. Free cash flow yield can be calculated by dividing estimated FCF by the current share price.

If the free cash flow yield exceeds the current dividend yield, a company appears to have “headroom” for a higher dividend payout.

Free cash flow measures aren’t available for every industry. For real estate investment trusts, we looked at funds from operations (FFO), which adds amortization and depreciation back to earnings and excludes gains on the sale of property. For banks, we used earnings per share because free-cash-flow estimates aren’t available and EPS is considered to be closer to FCF, in general, than it is for many other industries.

Here are the 12 stocks screened from the S&P Composite 1500 Index, sorted by dividend yield: