Stock Markets

Despite the holiday-shortened trading week that passed, volatility reached a two-year high due to Russia’s invasion of Ukraine towards the week’s end, followed by Western countries imposing sanctions on the aggressor. Heightened geopolitical risk combined with the continuing inflationary pressures and increasing restriction in central bank policy weighed on equities. Stocks descended further into correction territory as indexes declined by 12% compared to their January 3 peaks, later to rebound and recover some lost ground. The major indexes still closed the week mostly higher from the previous week, mostly due to gains early in the week. On Thursday, the Nasdaq Composite Index swung by 6.8%, its largest intraday range since the start of the Covid pandemic in March 2020. Within the S&P 500, the consumer discretionary sector underperformed overall due to travel-related shares responding to the European turmoil. Communication services, on the other hand, exhibited resiliency due to support from the Internet counters such as Google parent Alphabet and Facebook parent Meta Platforms. Health care shares also outperformed.\

Commodities and traditional safe-havens, including bonds and the U.S. dollar, rallied as news of the attacks on Kyiv, the Ukrainian capital, sent stocks and fixed income markets lower. Investors rushed to assets that are perceived to remain stable during periods of uncertainty and high risk. As a result, longer-term U.S. Treasury yields moved lower and the U.S. currency moved higher in particular against the Russian ruble and other emerging market currencies. At the end of the week, after the Russian government representatives stated they were ready for negotiations with Ukraine and a delegation will be sent to the Belarus capital, Minsk, bond yields recovered and stocks rallied sharply. It also appeared to investors that sanctions against Russia, particularly in the energy sector, will not be as severe as first anticipated.

U.S. Economy

Despite the recent shocks to the markets resulting from geopolitical struggles and the pandemic situation, the underlying fundamentals continue to remain favorable and the present setback is only temporary. The broader economy remains on solid footing and the current volatilities only work to influence the markets to gravitate to more sustainable drivers of returns. There will continue to be challenges to investors’ confidence in the markets, however, particularly the inflationary and monetary-policy uncertainties. It is a given that the Feds are certain to embark on a series of rate hikes simultaneously with shrinking its balance sheet, which is important to factor in long-term investment strategies since the market recovery will be protracted. Currently, the S&P 500 is approaching the average non-recessionary drawdown and most asset valuations are returning to their five-year historical averages, the ideal response would be to move towards quality investments and to seek opportunities in attractive prices as they present themselves. Investors should resist the impulse to succumb to fear and panic, instead move towards rebalancing strategies and dollar-cost averaging during price swings. It is also wise to take advantage of short-term dips to diversify one’s portfolio.

Metals and Mining

Expectations of price appreciation among precious metals have once again been disappointed last week, particularly in the nearly $100 intraday swing in gold prices seen Thursday. Russia’s foray into Ukraine sent gold prices to a session high of $1,976.50 per ounce, the peak it has seen in the last 1.5 years. However, placing a bet on geopolitical uncertainties has shown its risky side when the Russian-Ukraine encounter failed to escalate and the parties instead made moves towards diplomatic negotiations. Betting on safe-haven strategies is unsustainable because the risky situation upon which it is premised is also unsustainable, and when the conflict is resolved, gold prices plummet to even lower levels than they were at previously. Gold remains an effective safe-haven asset, but it should not be chased upwards during geopolitical conflicts.

In the week just ended, gold fell week-on-week by 0.48%, from $1,898.43 to $1,889.34 per troy ounce. Silver rose 1.46%, from $23.92 to $24.27 per troy ounce. Platinum corrected from the previous week’s close of $1,072.33 to the close this week of $1,059.35 per troy ounce, losing 1.21%. Palladium gained marginally by 0.76% for the week, from $2,350.75 to $2,368.72 per troy ounce. Base metals (3mo) were also mixed for the week. Copper, which closed the previous week at $9,956.00, ended this week at $9,873.00 per metric tonne for a loss of 0.83%. Zinc fared better, closing this week at $3,621.50 per metric tonne from the previous week’s close at $3,575.50, gaining 1.29%. Aluminum began at $3,262.50 and ended at $3,357.50 per metric tonne for an increase of 2.91%. Finally, tin moved up from the earlier week’s close at $44,140.00 to this week’s $44,470.00 per metric tonne, a gain of 0.75%.

Energy and Oil

The much anticipated, and feared, Russian incursion into Ukraine materialized this week, but instead of the string response expected from the international community, European leaders largely hesitated and argued among themselves. Oil prices rose slightly above the $100-per-barrel level on Friday, and gas prices surged to $50 per million British thermal units (mmBtu), a development which may have given rise to the benign response to the Russian invasion. It is well speculated that any severe sanction to be placed on the aggressor will send oil prices to much higher levels which none of the players dependent on Russian oil want. Fossil fuel flows from Russia are too important to the international markets for the Western countries to gamble on compromising. The lack of any serious sanctions on Russia’s energy exports are the principal reason that the sudden spike in oil prices largely recovered by the week’s end.

Natural Gas

Not surprisingly, in light of the uncertainties in geopolitical affairs, spot prices for natural gas rose at most locations during this report week, February 16 to February 23. Hub spot prices increased from $4.39 per mmBtu when the week began, to $4.57 per mmBtu at the end of the week. International spot prices were mixed while that of futures decreased. The price of the March 2022 NYMEX contract slid by $0.094, from $4.717 per mmBtu on February 16 to $4.623 on February 23. Prices in the Midwest rose slightly with cooler temperatures while those in the Gulf Coast also increased despite forecasts that the warm weather will continue. In the West, temperatures fell and with it prices increased; those in the Northeast rose as another winter storm is anticipated. Total natural gas supply in the U.S. market declined slightly this past week, even as the total consumption fell slightly. U.S. liquid natural gas exports are down by five vessels this week compared to the previous week.

World Markets

Equities fell in Europe due to fears that the Russian invasion of Ukraine will give way to higher inflation and economic slowdown. The pan-European STOXX Europe 600 Index closed 1.58% lower. France’s CAC 40 Index also ended 2.56% down while Italy’s FTSE MIB Index slid 2.77%. Germany’s DAX Index, one of the bourses with the highest exposures in Russia, plunged 3.16%. By comparison, the UK’s FTSE 100 Index slipped by a marginal 0.32%. The core eurozone bond yields descended after the Russian invasion into Ukraine triggered a flight to safety. Likewise giving way were the UK gilt and peripheral eurozone bond yields.

Likewise impacted by the Russia-Ukraine conflict, Japan’s stock market returns were negative during the past week’s trading. The Nikkei 225 lost 2.38% and the broader TOPIX Index descended 2.50%. The yield on the 10-year Japanese government bond dropped to 0.20% from 0.22% during the close of the previous week. The Governor of the Bank of Japan, Haruhiko Kuroda, announced that Japan’s central bank does not have any immediate plans to reduce its monetary stimulus. If necessary, it would purchase unlimited quantities of bonds to keep yields within the target range. The yen weakened to approximately JPY 115.32 versus the U.S. dollar, compared to JPY 115.00 during the preceding week.

The Chinese bourses sustained a weekly loss also in response to the geopolitical situation between Russia and Ukraine, indicative of the investors’ depressed risk sentiment. The Shanghai Composite Index slid 1.1% while the large-cap CSI 300 Index lost 1.6%. The yield on the 10-year Chinese government bond descended to 2.806% compared to the previous week’s yield of 2.814%. Regarding currencies, the yuan strengthened against the U.S. dollar, ending around 6.3135 per dollar from 6.33 the earlier week as a result of higher foreign inflows into Chinese assets. Further dampening buying sentiment into stocks was the decision by the People’s Bank of China to maintain interest rates steady. The central bank maintained the one-year and five-year loan prime rates at the same levels they were the previous week. This surprised experts and analysts who forecast that the benchmark lending rate will recede.

The Week Ahead

In the week ahead, the important economic data scheduled for release include the hourly earnings growth and the unemployment rate.

Key Topics to Watch

- Trade in goods, advance report

- Chicago PMI

- Atlanta Fed President Raphael Bostic speaks, Feb. 28

- Markit manufacturing PMI (final)

- ISM manufacturing index

- Construction spending

- Atlanta Fed President Raphael Bostic speaks, March 1

- ADP employment report

- Chicago Fed President Charles Evans speaks

- Louis Fed President James Bullard speaks

- Fed Chair Jerome Powell testifies at House committee

- Beige Book

- Initial jobless claims

- Continuing jobless claims

- Productivity revision (SAAR)

- Unit labor costs revision (SAAR)

- Markit services PMI (final)

- ISM services index

- Factory orders

- Core capital equipment orders (revision)

- Fed Chair Jerome Powell testifies at Senate committee

- New York Fed President John Williams speaks

- Nonfarm payrolls

- Unemployment rate

- Average hourly earnings

- Labor force participation rate, prime working age

- Chicago Fed President Charles Evans speaks

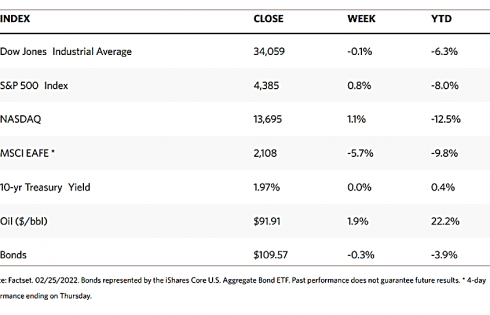

Markets Index Wrap Up