Biotechnology is so beaten down, relative valuation metrics suggest some stocks could more than double

Well, that didn’t take long.

Biotechnology as an investment sector is so hated, it stumbled into bear market mode for the year in less than a month. The jarring 20% decline happened after the group fell 22% last year, against an S&P 500 SPX gain of 27%.

“Boy, what a start of a year. And not in a good way,” says Jefferies biotech analyst Michael Yee, who accurately forecasted the 2022 weakness in December when many commentators had turned bullish.

Three things are bugging investors.

1. With so many small and midcap — or smidcap — biotech names down 25% to 40% in the past few months, investors fear hedge fund redemptions will force more selling. “No one wants to try to catch a falling knife,” says Yee.

2. There’s been a slew of depressing drug development setbacks from dozens of biotech companies, including BridgeBio Pharma BBIO, Allakos ALLK, Denali Therapeutics DNLI and Adagio Therapeutics ADGI. By January, 24 of 31 major data readouts were disappointments, by Yee’s count. “How can investors have enthusiasm about buying the group when there is so much bad news?” he asks.

3. Hoped-for buyouts have not materialized.

Put these three factors together, and it’s a bad storm. “The tone is one of significant depression,” says Yee.

The good news is …

As the investing adage says, your best purchases are the ones that are hardest to make. Given how tough it is to get enthusiastic about biotech, this truism tells us the group is a buy. You can take your time to average in, if Yee’s calls continue to be right. He thinks the above concerns could plague the group throughout the first quarter. But he expects the group to end the year higher, which suggests it is already a good time to start accumulating.

Here are five reasons why biotech will end the year higher, and 10 stocks to consider.

Biotech looks cheap

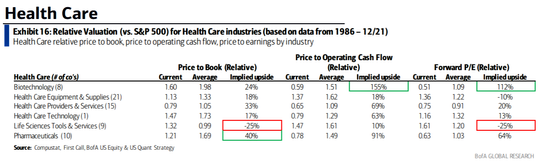

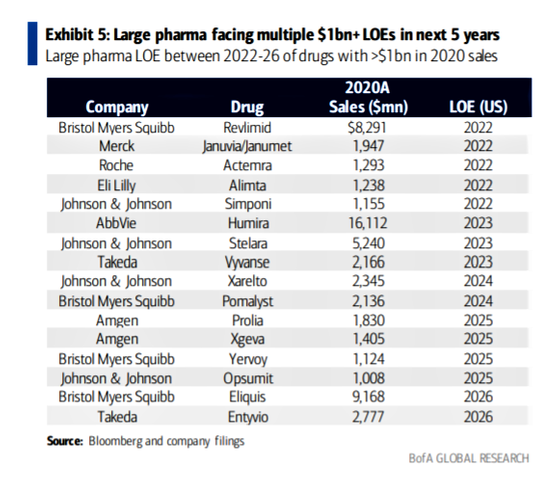

Biotech is so beaten down, several relative valuation metrics suggest it can move up anywhere from 24% to 155%, according to this recent analysis from Bank of America.

Omicron marks the end of the pandemic

Biotech companies got good at marketing via Zoom calls. But let’s face it. For product sales (and a lot of other things), there is nothing like face-to-face meetings. Now that Covid is backing off as a concern because Omicron is relatively mild, sales teams will gradually be able to get out and sell more in person. Patient visits to doctors and psychiatrists will pick up, too. This will increase diagnosis and prescriptions — also boosting sales.

Third, companies will find it easier to do trials, as people become more comfortable with visiting clinics and hospitals to receive experimental treatments. Companies that may get a boost from better trial enrollments in key drug development programs include: Incyte INCY in its programs to develop a treatment for the cancer myelofibrosis, and Intra-Cellular Therapies ITCI in its research on Lumateperone for major depressive disorder, according to RBC Capital Markets biotech analysts.

M&A will pick up

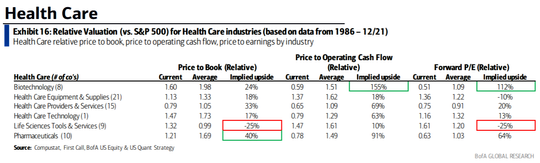

Biotech was in such a freefall that potential buyers just held off, waiting for better prices. Now that biotech stocks are stabilizing and product sales will start showing improvement, buyers will show more interest. Big Pharma certainly has the cash to buy, as you can see from this chart from Jefferies.

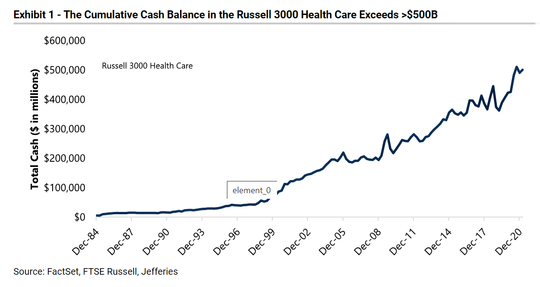

Big Pharma also has the need, given how many blockbuster products are losing patent protection. This chart from Bank of America summarizes the major loss of exclusivity (LOE) at Big Pharma over the next several years, which increases their hunger for buyouts to restock their pipelines.

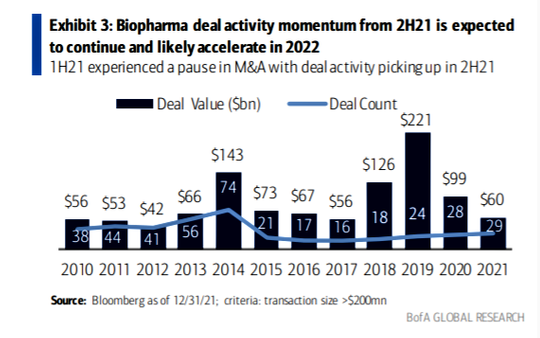

This chart shows that biotech M&A is so low, historically, it virtually has nowhere to go but up.

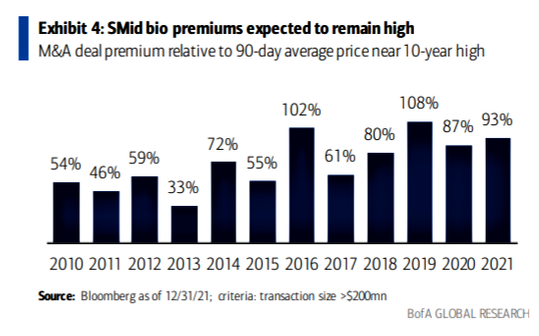

As mergers and acquisitions (M&A) pick up, the sight of biotech names rocketing 60% or more on takeover news will attract investor interest in the space — and the inevitable hunt for the next target. This dynamic will help turn the sector around. This chart shows you the typical takeover premium, by year. It’s almost always big.

If you want to try to position ahead of buyouts, where to shop for potential targets? First, avoid last year’s crop of initial public offerings (IPOs), which may look tempting because they are beaten down so much.

As of the end of last year, 73% of the 2021 IPOs were so-called busted IPOs — those trading below their IPO price. But those are mostly early stage companies. Many of them only have drug candidates in pre-clinical development.

In contrast, large pharma wants de-risked, late-stage drug candidates well along in Phase III trials, says Bank of America biotech analyst Tazeen Ahmad. He singles out Alnylam Pharmaceuticals ALNY and Argenx ARGX as favorites for 2022, in part, because they have a lot of potential catalysts. But they also have promising late-stage candidates, which makes them possible buyout candidates.

Alnylam, which is developing ribonucleic acid interference (RNAi) therapeutics as a way to stifle disease-causing proteins, will post Phase III trial data for its patisiran, a potential therapy for transthyretin amyloidosis characterized by the buildup of harmful proteins. It may also get approval in April for vutrisiran, a therapy for a heart condition called cardiomyopathy. Argenx will launch efgartigimod for a muscle condition called myasthenia gravis, but the drug has potential against other diseases as well.

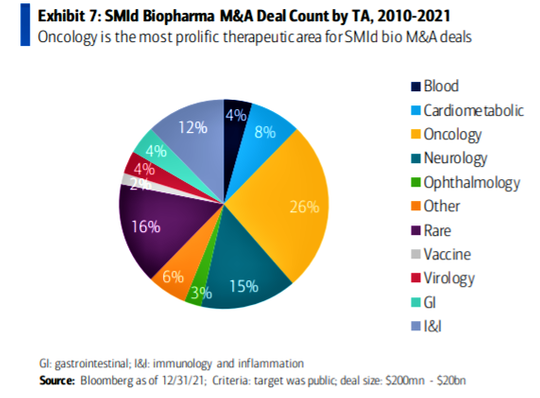

This chart shows that the most popular biotech companies for M&A are in cancer and rare diseases.

In oncology, consider Bicycle Therapeutics BCYC and Jasper Therapeutics JSPR as potential buyout candidates, says Oppenheimer analyst Jay Olson. Yee’s short list of potential buyout candidates include Alnylam Pharmaceuticals, Argenx, BioMarin Pharmaceutical BMRN and Mirati Therapeutics MRTX, all of which have late-stage drug candidates for cancer and rare diseases.

There will be lots of individual company catalysts

This could help turn around investor sentiment. Ahmad cites the Alnylam readout on patisiran, as well as potentially good news from Praxis Precision Medicines PRAX and Sage Therapeutics SAGE on their therapies for major depressive disorder. Yee cites I-Mab IMAB, which may post positive results in its study of its cancer drug Lemzoparlimab; Nektar Therapeutics NKTR for potentially good news on its cancer therapy Bempegaldesleukin; and Mirati for updates on its cancer therapy Adagrasib.

The political winds change

Biotech investors forever cower in fear of another “Hilary moment.” Back in 2015 presidential candidate Hilary Clinton tanked the sector by suggesting the need for aggressive government intervention to control drug prices. This risk is always in the air.

But now, for better or worse, with President Biden’s ratings at or near all-time lows, it’s looking like Republicans may gain a lot of ground in Congress in the midterm elections, which could dull the specter of government price controls. That won’t be good for people struggling to pay the often-exorbitant prices of drug therapies, which drug companies say are justified because the average drug costs billions to develop. But it would raise sentiment toward this currently hated stock group.

Michael Brush is a columnist for MarketWatch. At the time of publication, he had no positions in any stocks mentioned in this column. Brush has suggested INCY, ITCI, ALNY, BMRN, MRTX and SAGE in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.