Lightspeed POS (TSE:LSPD) had its price objective reduced by investment analysts at CIBC from C$125.00 to C$68.00 in a report issued on Monday, BayStreet.CA reports. The firm currently has an “outperform” rating on the stock. CIBC’s price target suggests a potential upside of 68.19% from the company’s current price.

Other equities analysts have also recently issued research reports about the company. Royal Bank of Canada lowered their target price on Lightspeed POS from C$104.00 to C$62.00 in a report on Friday, January 7th. Sumitomo Mitsui Financial Group reiterated a “hold” rating and set a C$40.00 target price on shares of Lightspeed POS in a report on Monday. JPMorgan Chase & Co. lowered their target price on Lightspeed POS from C$122.00 to C$100.00 and set a “na” rating for the company in a report on Friday, November 5th. Barclays set a C$123.00 price objective on shares of Lightspeed POS and gave the stock an “overweight” rating in a research note on Thursday, November 25th. Finally, BMO Capital Markets set a C$96.00 price objective on shares of Lightspeed POS and gave the stock an “outperform” rating in a research note on Thursday, November 25th. One research analyst has rated the stock with a hold rating, twelve have given a buy rating and one has issued a strong buy rating to the company’s stock. According to MarketBeat.com, Lightspeed POS currently has an average rating of “Buy” and a consensus price target of C$108.71.

Shares of LSPD traded up C$3.53 during trading hours on Monday, reaching C$40.43. The stock had a trading volume of 851,671 shares, compared to its average volume of 1,036,453. The company has a quick ratio of 8.35, a current ratio of 8.54 and a debt-to-equity ratio of 1.98. Lightspeed POS has a 52 week low of C$33.19 and a 52 week high of C$165.87. The firm has a 50-day moving average of C$52.36 and a 200 day moving average of C$96.42. The company has a market cap of C$5.99 billion and a P/E ratio of -20.84.

Lightspeed POS Company Profile

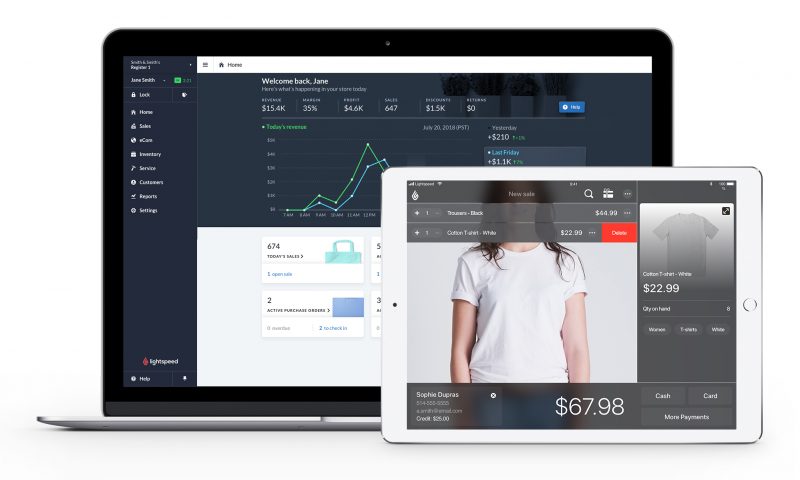

Lightspeed POS Inc provides commerce enabling Software as a Service (SaaS) platform for small and midsize businesses, retailers, restaurants, and golf course operators in Canada, the United States, Germany, Australia, and internationally. Its SaaS platform enables customers to engage with consumers, manage operations, accept payments, etc.