Dow, S&P 500 end less than 2% away from closing records

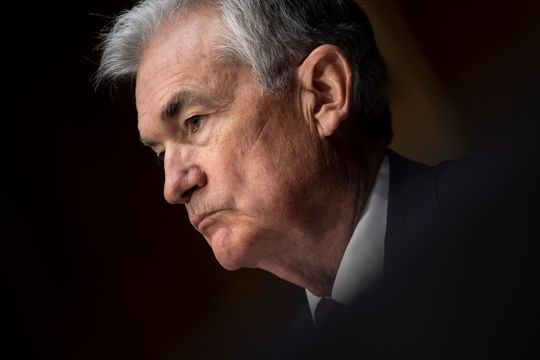

U.S. stocks ended higher Tuesday, with tech-related shares extending a bounce from the previous session, as investors appeared to take testimony by Federal Reserve Chairman Jerome Powell in stride as they looked for clues to the pace of future rate increases and other plans for tightening monetary policy in 2022.

What did major indexes do?

- The Dow Jones Industrial Average DJIA rose 183.15 points, or 0.5%, to close at 36,252.02.

- The S&P 500 SPX advanced 42.78 points, or 0.9%, to end at 4,713.07.

- The Nasdaq Composite COMP jumped 210.62 points, or 1.4%, to finish at 15,153.45.

On Monday, the Dow and S&P 500 ended lower, while the Nasdaq Composite closed fractionally higher. According to Dow Jones Markets Data, the Nasdaq’s reversal from a 2.7% slide earlier was the strongest intraday reversal since Feb. 28, 2020. The late-day reversal was driven by companies that had seen the worst year-to-date performance, according to Bespoke Investment Group.

What drove the market?

Major U.S. stock benchmarks ended higher after investors digested Federal Reserve Chairman Jerome Powell’s testimony before the Senate Banking Committee in a hearing on his nomination to serve a second term.

Powell painted a picture of a soft landing for the economy as the Fed moves to remove emergency stimulus measures and begin raising interest rates, even as market participants increasingly expect the central bank to move much more aggressively than previously anticipated after inflation proved hotter and much more persistent than policy makers had predicted.

“It really is time for us to move away from those emergency policy settings to a more normal level. It really should not have negative effects on the labor market,” said Powell, who is widely expected to be confirmed by the Senate.

Investors also assessed speeches from regional Fed presidents and prepared for Wednesday’s inflation data.

Kansas City Fed President Esther George, said in a speech Tuesday that the central bank should speedily reduce its enormous $8.5 trillion pile of bondholdings to help curb the highest U.S. inflation in almost 40 years and discourage undue risk-taking.

Cleveland Fed President Loretta Mester said she would back a rate increase in March if the economic backdrop resembles current conditions. Mester said she sees the Fed raising rates three times in 2022. George and Mester are both 2022 voting members of the Fed’s policy-setting Federal Open Market Committee.

Tech and other so-called growth stocks — shares of companies whose revenue and earnings are expected to grow faster than average — have been hard hit as Treasury yields have risen in response to expectations the Fed will be much more aggressive than previously anticipated in raising rates in an effort to rein in inflation that is well above target.

“The whole tech sector has been beaten up pretty good,” said Randy Frederick, managing director of trading and derivatives at Charles Schwab, in a phone interview Tuesday. “There’s a pretty big trend of people moving out of growth assets into more value assets, which is something that is consistent with the concerns about higher interest rates.”

The minutes from the December FOMC meeting released last week showed the central bank considering multiple rate increases this year and reducing its nearly $9 trillion balance sheet, which is still growing as the latest round of quantitative easing is wound down.

“The market is telling us that we’re going to get an interest rate hike in March,” said Frederick. That’s when Frederick also expects the Fed to start raising rates, which is sooner than he had been anticipating before minutes of the December meeting were released, he said.

The yield on the 10-year Treasury BX:TMUBMUSD10Y note, which ended Monday at the highest level since Jan. 17, 2020, pulled back slightly Tuesday to 1.745%. The 10-year yield has surged around 25 basis points this year.

“We would not be surprised if tech and large cap growth stocks stage comeback rallies here and there along the way, but ultimately we believe the rotation into value is the better trend in 2022,” said David Bahnsen, chief investment officer of The Bahnsen Group, a Newport, Calif.-based wealth management firm with $3.4 billion in assets under management.

“Our posture is that the broad market indices are vulnerable, and tech is the largest weightings in those broad market indices, but bottom-up selectivity still offers ample opportunities of value in this environment,” he said.

The S&P 500’s information technology sector XX:SP500EW ended 1.2% higher Tuesday, but remained down 3.4% for the year, according to FactSet data. The energy sector XX:SP500EW led the index’s gains, closing up 3.4% and surging 14.1% so far in 2022.

Even with the stock market’s recent turbulence, the S&P 500 remains just 1.7% off its record high close on Jan. 3, while the Dow was off 1.5% from its Jan. 4 record finish, according to Dow Jones Market Data.

“We’ve had this massive snapback from that COVID-related selloff” in March of 2020, said Tom Siomades, chief investment officer of AE Wealth Management, in a phone interview Tuesday. “A lot of people got ahead of their skis” and now have a “golden opportunity to reset” their portfolios as the Fed moves toward tightening its monetary policy.

Which companies were in focus?

- Shares of American Airlines Group Inc. AAL climbed 1.2% after the carrier updated its fourth-quarter guidance to reflect a performance that turned out to be not as bad as expected.

- Life-sciences company Danaher Corp. DHR said it expects fourth-quarter core revenue growth to exceed its own guidance, boosted by better-than-expected results at all three of its operating segments. Shares rose 0.8%.

How did other assets fare?

- The yield on the 10-year Treasury note fell 3.4 basis points to 1.745%. Treasury yields and prices move in opposite directions.

- The ICE U.S. Dollar Index DXY, a measure of the currency against a basket of six major rivals, was down 0.4%.

- Oil futures jumped, with West Texas Intermediate crude CL00 for February delivery CLG22 rising 3.8% to settle at $81.22 a barrel. Gold futures GC00 rose 1.1% to settle at $1,818.50 an ounce.

- Bitcoin BTCUSD was up 2.3% at $42,680.

- The Stoxx Europe 600 XX:SXXP closed 0.8% higher, while London’s FTSE 100 UK:UKX gained 0.6%.

- The Shanghai Composite CN:SHCOMP fell 0.7%, while the Hang Seng Index HK:HSI ended fractionally lower and Japan’s Nikkei 225 JP:NIK lost 0.9%.