This has been a remarkable year for stocks, but it may surprise you how many are in bear-market territory, usually defined as a decline of at least 20%.

Among a large group of beaten-down stocks, analysts working for brokerage firms expect dozens to soar in 2022. See them below.

A solid 2021, but look at the cap-weighting

The benchmark S&P 500 index SPX has risen 27.4% during 2021, following a 16.3% in 2020 — two years of pandemic and two years of double-digit gains. (All price changed in this article exclude dividends.)

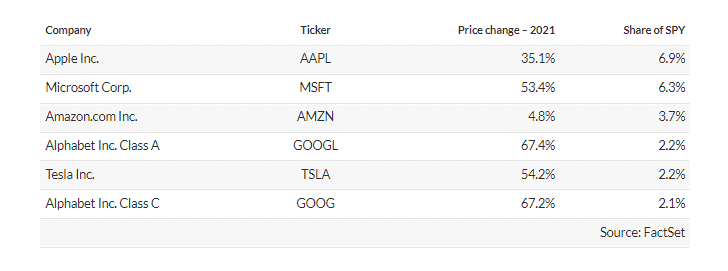

You probably know the S&P 500 is weighted by market capitalization, but you might not be aware of how extreme the weighting can be. Take a look at the weighting and performance of the top five companies held by the SPDR S&P 500 ETF Trust SPY, which tracks the S&P 500. Together, they make up 23% of the fund’s portfolio and the index:

SPY and the S&P 500 include two common-share classes for Alphabet Inc. GOOGL GOOG and two apiece for four other companies, for a total of 505 stocks.

Stocks in bear markets that analysts love

For a broader list of large-cap stocks listed in the U.S., including those of some of China’s biggest internet players, we added the components of the Nasdaq-100 Index NDX, comprised of the 100 largest Nasdaq-listed companies by market capitalization and tracked by the Invesco QQQ Trust QQQ.

After removing duplicates, this left a list of 529 stocks.

Within in the group, 94 are in a bear market — that is, they were down at least 20% from their 2021 intraday highs through Dec. 28, according to data provided by FactSet.

Among the 94, there are 30 with “buy” or equivalent ratings from at least two-thirds of analysts polled by FactSet. Here they are, sorted by the 12-month upside potential implied by the consensus price targets:

| Company | Ticker | Decline from 2021 high | Closing price – Dec. 28 | 2021 high | Date of 2021 high | Share “buy” ratings | Consensus price target | Implied 12-month upside potential |

| Pinduoduo Inc. ADR Class A | PDD | -73.6% | $56.04 | $212.60 | 02/16/2021 | 76% | $104.54 | 87% |

| Baidu Inc. ADR Class A | BIDU | -60.3% | $140.88 | $354.82 | 02/22/2021 | 83% | $232.32 | 65% |

| JD.com Inc. ADR Class A | JD | -39.2% | $65.87 | $108.29 | 02/17/2021 | 94% | $106.30 | 61% |

| MercadoLibre Inc. | MELI | -34.8% | $1,316.28 | $2,020.00 | 01/21/2021 | 87% | $2,011.00 | 53% |

| Caesars Entertainment Inc. | CZR | -22.6% | $92.78 | $119.81 | 10/01/2021 | 94% | $137.36 | 48% |

| Generac Holdings Inc. | GNRC | -33.6% | $348.18 | $524.31 | 11/02/2021 | 77% | $514.11 | 48% |

| Alaska Air Group Inc. | ALK | -28.8% | $52.90 | $74.25 | 04/07/2021 | 93% | $77.71 | 47% |

| PayPal Holdings Inc. | PYPL | -38.7% | $190.10 | $310.16 | 07/26/2021 | 84% | $273.65 | 44% |

| CrowdStrike Holdings Inc. Class A | CRWD | -30.6% | $207.23 | $298.48 | 11/10/2021 | 86% | $291.88 | 41% |

| Trip.com Group Ltd. ADR | TCOM | -48.5% | $23.29 | $45.19 | 03/17/2021 | 79% | $32.78 | 41% |

| T-Mobile US Inc. | TMUS | -21.3% | $118.16 | $150.20 | 07/16/2021 | 81% | $165.51 | 40% |

| Enphase Energy Inc. | ENPH | -33.9% | $186.79 | $282.46 | 11/22/2021 | 67% | $260.92 | 40% |

| Global Payments Inc. | GPN | -38.8% | $135.15 | $220.81 | 04/26/2021 | 85% | $188.41 | 39% |

| NetEase Inc. ADR | NTES | -27.7% | $97.15 | $134.33 | 02/11/2021 | 97% | $134.53 | 38% |

| Activision Blizzard Inc. | ATVI | -36.2% | $66.67 | $104.53 | 02/16/2021 | 71% | $90.86 | 36% |

| Southwest Airlines Co. | LUV | -34.7% | $42.29 | $64.75 | 04/14/2021 | 78% | $57.32 | 36% |

| Fidelity National Information Services Inc. | FIS | -29.9% | $109.29 | $155.96 | 04/29/2021 | 74% | $146.86 | 34% |

| Match Group Inc. | MTCH | -27.0% | $132.94 | $182.00 | 10/21/2021 | 68% | $175.11 | 32% |

| Leidos Holdings Inc. | LDOS | -22.4% | $88.26 | $113.75 | 01/25/2021 | 71% | $115.00 | 30% |

| WestRock Co. | WRK | -28.8% | $44.19 | $62.03 | 05/17/2021 | 67% | $56.92 | 29% |

| Medtronic PLC | MDT | -23.1% | $104.53 | $135.89 | 09/09/2021 | 85% | $134.52 | 29% |

| Teleflex Inc. | TFX | -26.6% | $330.03 | $449.38 | 04/28/2021 | 75% | $424.11 | 29% |

| Zimmer Biomet Holdings Inc. | ZBH | -28.9% | $128.21 | $180.36 | 04/29/2021 | 68% | $163.71 | 28% |

| PTC Inc. | PTC | -20.4% | $122.34 | $153.73 | 07/23/2021 | 71% | $156.15 | 28% |

| Phillips 66 | PSX | -21.6% | $73.93 | $94.34 | 06/10/2021 | 79% | $93.50 | 26% |

| Boeing Co. | BA | -26.0% | $206.13 | $278.57 | 03/15/2021 | 73% | $259.61 | 26% |

| Okta Inc. Class A | OKTA | -23.6% | $224.47 | $294.00 | 02/12/2021 | 82% | $279.88 | 25% |

| Walt Disney Co. | DIS | -23.6% | $155.20 | $203.02 | 03/08/2021 | 70% | $193.29 | 25% |

| Corning Inc. | GLW | -20.2% | $37.35 | $46.82 | 04/26/2021 | 69% | $44.38 | 19% |

| Lamb Weston Holdings Inc. | LW | -28.0% | $62.22 | $86.41 | 03/08/2021 | 78% | $73.29 | 18% |

| Source: FactSet |