Sales of new single-family homes rose 12.4% in November, the fastest pace in seven months, with low mortgage rates continuing to fuel heightened demand.

WASHINGTON — Sales of new single-family homes rose 12.4% in November, the fastest pace in seven months, as the housing industry continued to benefit from low mortgage rates and strong demand.

The November increase pushed the seasonally adjusted annual sales pace to 744,000 last month, the best showing since reaching 796,000 in April.

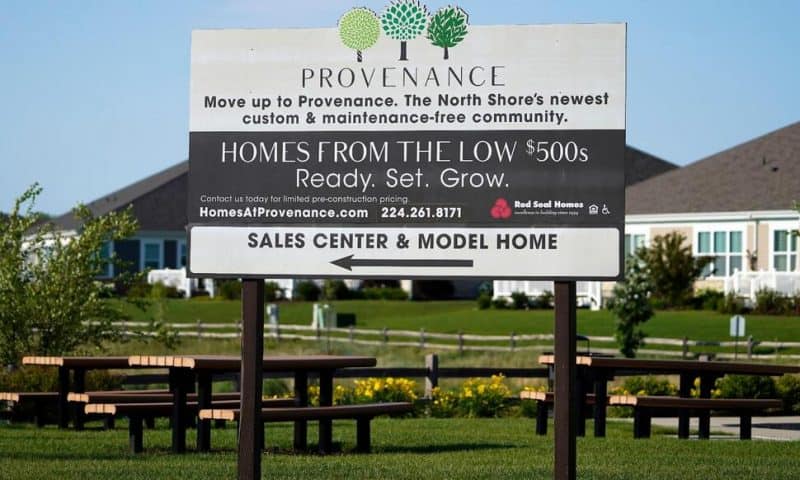

The median sales price of a new home sold in November hit $416,900, 14.1% higher than a year ago.

Demand has surged this year as many Americans cooped up by the pandemic seek out larger homes.

The sale of previously occupied homes rose for a third straight month in November to a seasonally adjusted annual rate of 6.46 million units, the fastest pace since January, according to a report this week from the National Association of Realtors.

Extraordinarily low mortgage rates have intensified demand.

Freddie Mac reported Thursday 30-year fixed rate mortgages averaged 3.05% this week, down from last week’s 3.12%.

Mortgage rates are likely to move higher next year as the Federal Reserve phases out the monthly bond purchases it has been making since the pandemic hit nearly two years ago. The Fed has already signaled that it expects to start raising interest rates as early as next spring to check sharply rising inflation.

But interest rate increases are expected to be modest and the shift higher may actually intensify demand as Americans try to lock in rates before they head even higher.

“Anticipation of higher mortgage rates as the Fed tapers should be supportive of sales over coming months,” predicted Rubeela Farooqi, chief U.S. economist at High Frequency Economics.

For November, sales were up in every region of the country except the Midwest, which saw a 25.4% drop. New home sales surged 53.2% in the West and were up 15.6% in the Northeast and 2.7% in the South.