Stocks got hammered on Monday, as investors fretted about monetary policy, government stimulus programs and the spread of the omicron variant.

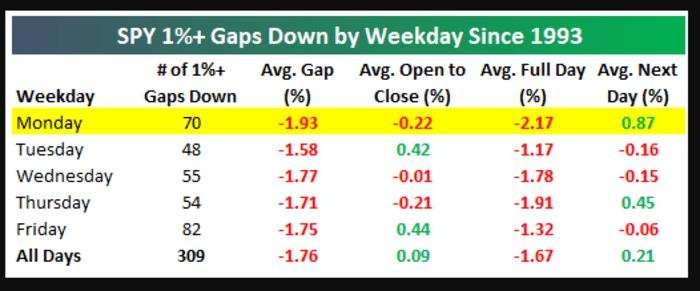

However, the folks at Bespoke note that the day after an ugly Monday selloff, with drops of at least 1%, tend to be followed by a comparatively strong Tuesday performance.

Using the popular exchanged-traded SPDR S&P 500 ETF Trust SPY as a proxy, the Bespoke Investment Group researchers say calculate that the average return in the following Tuesday after a fall of 1% or greater has been a gain of 0.9%. That’s over the past 309 sessions in which the S&P 500 ETF — one of the most popular ways to get exposure to the entire basket of S&P 500 SPX components — has fallen on a Monday since its creation in 1993.

On Monday, the S&P 500 index closed 1.1% lower at about 4,568, the Dow Jones Industrial Average DJIA, -1.23% ended 433 points, or 1.2%, lower, and the Nasdaq Composite Index COMP, -1.24% gave up 1.2%.

If history is any gauge, that may bode well for the market action on Tuesday but that might be little consolation to market participants fretful that the thinner-than-usual volumes, due to the Christmas holiday, will exacerbate swings and could amplify the turmoil in markets that appears to be partly stoked by COVID concerns and the reaction by governments across the globe to the spread of the highly transmissible new strain.

Early data suggest that only the COVID-19 vaccines developed by Pfizer PFE and German partner BioNTech BNTX and Moderna MRNA, -6.25%, bolstered by a booster shot, are effective against infection with the new omicron variant, with other vaccines such as AstraZeneca’s AZN and Johnson & Johnson’s JNJ failing to offer enough protection.