Shares of Squarespace, Inc. (NYSE:SQSP) have earned a consensus recommendation of “Buy” from the nineteen brokerages that are currently covering the firm, MarketBeat Ratings reports. Four equities research analysts have rated the stock with a hold recommendation and fifteen have given a buy recommendation to the company. The average 12-month price target among analysts that have updated their coverage on the stock in the last year is $61.60.

A number of research firms recently issued reports on SQSP. Guggenheim reaffirmed a “buy” rating on shares of Squarespace in a research report on Friday, August 27th. JMP Securities lowered their target price on Squarespace from $64.00 to $58.00 and set a “market outperform” rating on the stock in a research report on Tuesday, November 9th. Truist Securities began coverage on Squarespace in a research report on Thursday, October 21st. They issued a “buy” rating and a $50.00 target price on the stock. Piper Sandler lifted their price target on Squarespace from $50.00 to $52.00 and gave the stock an “overweight” rating in a report on Tuesday, November 9th. Finally, Royal Bank of Canada reduced their price target on Squarespace from $48.00 to $39.00 and set a “sector perform” rating for the company in a report on Friday, November 19th.

In related news, General Counsel Courtenay O’connor sold 4,375 shares of the business’s stock in a transaction that occurred on Monday, November 22nd. The stock was sold at an average price of $34.26, for a total value of $149,887.50. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website.

Several hedge funds have recently modified their holdings of SQSP. General Atlantic L.P. acquired a new position in Squarespace during the second quarter valued at approximately $1,328,471,000. Index Venture Growth Associates I Ltd acquired a new position in Squarespace during the second quarter valued at approximately $1,144,594,000. Vanguard Group Inc. acquired a new position in Squarespace during the second quarter valued at approximately $88,968,000. Dragoneer Investment Group LLC acquired a new position in Squarespace during the second quarter valued at approximately $76,319,000. Finally, Blackstone Inc acquired a new position in Squarespace during the second quarter valued at approximately $50,404,000. Institutional investors and hedge funds own 37.17% of the company’s stock.

SQSP opened at $32.09 on Monday. The firm has a 50-day moving average price of $39.59. Squarespace has a 1 year low of $31.71 and a 1 year high of $64.71.

Squarespace (NYSE:SQSP) last released its earnings results on Monday, November 8th. The company reported $0.04 earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of $0.05 by ($0.01). The company had revenue of $200.96 million during the quarter, compared to analyst estimates of $197.96 million. The business’s revenue was up 23.8% compared to the same quarter last year. During the same quarter in the prior year, the company posted $0.12 earnings per share. Equities research analysts forecast that Squarespace will post -2.87 earnings per share for the current fiscal year.

Squarespace Company Profile

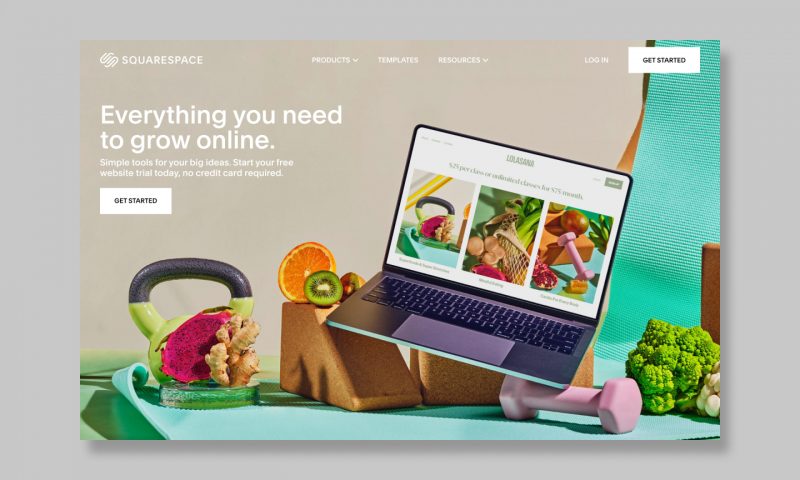

Squarespace, Inc operates platform for businesses and independent creators to build online presence, grow their brands, and manage their businesses across the internet. The company offers websites, domains, e-commerce, tools for managing a social media presence, marketing tools, and scheduling capabilities.