Analyst Carlo Santarelli still sees risk to the downside for Penn’s stock, but he backed away from his bearish stance since it already ‘massively underperformed’ its peers for the past year

Penn National Gaming Inc. shares have performed so poorly in the past year, that long-time defiantly bearish analyst Carlo Santarelli at Deutsche Bank said he no longer recommends selling, even as he still believes the risk is to the downside.

The stock PENN, +0.10% was little changed afternoon trading Friday, to sit just above the one-year closing low of $56.26 on Nov. 10.

In a research note with “It is what we thought it was” in its title, Santarelli upgraded Penn National to hold, after being at sell for the past 17 months. He kept his stock price target at $31, however, which implied TK% downside from current levels.

“Since our downgrade, and after numerous character assassinations, we stuck with our sell rating, because it was based on fundamentals, and ultimately we felt we were right and over time, the fundamentals would prevail,” Santarelli wrote.

He said his sell call in June 2020 was based on the belief that Penn’s margin opportunity would prove to be “considerably less” than its peers, the value investors placed on sports betting and iGaming was “exaggerated” and the overall valuation was stretched.

After the stock ended June 2020 at $30.54, the stock rocketed more than four fold to a record close of $136.47 on March 15, 2021: “[D]uring a time when retail trading and option buying took off, and fueled by numerous social media posts regarding the future success of the company, shares memed to almost $140,” Santarelli wrote.

Since that high, the stock has plunged nearly 60%. And while the price was still nearly double what it was at the end of June 2020, it Santarelli said it has “massively underperformed the regional peers” over the same time.

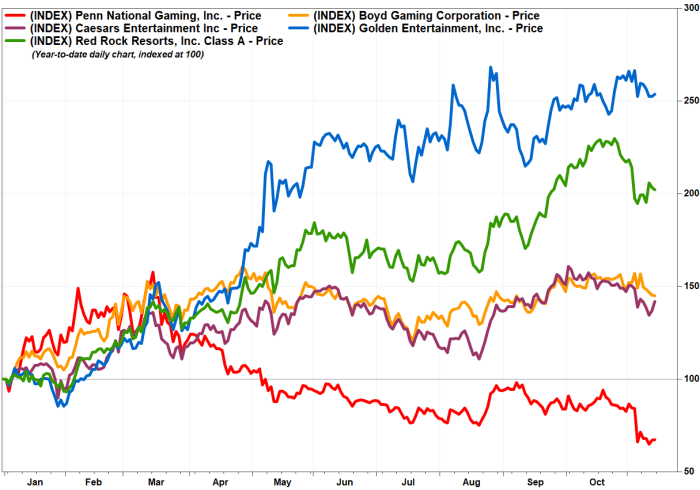

Even worse, Penn’s stock has tumbled 32.6% year to date, while shares of Boyd Gaming Corp. BYD, -0.34% have rallied 44.9%, Caesars Entertainment Inc. CZR, +4.03% have climbed 41.9%, Golden Entertainment Inc. GDEN, -0.02% have soared 153.8% and Red Rock Resorts Inc. RRR, -0.45% have shot up 102.1%. The S&P 500 index SPX, +0.72% has climbed 24.5% over the same time.

For Deutsche Bank, based on a 12-month view of the total shareholder return, a sell rating means the analyst recommends selling the stock, while a hold rating means the analyst recommends neither buy or sell.

The stock’s selloff this year was highlighted by the 21.1% plunge on Nov. 4, the biggest one-day selloff since March 2020, after the company reported a third-quarter profit that fell well short of expectations. To make matters worse, allegations also emerged that David Portnoy, founder of Barstool Sports, of which Penn owns a 36% equity stake, was aggressive and rough with women.

In the end, Santarelli said Penn was what he thought it was: “[A] a strong regional gaming operator with a solid C-level and operational management team, that was set up poorly from a margin perspective, relative to peers coming out of the pandemic, who overhyped a sports betting story to drive the stock, and made some questionable, at the time, and more highly questionable these days, iGaming-related acquisitions, in our view.”