The stock market could see a major upswing to end 2021 as a part of an “everything rally” sparked, at least partly, by falling cases of the delta variant, predict analysts a Fundstrat Global Advisors.

Such a meltup in values could also see bitcoin BTCUSD, 0.01% reach $100,000, said Tom Lee, Fundstrat founder, in comments on CNBC Monday where he also discussed his “everything rally” research note.

“A hundred thousand into year-end is pretty reasonable,” Lee told CNBC.

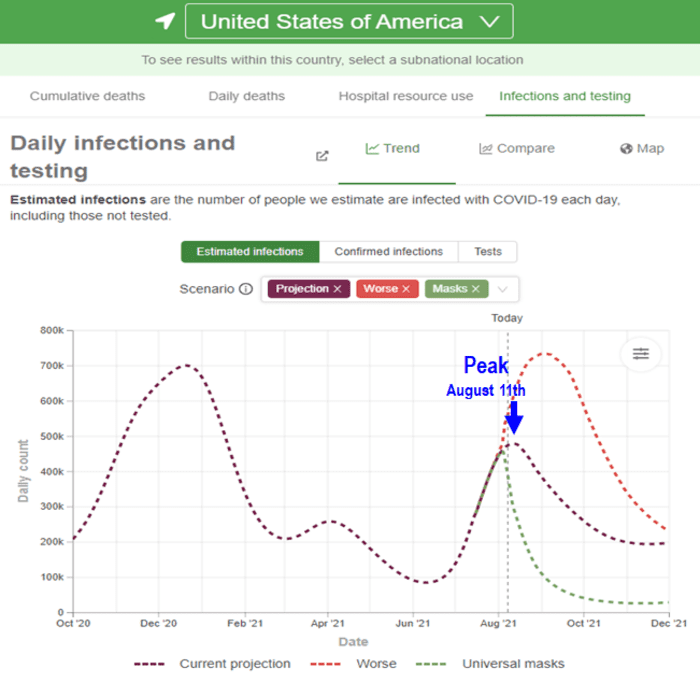

“While the hysteria around the continued surge in delta variant infection continues to grow, the IHME (Institute for Health Metrics, forecasters used by global policy makers) forecasts USA COVID-19 infections to peak this week,” wrote Lee and company, in a research note published Monday.

“What is also interesting is the IHME is not forecasting a fall surge. That is, they are not expecting a renewed wave of cases in the fall. The fall is back-to-school season, plus the start of flu season. Yet, the IHME sees this wave petering out,” wrote the Fundstrat folks, adding that this emboldens their prediction for a broad rally of assets at the end of the year.

A sign of falling cases would possibly produce a “relief rally,” especially if the IHME’s forecast that cases will peak this Wednesday.

Lee’s comments come as the Dow Jones Industrial Average DJIA, -0.30%, the S&P 500 index SPX, -0.09% and the Nasdaq Composite Index COMP, +0.16% were trading at or near record highs, with all three benchmarks look at year-to-date gains of at least 14%.

The strategist says that the “risk-on” atmosphere that might ratchet higher near the end of the year will help to drive up various segments of the market, including bitcoin.

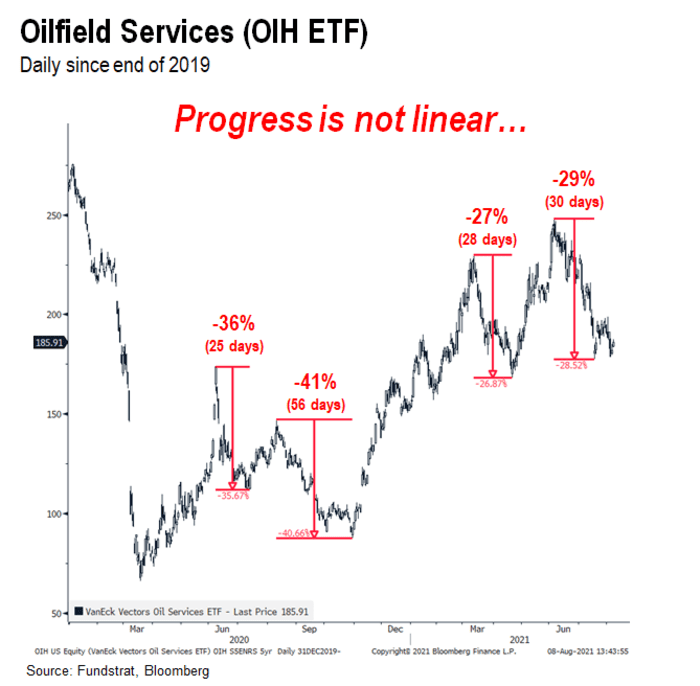

Against that backdrop, Fundstrat is expecting the energy sector to be one of the areas likely to outperform, highlighting VanEck Vectors Oil Services ETF OIH, -1.55%, as a good measure of returns for the oil sector, which has seen turbulence after the U.S. crude benchmark CL.1, 1.37% hit a high above $75 a barrel. OIH, referring to VanEck ETF’s ticker symbol, is up 37% so far this year but down 10.2% in August so far.