RingCentral, Inc. (NYSE:RNG) – Equities research analysts at Colliers Securities issued their Q2 2021 EPS estimates for RingCentral in a report released on Wednesday, May 5th. Colliers Securities analyst C. Trebnick expects that the software maker will post earnings of ($0.57) per share for the quarter. RingCentral (NYSE:RNG) last released its quarterly earnings results on Tuesday, May 4th. The software maker reported $0.27 EPS for the quarter, topping the Zacks’ consensus estimate of $0.25 by $0.02. The business had revenue of $352.36 million for the quarter, compared to analyst estimates of $339.43 million. RingCentral had a negative return on equity of 12.62% and a negative net margin of 9.66%. RingCentral’s revenue for the quarter was up 31.7% on a year-over-year basis. During the same period in the prior year, the company earned $0.19 EPS.

RNG has been the topic of a number of other reports. Morgan Stanley increased their price objective on RingCentral from $420.00 to $455.00 and gave the company an “overweight” rating in a research report on Wednesday, February 17th. Rosenblatt Securities increased their price objective on RingCentral from $345.00 to $430.00 and gave the company a “buy” rating in a research report on Thursday, February 4th. Northland Securities increased their price objective on RingCentral from $340.00 to $450.00 in a research report on Wednesday, February 17th. Evercore ISI increased their price objective on RingCentral from $360.00 to $535.00 in a research report on Wednesday, February 17th. Finally, Craig Hallum decreased their price objective on RingCentral from $530.00 to $410.00 and set a “buy” rating on the stock in a research report on Monday, March 22nd. Two analysts have rated the stock with a hold rating, sixteen have given a buy rating and one has issued a strong buy rating to the stock. The company presently has a consensus rating of “Buy” and an average price target of $440.43.

NYSE RNG opened at $257.04 on Monday. The firm has a market cap of $23.26 billion, a PE ratio of -208.97 and a beta of 0.70. RingCentral has a one year low of $229.00 and a one year high of $449.00. The stock’s 50 day simple moving average is $312.25 and its 200 day simple moving average is $341.70. The company has a debt-to-equity ratio of 4.65, a current ratio of 2.69 and a quick ratio of 2.69.

A number of institutional investors have recently modified their holdings of RNG. IFM Investors Pty Ltd raised its stake in shares of RingCentral by 16.0% in the 4th quarter. IFM Investors Pty Ltd now owns 7,041 shares of the software maker’s stock valued at $2,668,000 after purchasing an additional 973 shares during the period. NN Investment Partners Holdings N.V. raised its stake in shares of RingCentral by 68.8% in the 4th quarter. NN Investment Partners Holdings N.V. now owns 22,024 shares of the software maker’s stock valued at $8,347,000 after purchasing an additional 8,978 shares during the period. CHURCHILL MANAGEMENT Corp acquired a new stake in shares of RingCentral in the 4th quarter valued at about $19,233,000. CAPROCK Group Inc. acquired a new stake in shares of RingCentral in the 4th quarter valued at about $204,000. Finally, Primecap Management Co. CA raised its stake in shares of RingCentral by 1,614.4% in the 4th quarter. Primecap Management Co. CA now owns 184,300 shares of the software maker’s stock valued at $69,844,000 after purchasing an additional 173,550 shares during the period. 86.30% of the stock is currently owned by institutional investors and hedge funds.

In related news, CAO Vaibhav Agarwal sold 435 shares of the firm’s stock in a transaction on Monday, March 22nd. The stock was sold at an average price of $317.19, for a total transaction of $137,977.65. Following the sale, the chief accounting officer now owns 13,486 shares of the company’s stock, valued at approximately $4,277,624.34. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director R Neil Williams sold 4,776 shares of the firm’s stock in a transaction on Wednesday, March 24th. The stock was sold at an average price of $318.23, for a total value of $1,519,866.48. Following the sale, the director now directly owns 15,466 shares in the company, valued at approximately $4,921,745.18. The disclosure for this sale can be found here. Insiders have sold a total of 50,371 shares of company stock worth $18,956,540 in the last ninety days. 11.03% of the stock is currently owned by company insiders.

About RingCentral

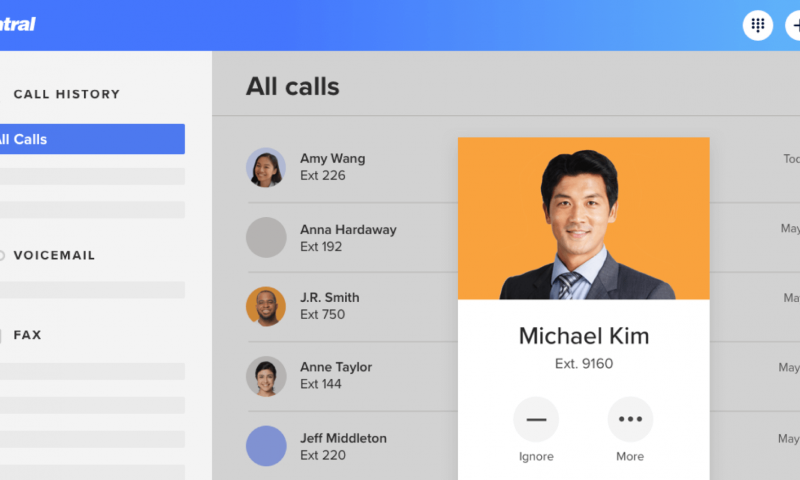

RingCentral, Inc provides software-as-a-service solutions that enable businesses to communicate, collaborate, and connect in North America. Its products include RingCentral Office that provides communication and collaboration across various modes, including high-definition voice, video, SMS, messaging and collaboration, conferencing, online meetings, and fax; RingCentral Contact Center, a collaborative contact center solution that delivers omni-channel; and RingCentral Engage Digital, a digital customer engagement platform that allows enterprises to interact with their customers.