Gold futures rose by nearly 3% on Monday to start the new year, after putting in the best annual return in a decade, with the move for bullion to its highest finish since November coming as the dollar sank to around a 2 1/2-year nadir.

“In the short term, expect gold prices to rise because of the economic consequences of the recent aggressive rise of COVID infections, hospitalizations, and deaths as well as the new and apparently highly contagious strain of COVID,” said Ed Moy, former director of the U.S. Mint and chief strategist at gold seller Valaurum.

“This will likely result in significantly increased economic stimulus in the United States, both monetary and fiscal, which in turn will put downward pressure on the [U.S. dollar] and push gold prices higher,” he said in emailed commentary.

The U.S. saw at least 201,476 new COVID-19 cases on Sunday, and at least 1,353 people died, according to a New York Times tracker. In the last week, the U.S. has averaged 212,893 cases a day, down 1% from the average two weeks ago

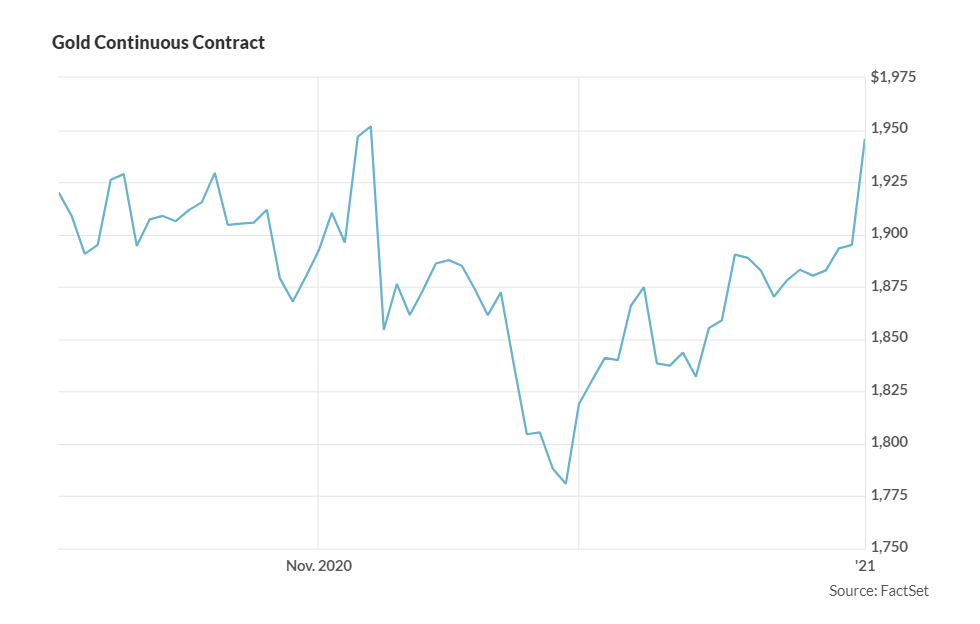

Against that backdrop, gold futures for February delivery GCG21, 0.31% GC00, 0.32% advanced $51.50 to settle at $1,946.60 an ounce, a gain of 2.7%. Based on the most-active contract, prices scored their highest finish since Nov. 6, and their largest one-day percentage gain since April 22, according to FactSet data.

Silver futures for March delivery SIH21, 0.77% SI00, 0.77%, meanwhile, rose 95 cents, or 3.6%, to finish at $27.364 an ounce.

The dollar was little changed as gold futures settled on Monday, but had traded as low as 89.423, around its lowest levels since April 2018, as measured by the ICE U.S. Dollar Index DXY, -0.21%, a gauge of the buck against six major rivals.

An “ongoing risk-rally means investors are continuing to swap their dollars for more risk sensitive currencies such as commodity dollars and emerging market currencies,” said Fawad Razaqzada, market analyst with ThinkMarkets, in a note Monday. “As a result, the dollar index has fallen to levels not seen since early 2018. This in turn, has helped to push prices of buck-denominated precious metals even higher.”

Prices for gold eased back a bit from Monday’s highest levels after U.S. data revealed a rise in the Markit manufacturing PMI to 57.1 in December from 56.5, with the improvement in the reading helping to dull some haven demand for the precious metal. November construction spending, meanwhile, was up by a better than expected 0.9%.

The moves for gold and silver come after the commodities produced their best annual gains since 2010, according to Dow Jones Market Data.

Gold rose around 0.5% last week, and 6.3% in December, and nearly 25% in 2020, with gains slowed to a mere 0.3% rise in the last three months of 2020.

Silver futures logged a more than 2% climb last week, a 17% rise in December, and a roughly 48% annual advance last year, aided by an almost 13% surge in the fourth quarter.

In other Comex metals trading Monday, March copper HGH21, 1.17% tacked on 1% to $3.5545 a pound. April platinum PLF21, +0.70% lost 0.7% to $1,071.50 an ounce and March palladium PAH21, 1.87% declined by nearly 2.6% to $2,391.20 an ounce.