European stocks slipped Monday, giving back some of last week’s rally as traders continued to focus on the reopening of the global economy.

Up 7.1% last week and 2.5% on Friday, the Stoxx Europe 600 SXXP, 0.01% fell 0.2%.

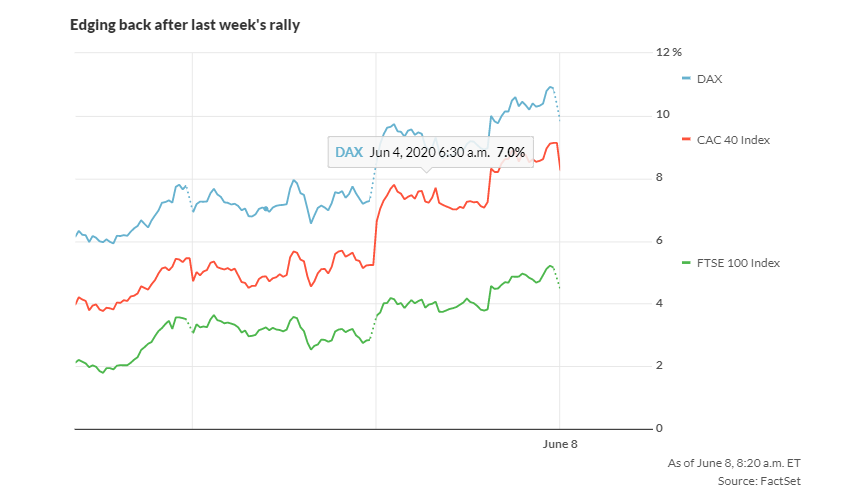

The German DAX DAX, 0.48% fell 0.1%, French CAC 40 PX1, 0.23% lost 0.2% while the U.K. FTSE 100 UKX, 0.28% rose 0.3%.

“Without any significant bearish leverage in sight, there is a high chance that investors chose to take a bit of profit following last week’s solid +300 pts rally on the Stoxx 50 Index and ahead of another busy week. Nonetheless, last week’s much better-than-expected U.S. jobs report may have pushed some investors to price a less dovish tone from the Fed’s upcoming meeting on Wednesday, which could lead to less directional markets this week,” said Pierre Veyret, technical analyst at ActivTrades.

The U.S. on Friday reported it added 2.5 million jobs in May, surprising economists who had forecast a decline.

Federal Reserve officials aren’t prepared to announce any decision on so-called yield caps when their two-day policy meeting concludes on Wednesday, The Wall Street Journal reported.

France’s labor minister, Muriel Pénicaud, told France Info that economic activity is 80% of normal.

Germany on Monday said it suffered a record drop in industrial production, of 17.9%, in April.

“The lifting of the lockdown measures should lead to a strong rebound in economic activity and also industrial production in May and June. However, at least for German industry, the period after the imminent rebound does not look too promising,” said Carsten Brzeski, chief economist for the eurozone and global head of macro at ING.

AstraZeneca AZN, -2.40% slipped 2.1% after Bloomberg News said it approached Gilead Sciences GILD, -1.01% last month over buying the maker of remdesivir. AstraZeneca said it doesn’t comment on rumor or speculation.

UBI Banca UBI, 3.09% rose 4.4% after Intesa Sanpaolo ISP, 2.73% said it has received authorization from the European Central Bank to acquire a controlling majority in it. Intesa shares rose over 3%.

Futures on the Dow Jones Industrial Average YM00, 0.99% rose 210 points.