Despite a recent stock rally, estimates suggest Apple’s full-year profit and sales will decline for only the second time since 2001

From a look at Apple Inc.’s stock, you might think that Wall Street was expecting something big from the company’s coming earnings report.

Apple shares AAPL, +1.23% keep roaring higher, buoyed by talk of momentum for the company’s new iPhones and services offerings as well as indications that the smartphone giant might be on a better trajectory in China. The stock notched yet another record high Friday, its fifth over the past six trading sessions, and it’s by far the best performer in the Dow Jones Industrial Average DJIA, +0.57% for 2019.

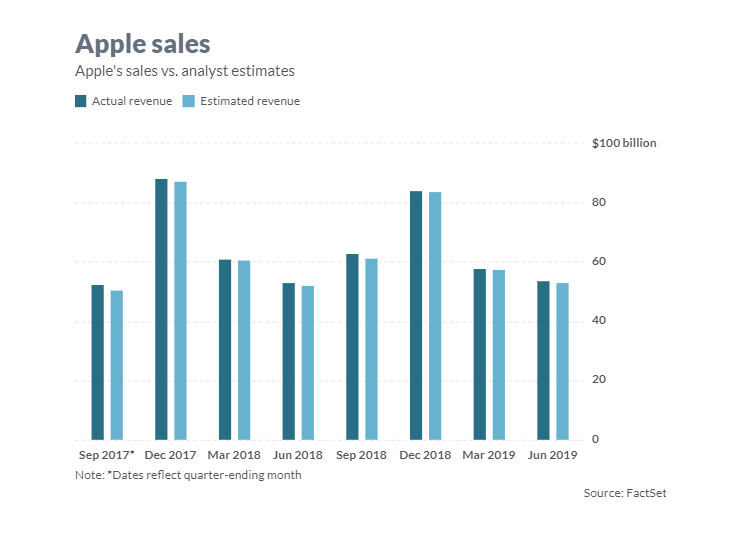

Consensus estimates, however, don’t back up all the supposed enthusiasm about Apple’s fiscal fourth-quarter report, scheduled for Wednesday afternoon. Analysts surveyed by FactSet see the company posting revenue of $63 billion, nearly flat from $62.9 billion a year ago. The report will cap off a fiscal year in which Apple’s earnings and revenue are both expected to decline from a year earlier, which has happened at Apple only once since 2001.

The fiscal fourth-quarter numbers will only contain a little more than a week’s worth of iPhone 11 sales, so the big test for Apple is in its outlook, which should show how the company expects its devices to perform over the holidays. Analysts are calling for a December-quarter sales bump over last year, but overall estimates haven’t budged for the period since the end of July.

Still, Morgan Stanley’s Katy Huberty, the most bullish analyst on the stock, says Apple doesn’t even have to do much with its earnings report to sustain its share-price trajectory.

“We believe Apple remains under-owned by investors despite the 15% gain since last reporting earnings and therefore if Apple is able to post in-line September-quarter results and December-quarter guidance then the stock can sustain momentum into year-end, barring any major shocks to global markets,” she wrote. “Ultimately investors appear to be owning the stock for the coming 5G iPhone cycle and ramping new services so even in the scenario of light December-quarter guidance, we expect inflows to the name in early 2020 as Apple’s multiple typically expands in the nine to 12 months ahead of major product cycles.”

What to expect

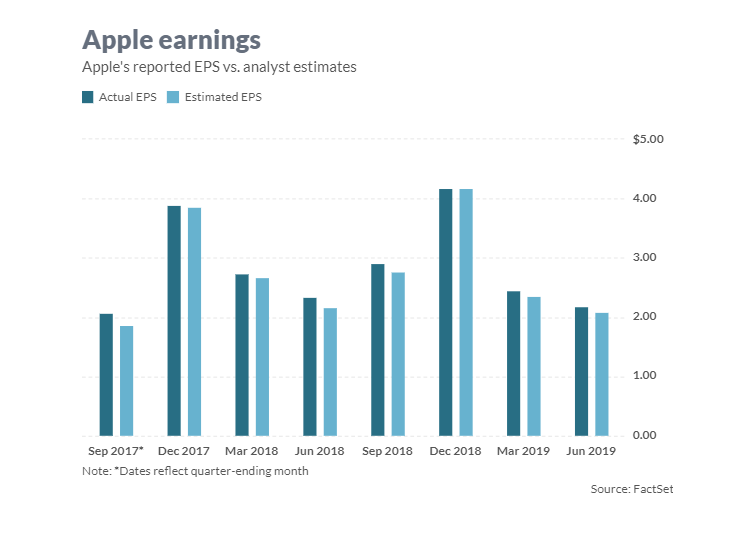

Earnings: Analysts surveyed by FactSet expect that Apple earned $2.83 a share for its fiscal fourth quarter, down from $2.91 in the year-earlier quarter. According to Estimize, which crowdsources projections from hedge funds, academics, and others, the average projection calls for $2.89.

Revenue: The FactSet consensus models $62.98 billion in September-quarter revenue, while the Estimize consensus is for $63.06 billion. A year earlier, Apple posted revenue of $62.9 billion.

The FactSet consensus calls for $32.77 billion in iPhone revenue, $4.67 billion in iPad revenue, $7.5 billion in Mac revenue, $5.94 billion in wearables, home, and accessories revenue, and $12.22 billion in services revenue.

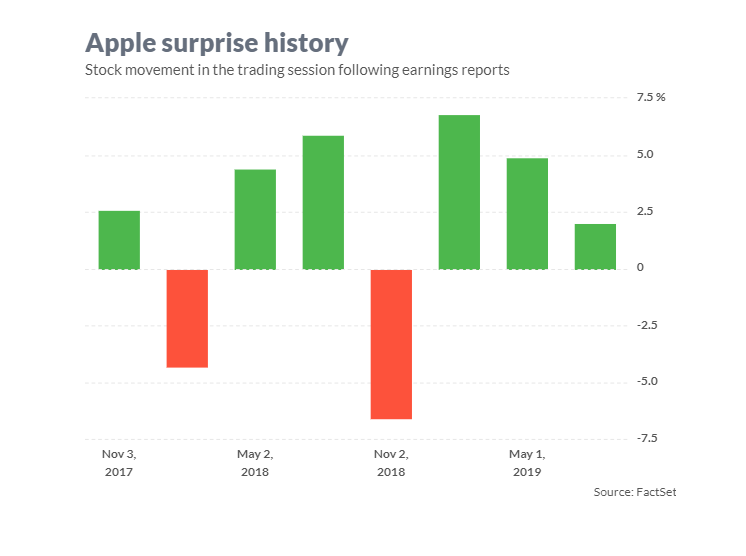

Stock movement: Apple shares have gained following seven of the company’s last 10 earnings reports, excluding a negative preannouncement made ahead of Apple’s last holiday quarter. The stock is up 56% so far this year as the Dow has risen 16%.

What else to watch for

One topic of interest heading into Apple’s report is how the company plans to account for its new Apple TV+ streaming service. The company is offering a year’s free trial to the service for those who make new hardware purchases, which Huberty says will require Apple to defer about $57 per iPhone sold to amortize as Apple TV+ services revenue over the year that the trial is active. She also expects that Apple will amortize content costs as services cost of goods sold for three years, but management may provide some guidance regarding the accounting treatment on the conference call.

Huberty rates the stock at overweight with a $289 target, the highest on Wall Street.

Apple TV+ is a big theme for D.A. Davidson analyst Tom Forte as well, with the service set to launch Nov. 1. He’ll be looking for the company’s outlook on the service now that pricing has been announced and Apple has publicized its free-trial offer affecting those who buy new iPhones, iPads, Macs, iPods or Apple TVs. Forte has a buy rating and $270 target on Apple shares.

China traction is another major issue for Apple, and UBS analyst Timothy Arcuri sees the company making progress in the region, which has been a sore spot thus far this year. “Monthly iPhone trends in China are encouraging,” he wrote, with the company posting sales growth there in two of the past three months, according to third-party data.

He rates Apple’s stock a buy with a $275 target price.

Monness, Crespi, Hardt, & Co. analyst Brian White tells investors to be mindful of the timing differences between this current cycle and the last one. All three of Apple’s new iPhones were available on Sept. 20 this year, whereas Apple released last season’s iPhone XR that October. He rates the stock a buy with a $265 target.