Bruker Co. (NASDAQ:BRKR) – Stock analysts at Svb Leerink boosted their Q3 2019 earnings estimates for shares of Bruker in a report issued on Thursday, June 20th, according to Zacks Investment Research. Svb Leerink analyst P. Souda now anticipates that the medical research company will post earnings per share of $0.42 for the quarter, up from their prior forecast of $0.41. Svb Leerink currently has a “Outperform” rating and a $53.00 price target on the stock. Svb Leerink also issued estimates for Bruker’s FY2019 earnings at $1.62 EPS, FY2020 earnings at $1.85 EPS, Q1 2021 earnings at $0.45 EPS and FY2021 earnings at $2.11 EPS.

Other equities research analysts also recently issued reports about the stock. Leerink Swann upgraded shares of Bruker from a “market perform” rating to an “outperform” rating in a research report on Friday, May 3rd. Wolfe Research began coverage on shares of Waters in a report on Thursday, May 30th. They issued an “underperform” rating on the stock. Deutsche Bank boosted their price objective on shares of Prudential Financial from $97.00 to $104.00 and gave the stock a “hold” rating in a report on Friday, April 12th. Needham & Company LLC boosted their price objective on shares of from $50.00 to $53.00 in a report on Monday, June 24th. Finally, Jefferies Financial Group reiterated a “buy” rating on shares of Linde in a report on Friday, June 21st. One analyst has rated the stock with a sell rating, five have issued a hold rating, seven have issued a buy rating and one has issued a strong buy rating to the company’s stock. The company presently has an average rating of “Buy” and a consensus price target of $48.18.

Shares of NASDAQ BRKR traded down $0.05 during midday trading on Monday, reaching $49.61. 427,927 shares of the company were exchanged, compared to its average volume of 737,098. Bruker has a 1 year low of $26.10 and a 1 year high of $51.41. The company’s fifty day moving average is $46.93. The company has a market capitalization of $7.71 billion, a PE ratio of 35.44, a P/E/G ratio of 2.41 and a beta of 1.32. The company has a current ratio of 2.12, a quick ratio of 1.27 and a debt-to-equity ratio of 0.42.

Bruker (NASDAQ:BRKR) last announced its earnings results on Thursday, May 2nd. The medical research company reported $0.28 earnings per share for the quarter, topping the Thomson Reuters’ consensus estimate of $0.24 by $0.04. The firm had revenue of $461.40 million for the quarter, compared to the consensus estimate of $450.46 million. Bruker had a return on equity of 26.28% and a net margin of 9.53%. The firm’s revenue for the quarter was up 6.9% on a year-over-year basis. During the same period in the previous year, the business earned $0.24 EPS.

The firm also recently disclosed a quarterly dividend, which was paid on Friday, June 21st. Stockholders of record on Monday, June 3rd were issued a dividend of $0.04 per share. This represents a $0.16 dividend on an annualized basis and a dividend yield of 0.32%. The ex-dividend date of this dividend was Friday, May 31st. Bruker’s payout ratio is 11.43%.

In other Bruker news, CEO Frank H. Laukien sold 400,000 shares of the business’s stock in a transaction dated Monday, June 3rd. The shares were sold at an average price of $41.48, for a total value of $16,592,000.00. Following the completion of the transaction, the chief executive officer now directly owns 37,991,030 shares of the company’s stock, valued at $1,575,867,924.40. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, Director Marc A. Kastner sold 1,374 shares of the business’s stock in a transaction dated Wednesday, May 15th. The stock was sold at an average price of $41.79, for a total transaction of $57,419.46. Following the completion of the transaction, the director now directly owns 10,811 shares of the company’s stock, valued at $451,791.69. The disclosure for this sale can be found here. Insiders have sold a total of 801,374 shares of company stock valued at $33,241,419 over the last ninety days. 26.50% of the stock is owned by insiders.

Several hedge funds and other institutional investors have recently made changes to their positions in BRKR. Mitsubishi UFJ Kokusai Asset Management Co. Ltd. grew its position in shares of Bruker by 7.3% during the 1st quarter. Mitsubishi UFJ Kokusai Asset Management Co. Ltd. now owns 7,285 shares of the medical research company’s stock worth $280,000 after buying an additional 494 shares during the period. Strs Ohio increased its position in Bruker by 5.3% during the 1st quarter. Strs Ohio now owns 10,685 shares of the medical research company’s stock valued at $410,000 after purchasing an additional 537 shares during the period. O Shaughnessy Asset Management LLC acquired a new stake in Bruker during the 1st quarter valued at approximately $35,000. California State Teachers Retirement System lifted its stake in Bruker by 0.6% during the 4th quarter. California State Teachers Retirement System now owns 160,993 shares of the medical research company’s stock valued at $4,793,000 after acquiring an additional 933 shares in the last quarter. Finally, Captrust Financial Advisors lifted its stake in Bruker by 164.7% during the 4th quarter. Captrust Financial Advisors now owns 1,824 shares of the medical research company’s stock valued at $54,000 after acquiring an additional 1,135 shares in the last quarter. 66.73% of the stock is owned by institutional investors.

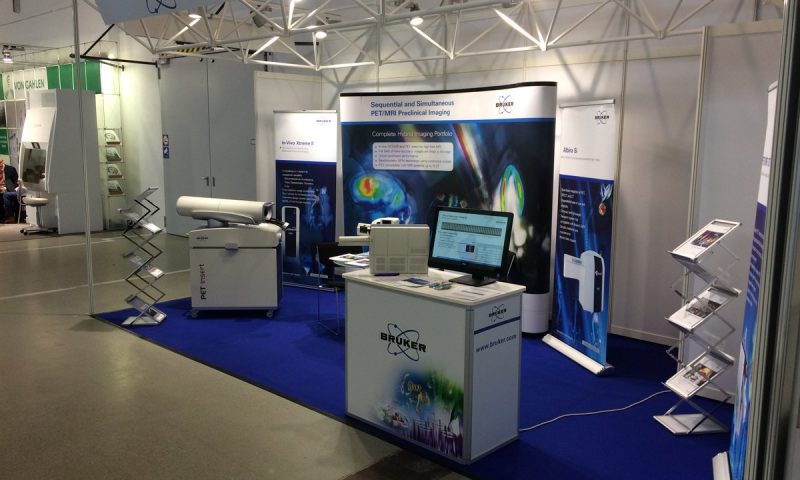

About Bruker

Bruker Corporation manufactures and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally. The company operates in two segments, Bruker Scientific Instruments, and Bruker Energy & Supercon Technologies. It offers life science tools based on magnetic resonance technology; life science mass spectrometry and ion mobility spectrometry solutions; infrared spectroscopy and radiological/nuclear detectors for chemical, biological, radiological, nuclear, and explosive detection in emergency response, homeland security, and defense applications; and research, analytical, and process analysis instruments and solutions based on infrared and Raman molecular spectroscopy technologies.