Fresenius Medical Care AG & Co. (NYSE:FMS) – Analysts at SunTrust Banks issued their Q1 2020 earnings per share (EPS) estimates for Fresenius Medical Care AG & Co. in a research note issued on Tuesday, June 25th, Zacks Investment Research reports. SunTrust Banks analyst D. Macdonald forecasts that the company will earn $0.59 per share for the quarter. SunTrust Banks also issued estimates for Fresenius Medical Care AG & Co.’s Q2 2020 earnings at $0.63 EPS, Q3 2020 earnings at $0.65 EPS and Q4 2020 earnings at $0.71 EPS.

Fresenius Medical Care AG & Co. (NYSE:FMS) last announced its quarterly earnings results on Thursday, May 2nd. The company reported $0.59 earnings per share for the quarter, beating analysts’ consensus estimates of $0.52 by $0.07. Fresenius Medical Care AG & Co. had a return on equity of 10.27% and a net margin of 11.94%. The firm had revenue of $4.13 billion for the quarter, compared to analysts’ expectations of $4.58 billion. During the same period in the prior year, the business posted $0.91 earnings per share. The business’s revenue was up 3.9% compared to the same quarter last year.

A number of other analysts have also recently weighed in on the company. Barclays reiterated a “hold” rating and issued a $14.00 price target on shares of MACOM Technology Solutions in a research report on Thursday, June 20th. Royal Bank of Canada lowered their price target on from GBX 3,000 ($39.20) to GBX 2,900 ($37.89) and set an “outperform” rating on the stock in a research report on Thursday, June 6th. DZ Bank reiterated a “neutral” rating on shares of Gerresheimer in a research report on Thursday. Zacks Investment Research cut First Merchants from a “hold” rating to a “sell” rating in a research report on Monday, July 1st. Finally, Commerzbank reiterated a “hold” rating and issued a $54.00 price target on shares of Fresenius Medical Care AG & Co. in a research report on Thursday, May 9th. Two equities research analysts have rated the stock with a sell rating, four have assigned a hold rating and four have issued a buy rating to the stock. The company presently has a consensus rating of “Hold” and a consensus target price of $53.05.

Shares of NYSE:FMS opened at $39.32 on Thursday. The company has a fifty day moving average of $38.40. Fresenius Medical Care AG & Co. has a fifty-two week low of $30.99 and a fifty-two week high of $53.40. The company has a market capitalization of $24.30 billion, a PE ratio of 17.32, a price-to-earnings-growth ratio of 2.81 and a beta of 1.43. The company has a quick ratio of 0.79, a current ratio of 1.02 and a debt-to-equity ratio of 0.73.

Several hedge funds have recently made changes to their positions in the company. Harvest Group Wealth Management LLC bought a new position in Fresenius Medical Care AG & Co. in the first quarter valued at about $29,000. Osborn Williams & Donohoe LLC acquired a new position in Fresenius Medical Care AG & Co. in the first quarter valued at about $42,000. Magellan Asset Management Ltd lifted its stake in Fresenius Medical Care AG & Co. by 52.3% in the fourth quarter. Magellan Asset Management Ltd now owns 1,433 shares of the company’s stock valued at $46,000 after buying an additional 492 shares during the period. Rehmann Capital Advisory Group lifted its stake in Fresenius Medical Care AG & Co. by 33.4% in the fourth quarter. Rehmann Capital Advisory Group now owns 1,748 shares of the company’s stock valued at $57,000 after buying an additional 438 shares during the period. Finally, QS Investors LLC acquired a new position in Fresenius Medical Care AG & Co. in the fourth quarter valued at about $58,000. Institutional investors own 1.45% of the company’s stock.

About Fresenius Medical Care AG & Co.

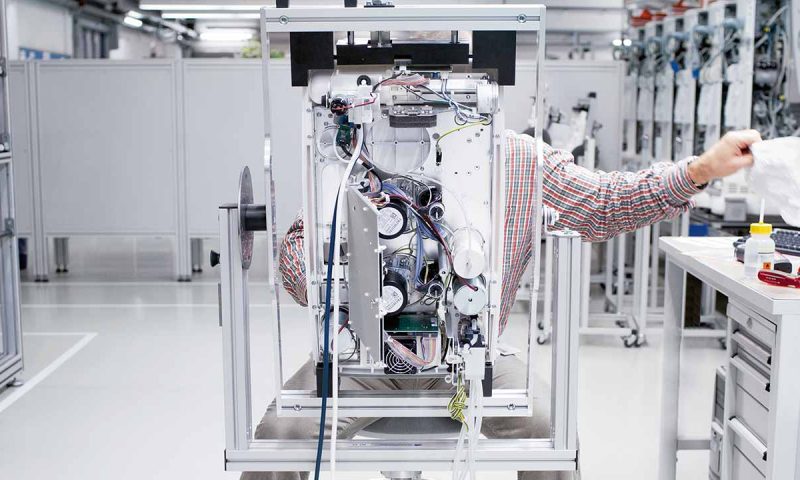

Fresenius Medical Care AG & Co KGaA, a kidney dialysis company, provides dialysis care and related services, and other health care services in Germany, the United States, and internationally. It offers dialysis treatment and related laboratory and diagnostic services through a network of outpatient dialysis clinics; materials, training, and patient support services comprising clinical monitoring, follow-up assistance, and arranging for delivery of the supplies to the patient’s residence; and dialysis services under contract to hospitals in the United States for the hospitalized end-stage renal disease (ESRD) patients and for patients suffering from acute kidney failure.