Vericel Corp (NASDAQ:VCEL) – Svb Leerink decreased their Q2 2019 earnings estimates for shares of Vericel in a report issued on Wednesday, June 19th, Zacks Investment Research reports. Svb Leerink analyst D. Antalffy now forecasts that the biotechnology company will earn ($0.47) per share for the quarter, down from their prior estimate of ($0.08). Svb Leerink also issued estimates for Vericel’s Q3 2019 earnings at $0.00 EPS, FY2019 earnings at ($0.34) EPS, Q1 2020 earnings at ($0.04) EPS and FY2020 earnings at $0.26 EPS.

Several other research analysts have also issued reports on the company. Oppenheimer cut their price target on 2U from $83.00 to $67.00 and set an “outperform” rating on the stock in a report on Wednesday, May 8th. BidaskClub upgraded Xilinx from a “hold” rating to a “buy” rating in a report on Saturday, June 29th. Finally, Zacks Investment Research lowered Zynerba Pharmaceuticals from a “buy” rating to a “hold” rating in a report on Saturday, May 11th. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating and four have assigned a buy rating to the company’s stock. The company currently has a consensus rating of “Buy” and a consensus target price of $22.98.

Shares of Vericel stock traded up $0.25 on Friday, hitting $19.83. 364,375 shares of the company’s stock traded hands, compared to its average volume of 495,866. The firm’s fifty day moving average price is $17.26. The company has a market cap of $859.78 million, a P/E ratio of -141.64 and a beta of 2.83. The company has a debt-to-equity ratio of 0.24, a current ratio of 8.47 and a quick ratio of 8.16. Vericel has a one year low of $8.95 and a one year high of $21.00.

Vericel (NASDAQ:VCEL) last announced its earnings results on Tuesday, May 7th. The biotechnology company reported ($0.07) EPS for the quarter, meeting the consensus estimate of ($0.07). Vericel had a negative return on equity of 3.40% and a negative net margin of 3.51%. The company had revenue of $21.81 million for the quarter, compared to analyst estimates of $22.51 million. During the same quarter in the prior year, the company earned ($0.21) EPS. The firm’s revenue for the quarter was up 21.0% compared to the same quarter last year.

In other Vericel news, Director Steven C. Gilman sold 7,500 shares of the stock in a transaction that occurred on Wednesday, May 1st. The stock was sold at an average price of $16.81, for a total value of $126,075.00. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CFO Gerard J. Michel sold 17,500 shares of the stock in a transaction that occurred on Monday, May 13th. The stock was sold at an average price of $17.02, for a total value of $297,850.00. The disclosure for this sale can be found here. In the last quarter, insiders sold 42,500 shares of company stock worth $697,275. Corporate insiders own 4.50% of the company’s stock.

Several hedge funds have recently bought and sold shares of VCEL. Morgan Stanley lifted its holdings in shares of Vericel by 19.6% in the third quarter. Morgan Stanley now owns 102,234 shares of the biotechnology company’s stock valued at $1,446,000 after purchasing an additional 16,724 shares in the last quarter. Rhumbline Advisers lifted its holdings in shares of Vericel by 60.3% in the fourth quarter. Rhumbline Advisers now owns 56,958 shares of the biotechnology company’s stock valued at $991,000 after purchasing an additional 21,422 shares in the last quarter. State Board of Administration of Florida Retirement System bought a new position in shares of Vericel in the fourth quarter valued at approximately $205,000. 361 Capital LLC lifted its holdings in shares of Vericel by 25.5% in the fourth quarter. 361 Capital LLC now owns 158,643 shares of the biotechnology company’s stock valued at $2,760,000 after purchasing an additional 32,279 shares in the last quarter. Finally, New York State Common Retirement Fund lifted its holdings in shares of Vericel by 6.4% in the fourth quarter. New York State Common Retirement Fund now owns 43,500 shares of the biotechnology company’s stock valued at $757,000 after purchasing an additional 2,600 shares in the last quarter. Institutional investors own 85.17% of the company’s stock.

About Vericel

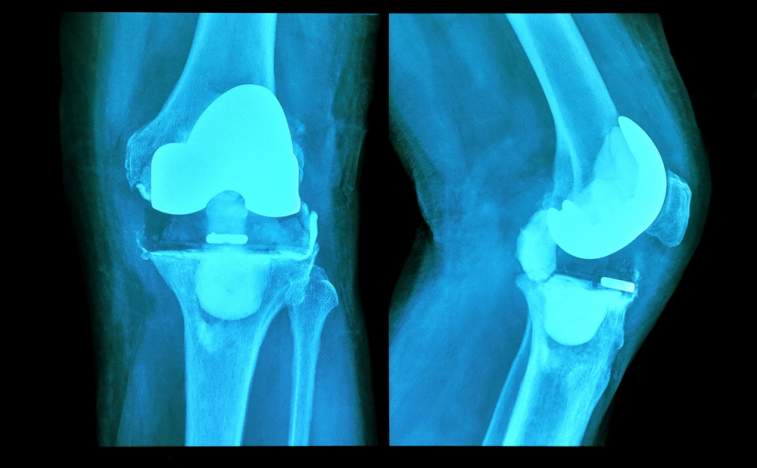

Vericel Corporation, a commercial-stage biopharmaceutical company, researches, develops, manufactures, and distributes cellular therapies for sports medicine and severe burn care markets. It markets autologous cell therapy products, including MACI, an autologous cellularized scaffold product for the repair of symptomatic, and single or multiple full-thickness cartilage defects of the knee; and Epicel, a permanent skin replacement humanitarian use device for the treatment of patients with deep-dermal or full-thickness burns.