World shares mostly lower ahead of Fed meeting, as White House says trade talks to resume next week.

BANGKOK — Shares were mostly lower in Europe early Wednesday ahead of the Federal Reserve’s policy statement, after a lackluster day of trading in Asia.

Germany’s DAX sank 0.8 percent to 11,695.08 and the CAC 40 in France gave up 0.1 percent to 5,418.15. Britain’s FTSE 100 slipped less than 0.1 percent to 7,321.74. Wall Street looked set for a steady start with the future contract for the Dow Jones Industrial Average up 0.1 percent to 25,929.00. That for the Standard and Poor’s 500 also rose 0.1 percent, to 2,839.80.

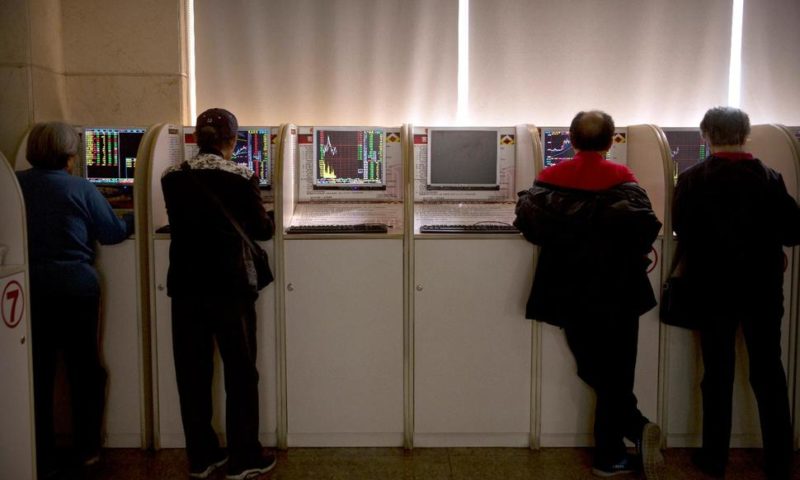

In Asia, fresh news on China-U.S. trade talks helped Chinese benchmarks to trim early losses. The Shanghai Composite was flat at 3,090.64 and Hong Kong’s Hang Seng fell 0.5 percent to 29,320.97.

White House officials said Tuesday that top U.S. trade and economic officials will visit China late next week for another round of negotiations on their dispute over Beijing’s industrial policies and other issues.

The officials, who spoke on background because they weren’t authorized to comment publicly, said Treasury Secretary Steven Mnuchin and U.S. Trade Representative Robert Lighthizer will lead the delegation.

The news suggested hope for progress, albeit delayed, in the tariffs war between the two largest economies. Business lobbyists say an agreement now probably won’t be reached until late April.

Elsewhere in Asia, Japan’s Nikkei 225 index gained 0.2 percent to 21,608.92, while the S&P ASX 200 gave up 0.3 percent to 6,165.30. South Korea’s Kospi was virtually unchanged at 2,177.10. India’s Sensex advanced 0.2 percent to 38,422.94.

Shares were higher in Taiwan and Thailand but fell in Singapore and Indonesia.

Global investors are looking ahead to the Federal Reserve’s interest rate policy update due later Wednesday. The central bank has signaled that it will be “patient” in raising interest rates.

“Against the backdrop of heightened concerns over U.S.-China trade and ahead of the Fed meeting, Asia markets may well trade cautiously once again,” Jingyi Pan of IG said in a commentary. She added that “the broad sense is that regional markets will be attuned toward the Fed meeting.”

The Fed has made clear that with a dimmer economic picture in both the United States and globally, it no longer sees the need to keep raising rates as it did four times in 2018. Among the key factors, besides slower growth, are President Donald Trump’s trade war with China, continually low inflation levels and Prime Minister Theresa May’s struggle to execute Britain’s exit from the European Union.

CURRENCIES: The dollar rose to 111.58 Japanese yen from 111.40 yen. The euro slipped to $1.1343 from $1.1351 on Tuesday.

ENERGY: Benchmark U.S. crude oil picked up 4 cents to $59.33 per barrel in electronic trading on the New York Mercantile Exchange. It gave up 9 cents to close at $59.29 a barrel on Tuesday. Brent crude, the international standard, gained 20 cents to $67.81 a barrel.