Electric Car Makers, Electrameccanica Vehicles Corp. (NASDAQ:SOLO), Are Riding SOLO, Hitting Market with Innovative 3-Wheel Micro EV.

Demand for Electric Vehicles (EVs) is sharply on the rise, leading to initiates both private and publicly-backed to incentivize an electric revolution on the roads, including a $50 billion pledge from Volkswagen to embark on an electric car ‘offensive’.[1]

In the United States, there are currently approximately 840,000 EVs on the road, according to the Edison Electric Institute’s report from June 2018. Between Q1 of 2017 and Q1 of 2018, sales increased 32%.[2]

The proportionate number of EVs on the road is set to increase, with electric options becoming more economic to own and run—even compared to gasoline and diesel engines.[3]

That gap is about to widen more so, with the launch of the SOLO from veteran Italian carmakers, Intermeccanica, which in 2017 was acquired by Vancouver-based Electrameccanica Vehicles Corp. (NASDAQ:SOLO).

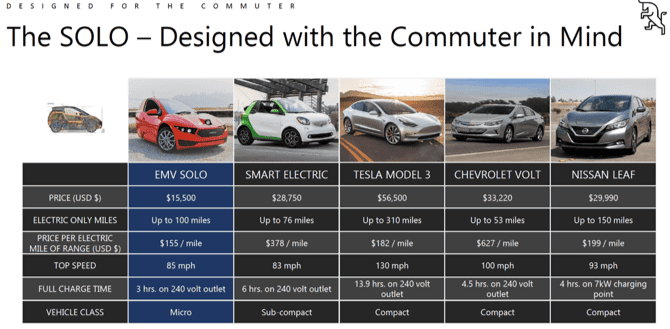

Meet the Market’s Lowest Cost Electric Vehicle

Eye catching with its unique three-wheeled, single-seat design,[4] the game-changing EV currently has another advantage that even the majors can’t currently touch—its price.

Retailing at ~$15,500 USD, the SOLO is the least expensive EV on the market. Now with a manufacturing agreement with China’s largest motorcycle manufacturer in place, Electrameccanica Vehicles Corp. (NASDAQ:SOLO) is set to further reduce its production risk, and capex, and increase it profit margins.

“Electrameccanica has a total of 64,154 vehicle pre-orders across all models, representing $2.4 billion in potential sales orders”

The company has two other EV’s in various stages of development, including the Tofino, an all-electric two-seat sports car, and the eRoadster, an electric evolution of Intermeccanica’s widely renowned classic vehicle design.

With the SOLO and Tofino, Electra Meccanica brings a unique, winning EV formula for 2019.

Pre-Orders Galore: Billions in Potential Sales in Play

As of December 20, 2018, Electrameccanica Vehicles Corp. (NASDAQ:SOLO) had a total of 64,154 vehicle pre-orders across all models, representing $2.4 billion in potential sales at the targeted MSRP.

Pre-orders consist of 23,030 pre-orders for the SOLO single-passenger electric vehicle, which has a $15,500 target MSRP, and 41,124 pre-orders for the Tofino two-seat roadster sports car, which has a $50,000 target MSRP.

Over a three-year period commencing Q1 2019, Electrameccanica Vehicles Corp. (NASDAQ:SOLO) anticipates the delivery of 75,000 SOLOs. Capitalizing on an established sales, distribution and service model, the company will partner with existing dealership networks to drive sales of the SOLO in non-core markets where the company doesn’t maintain a dealership presence.

Electrameccanica Vehicles Corp. (NASDAQ:SOLO) will begin its deliveries through existing dealerships in Los Angeles, and Vancouver. So far there has been significant dealer interest worldwide—evidenced by dealer letters of intent for over 21,000 SOLOs.

Electrameccanica Offers First Look From Its China Facility

Adding Major Industry Experience to Its Board

Electrameccanica has begun adding strategic members to its board to strengthen its automotive industry experience. Most recently, the company appointed Peter Savagian as an Independent Director.

Mr. Savagian is a pioneer in automotive electrification, with a broad expertise in the technology, development, launch and production of electric vehicles. In 1990 he began work on the General Motors EV1, the first modern electric vehicle and was named Chief Engineer of Electric Propulsion Systems in 1998. Later, as General Director of Electrified Propulsion, he built and led multiple teams to innovate, engineer and execute the full range of electrified vehicle propulsion systems. His accomplishments at General Motors include 13 electrified autos brought to production. Notably, these include the first modern Electric Vehicle, the GM EV1, the first plug-in hybrid, the Chevy Volt, and the industry’s first long-range value EV, the Chevy Bolt.

Strong Macroeconomic Markers for the EV Market

As the world begins to make the steady shift into the EV market, some jurisdictions are more eager than others.

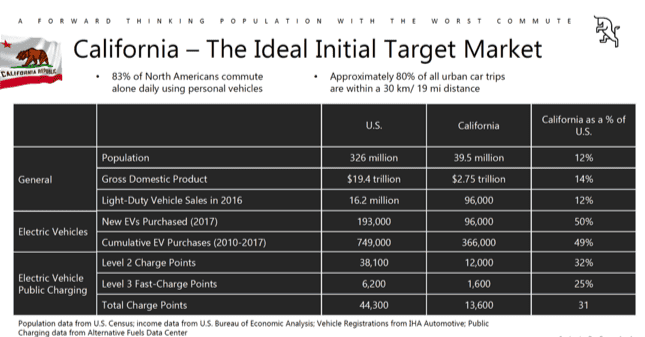

There’s likely no market more eager to get rolling than the state of California. As the nation’s largest EV market, the Golden State has recently considered nearly doubling its subsidy for each pure electric vehicle sold in the state—moving up to $4,500 from $2,500. This is on top of the federal government’s currently offered $7,500 tax credit on each electric vehicle sold.[5]

Given this environment, Electrameccanica Vehicles Corp. (NASDAQ:SOLO) has targeted California as the ideal Initial Target Market.

California is a trend-setter market, with a predilection towards adopting new technologies and adhering to increasingly progressive policies. With its extremely high cost of commuting, California has a state-wide goal for EV adoption, supported by subsidies and investment in charging infrastructure.

With its $15,500 USD price tag, a buyer in California could possibly see up to $12,000 USD in tax incentives already taken care of for the SOLO—an overall out-of-pocket discount of more than 77%.

Manufacturing a Chinese EV Advantage

In order to scale production to achieve a strong margin profile, automakers seeking an advantage in the EV market are looking for a Chinese manufacturing advantage. Even industry leader Tesla Motors is becoming forthright in its need for China, the world’s largest auto market, in order to succeed.

Not only is Chinese customer demand and government support for EVs skyrocketing, but the economic advantage of producing in the country is major.

Tesla CEO Elon Musk has expressed his concern that without manufacturing in China, Tesla won’t be able to produce the company’s goal of 10,000 Model 3 electric sedans per week nor be able to offer the eagerly awaited base model at a price of $35,000.[6]

“Bottom line is we need the Shanghai factory to achieve that,” said Musk.

There’s been a lot of interest for EV makers surrounding China. Volkswagen’s and GM’s SAIC Motor, Warren Buffett-backed BYD, and the recently public NIO are a few among the companies that are already up and running in the country.

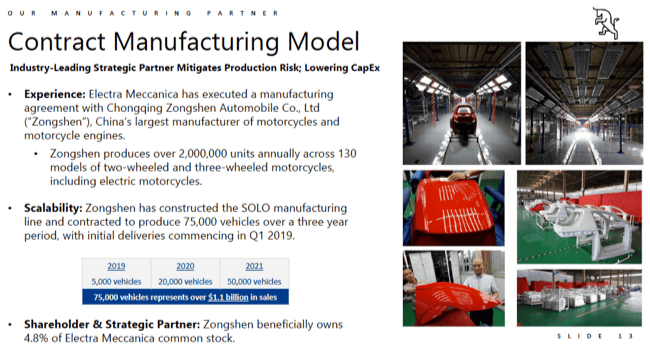

For Electrameccanica Vehicles Corp. (NASDAQ:SOLO), a deal with shareholder and strategic partners, Chongqing Zongshen Automobile Co., Ltd, has set the SOLO manufacturing line in motion.

Zongshen is China’s largest manufacturer of motorcycles and motorcycle engines. The company already produces over 2 million units annually, across 130 models of two-wheeled and three-wheeled motorcycles, including electric models.

Together, the Electra Meccanica and Zongshen agreement should yield a level of scalability that would deliver a massive manufacturing advantage for SOLO and the other models. Zongshen has already constructed the SOLO manufacturing line, and has been contracted to produce 75,000 vehicles over a three-year period, with initial deliveries commencing in Q1 2019.

The economic advantage of this arrangement is quite clear, with scaled gross margins expected in the ~25% range.

This industry-leading contract with a manufacturing partner reduces production risk for Electrameccanica Vehicles Corp. (NASDAQ:SOLO), while accelerating production, and notably minimizes capital expenditures.

MAJOR EV-AUTOMAKER COMPARABLES

So far, the majors in the EV space are working diligently to secure production for their upcoming lines of vehicles. Each has a unique struggle in the lead-up to the eventual EV revolution, including getting costs down, making profitable lines, and securing materials

With a simple line of two offerings, and more to come in the future, Electrameccanica Vehicles Corp. (NASDAQ:SOLO) has already hit the ground running with the lowest cost EV on the market.

Here are a few of the ongoing stories in the EV space happening right now:

Tesla, Inc. (NASDAQ:TSLA)

Market Cap: $52.516 billion

Recent Headline: Tesla is staking its future on China — here’s what it’s up against

The Nevada-based Tesla Motors gigafactory made headlines over the last few years, as the premiere EV brand name became an American success story. However, the company has recently made clear its intentions to enter the Chinese market, and attempt to compete with foreign and Chinese automakers that are already manufacturing and selling EVs in the country. CEO Elon Musk admits his company won’t be able to produce 10,000 Model 3 electric sedans per week, as originally aimed. Ahead of Musk’s company, Electra Meccanica has ramped up production at a new Zongshen factory, for both its SOLO and Tofino models.

—

Kandi Technologies (NASDAQ:KNDI)

Market Cap: $276.77 Million

Kandi Technologies Group, Inc., through its subsidiaries, designs, develops, manufactures, and commercializes electric vehicle (EV) products and parts and off-road vehicles in the People’s Republic of China and internationally. It offers off-road vehicles, including go-karts, all-terrain vehicles, utility vehicles, and other vehicles for sale to distributors or consumers; and EV parts comprising battery packs, EV drive motors, EV controllers, air conditioners, and other electric products.

—

NIO Inc. (NYSE:NIO)

Market Cap: $1.461 billion

NIO Inc. designs, manufactures, and sells electric vehicles in the People’s Republic of China, Hong Kong, the United States, the United Kingdom, and Germany. The company offers five, six, and seven-seater electric SUVs. It is also involved in the provision of energy and service packages to its users; marketing, design, and technology development activities; manufacture of e-powertrains, battery packs, and components; and sales and after sales management activities.

—

General Motors Company (NYSE:GM)

Market Cap: $54.621 billion

Recent Headline: GM is going ‘all-electric,’ but it doesn’t expect to make money off battery-powered cars until early next decade

The largest US automaker, General Motors,is committed to eventually make its entire vehicle lineup “all-electric,” but doesn’t expect to make them profitably until “early next decade”. While pouring money into EV technology, looking to capture a market that’s garnered much excitement thanks to Tesla, General Motors has made it clear that the company is committed to an all-electric future, with its luxury brand Cadillac being the lead brand for its electrification efforts. While such changes are cumbersome for massive automakers, groups like Electra Meccanica are able to capture the early market advantage with pre-orders and an early run at scalability. As of October, 2018, Electra Meccanica has booked pre-orders in excess of CAD $2.4 billion and is growing.

—

Strong Leadership Team At The Cutting Edge Of The EV Space

“I am very pleased with our team’s progress to date. Having driven the 2019 SOLO myself, I’m convinced we have a winning car on our hands.”

– Electra Meccanica Founder and President, Henry Reisner

On the road to achieving its goals, Electrameccanica Vehicles Corp. (NASDAQ:SOLO) has been steered by an experienced leadership team. In order to navigate the rollout of both the SOLO and the Tofino to a customer base that’s hungry for a new experience behind the wheel, the Electra Meccanica team has been crucial to the brand’s successes.

Paul Rivera joined Electra Meccanica as Chief Executive Officer in August 2019. Before joining Electra Meccanica, Rivera most recently served as President of Ricardo, USA, a division of Ricardo, PLC (LON: RCDO), a 100-year-old global engineering, strategic, and environmental consultancy business with a value chain that includes the design, engineering, testing, and product launch, of vehicle systems, as well as the niche manufacture of high performance products. Previous to that, as Executive VP of Hybrid & Electric Systems at Ricardo, Rivera led the company’s evolution towards an efficient and sustainable low carbon future. Ricardo’s engineering and design solutions have had a significant impact on technical developments throughout the auto sector, providing innovative solutions across engines, drivelines and hybrid systems, as well as supporting the development of emerging technologies such as autonomous and connected vehicles.

Henry Reisner has served as the President of Intermeccanica since 2001. Intermeccanica is an Italian automobile manufacturer in operation for over 60 years, which Electrameccanica acquired in 2017. Reisner’s background includes extensive experience in the automotive industry with a background in manufacturing. Having overseen early production of the SOLO, he’s expressed his confidence in the company achieving its goals.

With the international aspirations and multinational production and sales goals for the company, Rivera and Reisner are joined by Chief Administrative Officer Isaac Moss. With over 27 years of international business, multi-jurisdictional investment banking and corporate finance experience, Moss’ expertise has ranged across several industries, including specialty chemicals, tech and green energy.

The management team is rounded out by CFO Bal Bhullar, and General Manager Ed Theobald. Bhullar is an accomplished financial executive with over 25 years of experience, that includes CFO experience at several public and private companies. Theobald has over 40 years of experience across several industries, including 19 years as General Manager at Envirotest Canada, a subsidiary of ESP Global.

5 Reasons Investors Should Put Electrameccanica Vehicles Corp. (NASDAQ:SOLO) on Their Radar

1. Lowest-Cost EV on the Market: In this new era of electric vehicles, to hold the distinction of the lowest cost EV on the market is a significant advantage for Electrameccanica Vehicles Corp. (NASDAQ:SOLO). Where the next lowest cost EV at the moment is the Smart Electric, which is nearly double the price at $28,750, the EMV SOLO stands in an economic class of its own at an MSRP of $15,500 USD.

2. Over 64,000 Pre-Orders, Worth Billions in Value: As of December 20, 2018, Electrameccanica Vehicles Corp. (NASDAQ:SOLO) has accrued a total of 64,154 vehicle pre-orders across all models, representing $2.4 billion in potential sales at the targeted MSRP. With delivery commencing in Q1 2019, the company will begin with deliveries through existing dealerships in Los Angeles, and Vancouver—with significant dealer interest worldwide, evidenced by dealer letters of intent for over 21,000 SOLOs.

3. Strong Macroeconomic Markers for EV Market: The EV market is growing at a rapid pace, supported by government incentives, and increased customer demand to move away from fossil fuels. Electrameccanica Vehicles Corp. (NASDAQ:SOLO) has targeted California as the IDEAL Initial Target Market. California is a trend-setter market, with a predilection towards adopting new technologies and adhering to increasingly progressive policies. With its $15,500 USD price tag, a buyer in California could possibly see up to $12,000 USD in tax incentives already taken care of for the SOLO.

4. Industry-Leading Contract with Chinese Manufacturing Partner: Ahead of major comparables, such as Tesla, Electrameccanica Vehicles Corp. (NASDAQ:SOLO) has secured a major manufacturing contract with leading Chinese motorcycle manufacturer, Zongshen. As per the contract, Zongshen will produce 75,000 vehicles over a three-year period, with initial deliveries commencing in Q1 2019. The economic advantage of this arrangement is expected to return gross margins of ~25% at scale.

5. Strong Leadership Team At The Cutting Edge

Of The Lithium Technology Space: The Electrameccanica

Vehicles Corp. (NASDAQ:SOLO) team is built

to produce vehicles on an international scale. Led by founders CEO Jerry

Kroll, and President Henry Reisner, the Intermeccanica/Electrameccanica

team has the experience to compete in the automotive industry. With several

decades of experience that span multiple industries and countries, the

Electrameccanica team is set to rollout both the SOLO and the Tofino models and

to exploit deep connections within the

automobile industry built through over

60 years of automobile legacy through Intermeccanica.

[1] https://www.cnn.com/2018/11/16/business/volkswagen-electric-cars/index.html

[2] https://www.eei.org/resourcesandmedia/energytalk/Pages/Issue-In-Depth.aspx?i=5-1-2018

[3] https://www.theguardian.com/environment/2019/feb/12/electric-cars-already-cheaper-own-run-study

[4] https://www.digitaltrends.com/cars/three-wheel-evs-motorcycles-work-like-cars/

[5] https://www.bloomberg.com/news/articles/2018-09-25/california-mulls-an-additional-2-000-subsidy-for-electric-cars

[6] https://www.cnbc.com/2019/02/11/tesla-faces-steep-competition-in-china.html

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.