All Posts in "Uncategorized"

Protected: Developing Golden Opportunities in Canadian Precious Metals

Protected: Chasing Copper in Nevada Ahead of Shortages Predicted by the World Bank

Protected: QuestCap Inc. (CSE:QSC) (FRA:34C1) – The Social Impact Investment Company Targeting Pandemic Response Technologies and Therapies

The Top Buying Opportunities Amid An Immense Sell-Off

Clearly the stock market is, and has been under siege lately. The answer for this is obvious, but the answer to many people, traders and institutions may not be so clear.

To us, we are looking for value buys, stocks that got beaten down for no real reason other than the fact that the markets in general were getting tumbled, and they went along for the ride.

This type of trading activity can be terrible for some companies and have an immense impact across the board, and let’s face it, people tend to over react.

We are currently looking at stocks that in our opinion will have an almost immediate bounce back once stabilization occurs, and you can bet the farm, things will stabilize once the media stops freaking everyone out.

If you enter your email in the box provided below, we will email you our research once it’s completed.

Thank you

Equity Insider

Subscribe to receive our free

Market Review Weekly

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). Individuals are strongly encouraged to not use this publication as the basis for any investment decision.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in any of our reports is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

This Swing Trade Is Ready To Rock

What Is Swing Trading?

Swing trading is a style of trading that attempts to capture gains in a stock (or any financial instrument) over a period of a few days to several weeks. Swing traders primarily use technical analysis to look for trading opportunities. These traders may utilize fundamental analysis in addition to analyzing price trends and patterns.

We spend a lot of time analysing different stocks within different trading patterns, and swing trading can be amongst the most rewarding style of trade a person can do.

We believe we have identified a stock that’s patterns are looking very strong for a breakout within the next couple weeks, so if you’re interested in hearing more, put your email address in the box provided and we will let you know when the information is complete.

Editorial Team

Equity Insider

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Equity Insider is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). Individuals are strongly encouraged to not use this publication as the basis for any investment decision.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in any of our reports is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

Precision Diagnostics Potentially Could Save Society Billions in Burden Costs

Precision Diagnostics Developers Navidea Biopharmaceuticals Inc. (NYSE:NAVB) Leveraging FDA-Approved Proprietary Tech to Target Several Costly Diseases

Before we get into what Navidea Biopharmaceuticals Inc. (NYSE:NAVB) does, and why we think it’s a good play, we wanted to point something out.

One of the best indicators that something is about to happen with any particular stock is when INSIDERS start buying up the stock. In this case, you need to know a few facts, facts that will undoubtedly show you that your timing is near perfect with this trade:

Navidea Biopharmaceuticals Inc. (NYSE:NAVB) has seen significant Insider buying lately: John Scott, a 10%+ holder of Navidea just purchased an additional 2,373,529 shares on February 13, 2020, which brings his total ownership up to 8,052,301

Navidea has 40 different institutional investors, which is very impressive for a NYSE company priced so low, and you can bet there’s a reason for this.

More impressive is the amount of shares that are held by insiders. We added up the insider roster found at Fintel.io and calculated a total of 16,354,087 shares that are held by insiders, which is HUGE because according to the Wall Street Journal, the company only has 22.58M shares outstanding. By our calculations, that means 72.4% is held by insiders!

What does all this mean? Put simply, any significant, or even semi-significant market activity will push the stock price of this company through the roof, and in our opinion, it’s just a matter of time, probably sooner than later.

Let’s take a look at what Navidea Biopharmaceuticals Inc. (NYSE:NAVB) does, because we want to outline why we think it’s a good buy right now

“A stitch in time saves nine”, is a very popular proverb warning about the dangers of procrastination. But in the case of healthcare and precision diagnostics, that early stitch could save BILLIONS. One clear example of this is the growing problem of Rheumatoid Arthritis (RA), which is being increasingly diagnosed in the population, due to an ever-aging populace.[1]

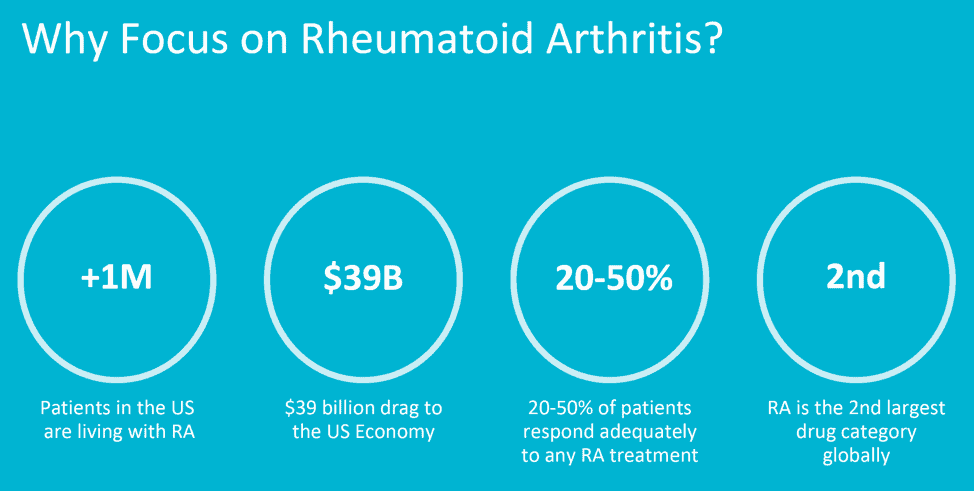

Some estimates place the direct and indirect burden cost of arthritis and related rheumatic conditions on the economy at around $353 billion.[2] The societal burden on the US economy is greater than $39 billion annually.[3]. Not only is the Global Rheumatoid Arthritis Drugs Market projected to be worth $50.5 Billion by 2025[4], but the amount of lost work hours and productivity attributed to RA also make a significant dent on society.

Despite having no cure, doctors recommend that patients adhere to suggested treatments early in diagnosis to decrease the severity of symptoms[5]—the earlier the better. Across many of the most prominent and costly diseases in the world, early detection is incredibly important, when it comes to predicting success.

Not only for patients with rheumatoid arthritis, but also with cancer, and cardiovascular disease (CVD). But rheumatoid arthritis can be difficult to diagnose in its early stages because the early signs and symptoms mimic those of many other diseases. According to the Mayo Clinic, there is no one blood test or physical finding to confirm the diagnosis.

There is no cure for rheumatoid arthritis, but clinical studies indicate that remission of symptoms is more likely when treatment begins early with medications known as disease-modifying antirheumatic drugs (DMARDs), steroids, or Nonsteroidal anti-inflammatory drugs (NSAIDs). In order to obtain early detection of these symptoms (not only in RA, but in cancer, CVDs and other auto-immune disorders), one under-the-radar NYSE company is developing a platform that has wide ranging potential in the field of immuno-diagnostics and immuno-therapeutics.

This company has developed a proprietary FDA- and EMEA-approved delivery system that targets a receptor found associated with several diseases, called activated macrophages. With Phase II and Phase III studies ongoing across conditions, this advanced precision diagnostics platform has extreme game-changing potential for many of healthcare’s biggest problems.

Meet Navidea Biopharmaceuticals, Inc. (NYSE:NAVB), a still lesser known innovator, that’s developed the ManoceptTM Precision Targeting Platform.

In-Depth Look:

Navidea Biopharmaceuticals, Inc. (NYSE:NAVB)

ANALYST OVERVIEW:

Company – Navidea Biopharmaceuticals, Inc.

Rating – STRONG BUY

Navidea’s analyst coverage includes:

- CNN Business – BUY x 2 – $3.50

- Barchart – STRONG BUY x 2 – $5.00

- Nasdaq.com – STRONG BUY – $3.50

- WSJ Markets – BUY x 2 – $3.50

Meet Navidea Biopharmaceuticals, Inc. (NYSE:NAVB)—a still under-the-radar precision medicine leader with immuno-targeted products designed to help identify the sites and pathways of undetected disease and enable better diagnostic accuracy, clinical decision-making, targeted treatment, and ultimately, patient care.

The Company focuses on the development of innovative immunodiagnostic agents and immunotherapeutics that can and will make a difference for individuals, as well as their families, physicians and care givers, touched by devastating conditions like cancer, autoimmune, infectious and inflammatory diseases.

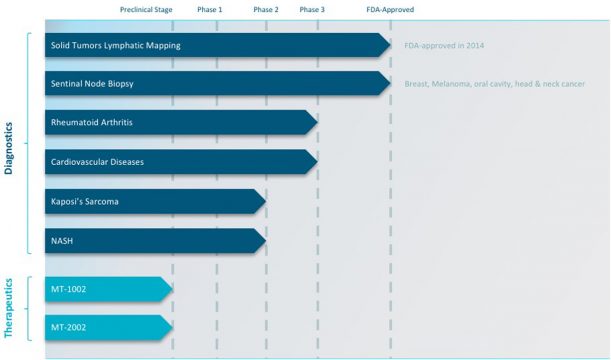

Through its Manocept™ technology, Navidea seeks to develop next-generation targeted diagnostics and therapies for cancer, autoimmune conditions, and other inflammatory diseases. The company is developing a pipeline of immunodiagnostic applications beginning with rheumatoid arthritis, Kaposi’s sarcoma and cardiovascular disease with an addressable market that is substantial.

Navidea’s strategy is to deliver superior growth and shareholder return by bringing to market novel products and advancing the Company’s pipeline through global partnering and commercialization efforts.

Meet the ManoceptTM Precision Targeting Platform

Navidea Biopharmaceuticals, Inc. (NYSE:NAVB) is developing multiple precision-targeted products based on its ManoceptTM platform. This state-of-the-art platform enhances patient care by identifying the sites and pathways of disease, enabling diagnostic accuracy, clinical decision-making, and targeted treatment.

Navidea’s Manocept™ platform is predicated on the ability to specifically target the CD206 mannose receptor expressed on macrophages. Macrophages play important roles in many disease states and are an emerging target in many disorders. This flexible and versatile Manocept platform acts as an engine for purpose-built molecules that may enhance diagnostic accuracy, clinical decision-making, targeted treatments and ultimately patient care. As an immunodiagnostic tool, the Manocept technology has the potential to utilize a breadth of imaging modalities, including SPECT, PET, intra-operative and/or optical-fluorescence detection. By adding a therapeutic agent on the Manocept molecular backbone, there is the potential to develop novel, targeted immunotherapies specifically designed to selectively deliver a drug that can kill or alter disease-associated macrophages.

Through expanding its focus on developing its innovative ManoceptTM platform, Navidea presents an interesting investment opportunity in a growing diagnostics market. The Manocept platform is protected by issued patents and has been FDA- and EMEA-approved.

These approvals confirm that the product is:

- effective at targeting its receptor

- safe when dosed at a dose that is effective at targeting its receptor and

- the manufacturing stability and related concerns have been successfully addressed with at least one compound.

The Manocept platform serves as the molecular backbone of Tc99m tilmanocept—the first product developed and commercialized by Navidea based on the platform. Not only has the company worked on the platform for diagnostics, but Navidea has also demonstrated in numerous animal models that they can:

- Selectively deplete or convert the disease-causing macrophages with a short acting agent to comprehensively treat the disease by eliminating all the disease-causing agents but in a highly selective manner so that we do not

- Suppress or in any way diminish the immune system from reacting as needed to normal immunological stimuli.

The activated macrophage is critical to both fighting disease and, when improperly activated, causes and/or potentiates many of the most important diseases such as many forms of cancer or autoimmune diseases.

- Cancer – potentiating the immune system’s support of the tumor via production of VEGF, numerous checkpoint inhibitor ligands, proteases crucial for metastasis etc.

- Autoimmune diseases – via production of TNF alpha, superoxide’s, IL-12, increase T1’s and many other pro-inflammatory chemokines and cytokines)

Growth in Immuno-Diagnostics Market

There is a steady growth being predicted and witnessed in the Global Immunodiagnostics Market which is projected to reach $17.8 billion by 2022 with CAGR of 7.3%[6] and $22.7 billion by the end of 2025.[7]

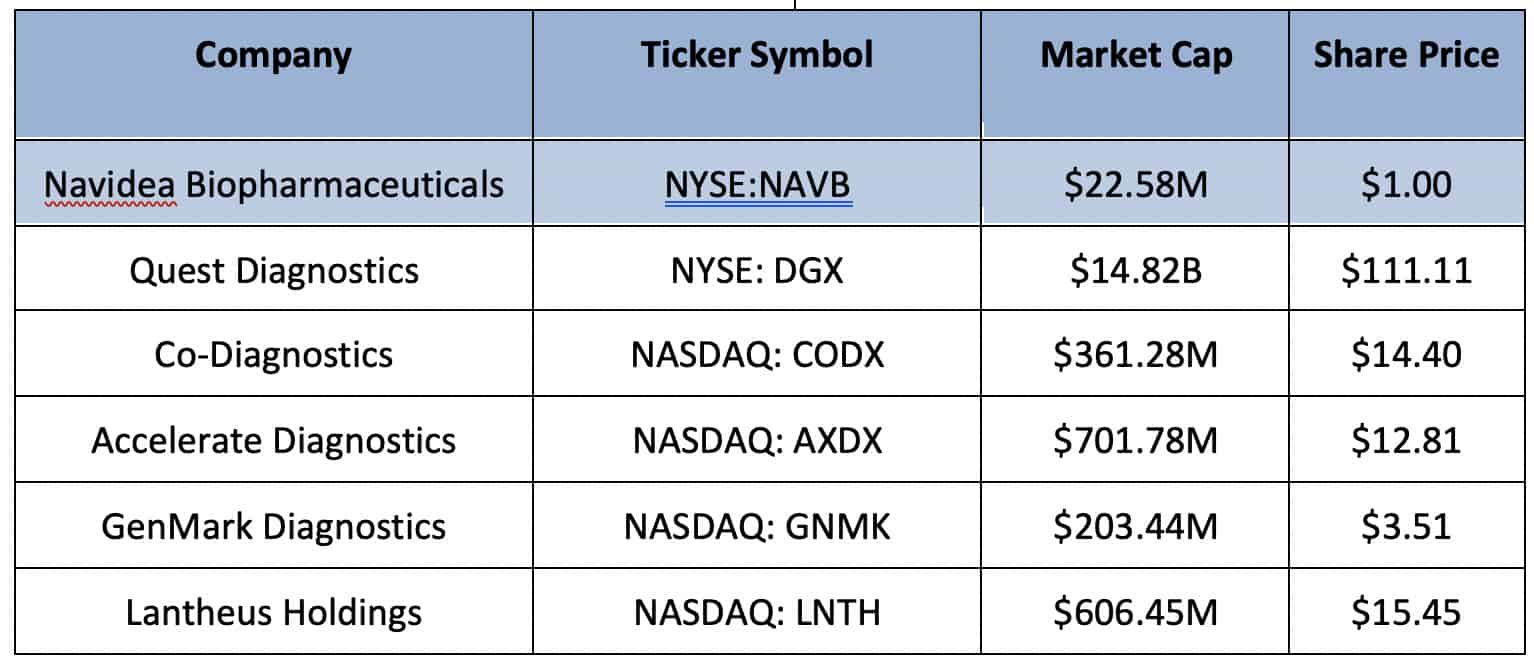

For Navidea Biopharmaceuticals, Inc. (NYSE:NAVB) there is an opportunity to capitalize on the growing performances of its diagnostics stock peers, while also targeting the precision medicine market as well.

The Precision Medicine Market is projected to be worth $85.5 Billion by 2025, growing at a CAGR of 9.9%.[8]

Diagnostics Peer Stocks

Envisioning a World Where Disease can be Precisely Identified and Treated

Beyond Rheumatoid Arthritis, Navidea Biopharmaceuticals, Inc. (NYSE:NAVB) is also developing other prospects in its diagnostics pipeline, including:

- Cardiovascular Disease (CVD)

- 92 million Americans living

with CVD

- 1 in 3 US adults

- Phase 2 Study ongoing

- Leading cause of death in the US

- 92 million Americans living

with CVD

- Kaposi Sarcoa (KS)

- Orphan Disease that is highly life threatening in a minority of patients

- Phase 2 Study ongoing

Developing Drug Delivery Model with World-Class Partnerships

Navidea Biopharmaceuticals, Inc. (NYSE:NAVB) is also pursuing the drug delivery model, meaning the company will continue to develop the core technology and focus its efforts on providing potential partners, who will fund and manage the commercialization efforts for specific applications of interest to them, with products designed to maximize the performance and value for specific indications.

Navidea’s plan is to partner the existing imaging agents and to continue to develop new indications using existing funds, grants and partner payments.

For example, oral or topical formulations for chronic inflammatory conditions; for CNS indications, products that cross the blood brain barrier; for cancer, longer-acting more-powerful agents; and for therapeutics, they have plans to spin out Macrophage Therapeutics and raise venture capital funding to enable expanded IP and product development for acute indications and orphan diseases while continuing to expand partnering discussions for larger indications.

On March 3, 2017 Navidea Biopharmaceuticals, Inc. (NYSE:NAVB) completed the sale of the North American rights to Lymphoseek® to Cardinal Health 414, receiving approximately $82 million at closing. Navidea will have the opportunity to earn up to $227 million of additional consideration through 2026, with $17.1 million guaranteed over the next three years.

Impressive Management Team and Board Leading the Way

The Management Team and Board of Directors of Navidea Biopharmaceuticals, Inc. (NYSE:NAVB) are leaders in research, development, and commercialization of precision diagnostic and radiopharmaceutical imaging agents.

The company is led by CEO, CFO and COO Jed A. Latkin, a former Portfolio Manager at Nagel Avenue Capital, ING Investment Management, and Morgan Stanley Investment banking.Latkin previously served as CFO of Viper Powersports, CEO of End of Life Petroleum Holdings, CEO of Black Elk Energy, Portfolio Manager of Precious Capital and CFO of West Ventures. He currently serves on the boards of the Renewable Fuels Association and Buffalo Lake Advanced Biofuels

He’s joined by Chief Compliance Officer, William Regan, who served as Principal of Regan Advisory Services (RAS) consulting on all aspects of regulatory affairs within pharma, biotech and diagnostic imaging business, including PET, contrast agents and radiopharmaceuticals. Prior to RAS, Regan managed radiopharmaceutical manufacturing, quality assurance, pharmaceutical technology and regulatory affairs at Bristol-Myers Squibb (BMS), also serving as global regulatory head for BMS’ Medical Imaging business

Chief Medical Officer, Dr. Michael Rosol brings training and experience in the fields of biophysics, physiology, and biological/medical imaging, with work focused on cardiovascular imaging, preclinical and clinical imaging instrumentation and applications, animal models of human disease, pathophysiology, biomarkers, and imaging in toxicological and clinical trials.

Prior to joining Navidea, Dr. Rosol has served as Associate Director in the Clinical and Translational Imaging Group at Novartis Institutes for BioMedical Research, Senior Director of Business Development at Elucid Bioimaging, Inc., Chief Scientific Officer of MediLumine, Inc., and the Head of the Translational Imaging Group at Novartis Pharmaceuticals Group.

The Navidea Board of Directors includes Michael Rice, Dr. Claudine Bruck, Dr. Kathy Rouan,and Adam Cutler.

Rice is a founding partner of LifeSci Advisors, LLC and LifeSci Capital, LLC, companies which he co-founded in March 2010. Prior to co-founding LifeSci Advisors and LifeSci Capital, Mr. Rice was the co-head of health care investment banking at Canaccord Adams, and a Managing Director at JPMorgan/Hambrecht & Quist. Mr. Rice currently serves on the board of directors of RDD Pharma, a specialty pharmaceuticals company.

Dr. Bruck is co-founder and has served as Chief Executive Officer of Prolifagen LLC, and is a member of the board of directors of QRPharma. In 1985, Dr. Bruck joined GlaxoSmithKline (“GSK”) to build GSK’s HIV vaccine program. In her role in GSK’s vaccine group, Dr. Bruck was instrumental in the development of GSK’s HPV vaccine (Cervarix), and headed their cancer vaccine program from inception to Phase 2 before joining the drug discovery group of GSK

Also with a GSK connection is Dr. Rouan who was appointed SVP and Head of Projects, Clinical Platforms and Sciences for the pharma giant. The PCPS organization within GSK encompasses the Global Clinical Operations, Statistics and Programming, Clinical Pharmacology, GCP Quality, Third Party Resourcing and Project Management functions and includes approximately 1,800 staff in 20 countries.

Adam Cutler currently serves on the Board of Directors for Inmed Pharmaceuticals, and joined Molecular Templates, Inc. as its Chief Financial Officer in November 2017. Prior, he was Senior Vice President of Corporate Affairs for Arbutus Biopharma Corporation, where he was responsible for investor relations and contributed to the company’s business development and corporate finance efforts. Mr. Cutler has also worked as a biotechnology equity research analyst with Credit Suisse, Canaccord Genuity, JMP Securities, and Bank of America Securities.

—

8 Reasons to Further Examine

Navidea Biopharmaceuticals, Inc. (NYSE:NAVB)

- Insider buying / holdings: With recent major insider buying activity, and the fact that insiders account for over 72% of the outstanding share structure, makes Navidea very attractive to us.

- Focus on Rheumatoid Arthritis because it involves over 1M patients in the US, creating a $39B drag to the US Economy, and servicing the 2nd largest drug category globally.

- FDA/EMA-approved diagnostic product, the ManoceptTM platform is effective at targeting its receptor, with safe dosage and manufacturing stability.

- Non-invasive imaging targeting CD206 receptors on Activated Macrophages offers potential for effective treatment.

- Experienced management team and board with successes in portfolio management and drug development with major pharmaceutical companies, including GSK.

- Proprietary FDA- and EMEA-approved delivery system that targets a receptor expressed only on activated macrophages.

- Overcoming lack of biomarkers in the market to guide treatment selection and/or monitor response.

- Allows physicians an inside look at their patients’ developments, including early indication of treatment effectiveness.

As any investment in the stock market, investing in any security can be risky. Investors should do their reasonable due diligence by reading the risks and uncertainties as detailed in the company’s most recent 10-Q and 10-K filings with the SEC.

The Editors

USA News Group

Sources:

[1] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4845363/

[2] https://www.healthline.com/health-news/rheumatoid-arthritis-heavy-cost-to-patients-economy#1

[3] https://www.ncbi.nlm.nih.gov/pubmed/30589626

[4] https://www.ihealthcareanalyst.com/global-rheumatoid-arthritis-drugs-market/

[5] https://www.rheumatoidarthritis.org/treatment/

[6] https://www.alliedmarketresearch.com/immunodiagnostics-market

[7] https://www.fortunebusinessinsights.com/industry-reports/immunodiagnostics-market-100444

[8] https://www.grandviewresearch.com/press-release/global-precision-medicine-diagnostics-therapeutics-market

DISCLAIMER

Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. The information contained in this report has not been paid for by the profile company, Navidea Biopharmaceuticals, Inc., and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has not paid a fee for Navidea Biopharmaceuticals, Inc. advertising, digital media, content creation. There may be 3rd parties who may have shares of Navidea Biopharmaceuticals, Inc., and may liquidate their shares which could have a negative effect on the price of the stock. The owner/operator of MIQ have purchased 85,000 shares in the open market prior to the dissemination of this report and will sell these shares in the open market commencing immediately. The fact that we own shares of Navidea Biopharmaceuticals, Inc. constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operators of MIQ reserve the right to buy and sell, and will buy and sell shares of Navidea Biopharmaceuticals, Inc. at any time commencing immediately without any further notice. Let this disclaimer serve as notice that all material disseminated by MIQ has not been approved by Navidea Biopharmaceuticals, Inc.; this is not a paid advertisement, we are not licensed under any securities laws to provide investment advice, this publication is not investment advice, nor is this publication any sort of personalized financial advice, and we own shares of Navidea Biopharmaceuticals, Inc. that we will sell immediately, and we also reserve the right to buy shares of the company in the open market.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

Weekly Market Review – January 18, 2020

Stock Markets

What analysts call better-than-expected economic data, encouraging corporate earnings from U.S. banks, and the signing of the “phase-one” trade agreement helped raise U.S. stocks to fresh record highs last week. A surge in housing starts bolstered by strong retail sales point to a resilient consumer that is supported by a continued strong labor market. The “phase-one” trade agreement between the U.S. and China was formally signed last week, fulfilling expectations for a deal that was already done. Important terms of the deal included commitments from China to increase purchases by $200 billion over the next two years ($78 billion of manufactured goods, $52 billion in energy, $32 billion of agricultural products, and $38 billion in services). Analysts agree that the agreement removes significant uncertainty, however, they say trade issues will likely continue as a source of volatility through 2020.

U.S. Economy

The closing of stocks at record highs last week was driven by the U.S. and China reaching the “phase-one” trade agreement. Analysts believe the recent trade agreement is a significant step in the de-escalation of the trade tensions between the two superpowers. It takes away much of the threat that new tariffs create and creates confidence that a more comprehensive deal is achievable. Still, tariffs remain in place on two-thirds of U.S. imports from China. So, attention now shifts to implementation and enforcement. Potential failure to meet the terms of the deal could create temporary setbacks which could stretch as far as additional new tariffs. Further tariff relief and more complete trade cohesiveness that would include including structural fundamentals, like industrial subsidies, is likely to be in place by the time we reach the U.S. election. The current agreement gets rid of significant uncertainty, but all agree that trade issues will likely create some volatility in the coming year. Analysts expect stocks to continue to rise but at a slower pace than they have over the past decade. This is widely supported by ongoing economic growth, modest earnings growth, and accommodative central banks.

Metals and Mining

The precious metals sector was two sided this week, with gold and silver remaining in a channel, while both platinum and palladium climbed. Platinum was up 4.4 percent from last week, exceeding US$1,000 per ounce for the first time in two years. The precious metal had been sidelined for much of the growth that palladium and gold experienced in 2019. Now it’s starting to see a benefit from the same motivators that drove those metals. Rallying from US$976 (January 10) to US$1,037 (January 16), Platinum exhibited its best performance year-to-date. It is on track to surge to highs not experienced since 2015. The phase one trade deal between China and the US countered some of the volatility that entered the market earlier in this month. The exchange traded-funds sector (ETF) may help motivate the platinum’s price too, since last year, platinum ETFs grew by 12 percent with investors purchasing 90,000 ounces or 11 percent of global supply. Easing geopolitical tensions moved against gold’s momentum, putting it on course to record its weakest performance in nearly two months. News of the phase one deal pushed gold below US$1,550 only to rebound supported from a weaker equity market and lower US dollar. Another round of increased buying from central banks and monetary policy are also projected to impact the value of gold in 2020. Palladium continued its upward trend this week. The precious metal star climbed 14 percent to trade at an all-time high of US$2,429 on January 17. Palladium’s hyperbolic performance has now moved the industrial metal beyond platinum and gold’s record highs, making it the most valuable of the four exchange-traded precious metals. The German bank pointed to the prolonged supply deficit as the current catalyst behind palladium’s best historic performance. Like gold, silver remained locked in a range staying below US$18 an ounce for much of the week. Silver has exhibited the poorest price growth of all four precious metals. It ended the week without any gains.

Energy and Oil

As expected, China has been the key oil price driver this week. The phase one trade deal drove prices higher before worrying economic data from the country dragged prices lower. Oil prices regained a bit of ground by week’s end. That was based on optimism surrounding the Phase 1 U.S.-China trade deal only. The global oil market managed to dodge a bullet after the U.S. and Iran backed away from war talk and eased tensions. But the geopolitical risk has not disappeared. In any case, non-OPEC oil supply is expected to continue to grow faster than demand this year. Once again that leaves the market with a persistent supply surplus, according to the IEA. The result is tremendous pressure on OPEC+, which may find that it needs to cut even further than current levels. In the U.S. Permian basin, the industry is suffering through bankruptcies, slower growth and investor scrutiny. Many analysts suggest that production should grow this year, however skeptical investors are starting to see a potential for peak in supply over the near-term period. Natural gas spot price movements were mixed this week. The Henry Hub spot price fell from $2.08 per million British thermal units (MMBtu) last week to $1.98/MMBtu this week. At the New York Mercantile Exchange (Nymex), the price of the February 2020 contract decreased 2¢, from $2.141/MMBtu last week to $2.120/MMBtu this week. The price of the 12-month strip averaging February 2020 through January 2021 futures contracts declined 3¢/MMBtu to $2.290/MMBtu.

World Markets

Stock in Europe rose this week as trade tensions eased, and investors welcomed strong Chinese economic data. The pan-European STOXX Europe 600 Index ended the week 1.33% higher, and the UK’s FTSE 100 Index gained 1.30%. Germany’s DAX Index advanced 0.3%. For the UK, poor economic data, combined with recent dovish speeches and comments by Bank of England (BoE) Monetary Policy Committee (MPC) members, set speculation in motion that an interest rate cut is in the cards at the January 30 policy meeting. What was suggested as a quarter-point reduction in the benchmark Bank Rate, from 0.75% to 0.50%, just rose to 80% on expectations. Analysts see rate cut as a form of insurance given the sharp slowdown at the end of the year. This move that probably should have occurred at the end of 2019 but was weigh laid by the general election. Analysts also expect data to begin improving as uncertainty has receded since the Conservative Party election victory, so purchasing managers’ surveys of the construction, manufacturing, and services sectors, will still be key to policymakers’ voting intentions.

China’s stock market moved slowly ahead of the signing of the phase one trade deal with the U.S. and did not rebound after the announcement. The Shanghai Composite lost 0.8% during the week while the CSI 300 large-cap index edged down 1.2%. The trade deal was already baked into the market came largely as expected. Many observers in the region viewed the deal as driven primarily by U.S. election politics and as a band-aid rather than a solution. For its part, China has pledged to import much more from the U.S. There are worries that the target of a USD 200 billion increase in imports of goods and services from the U.S. over the next two years may be very difficult to achieve and could fall short. Regional skeptics also doubt China’s claim that other countries will not suffer as it redirects purchases back to the U.S.

The Week Ahead

U.S. markets will be closed on Monday to observe Martin Luther King Jr. day. Important economic data being released include pending home sales, the leading index on, and the Markit Purchasing Managers’ Index on Friday. This is an important week in the corporate earnings season as another 43 companies of the S&P 500 will be reporting fourth-quarter earnings.

Key Topics to Watch

- Chicago Fed national index

- Existing home sales

- Weekly jobless claims

- Leading economic indicators

- Markit manufacturing PMI (flash)

- Markit services PMI (flash)

Markets Index Wrap Up

Protected: IoT Experts Tapping into the Trillion Dollar Market One Solution at a Time

Weekly Market Review – January 11, 2020

Stock Markets

Stock markets closed at near new all-time highs last week after the U.S. and Iran recoiled and avoided expected escalation in geopolitical tensions. Iran took retaliatory steps for the death of its general with missile strikes against U.S. military bases in Iraq. There were no casualties, whether on purpose or not, but President Trump eased tensions by offering an olive branch. As a result, oil declined 6% on the week, recording its worst weekly performance since July of 2019. Where the economy is concerned, December jobs reports showed a slowdown in the overall job gains, but that was to be expected since it followed what was a very over performing November. And while wage growth was not quite as strong, the data shows wages are still growing faster than consumer prices. That’s adding a big boost to consumer confidence and spending, both big drivers of the current market.

U.S. Economy

The US economy remains surprisingly robust. An escalation in military tensions and the strong employment report combined to send the Dow briefly above the 29,000-mark last week for the first time in history. It appears that the stock market has picked up in 2020 right where it finished 2019. Even the combination of political uncertainties and widely positive economic conditions have not really changed. Analysts expect three things will dominate the investment perspective this year; 1. policy/political risks, 2. Domestic and global economic trends, and 3. The potential for this market rally to based on what takes place in numbers 1 and 2. These are the narratives to follow closely and mine for information that will dominate the economy this year.

Metals and Mining

Precious metals benefited greatly from growing geopolitical uncertainty in the Middle East following last week’s attack on an Iranian military personnel. Both gold and palladium started the week with highs for the year. Gold then reached a seven-year peak at US$1,578.80 an ounce. Palladium raced above US$2,000 an ounce to US$2,023. Not to be outdone, silver, was also pushed higher by the uncertainty, and reached a year-to-date high of US$18.55 an ounce on Tuesday. Platinum followed the trend on the week and moved to US$989 an ounce on Sunday before dipping lower and staying steady. The aerial assault carried out by Iran on Iraqi targets late Tuesday sent ripples through the market. A rush to safe haven assets pushed gold as high as US$1,610. Once the evaluations came in only to find there were no reported casualties, all metals prices began to retreat back to their pre-attack levels. Gold was trading for US$1,556.77 as of 10:53 a.m. EST on Friday (January 10). Palladium was the one metal that retained this week’s gains and has even creeped up. The metal, which is used in catalytic converters for gasoline-powered cars, is still vital for reducing emissions from vehicles. It continues to break records as it hit another all-time high selling for US$2,122 Thursday. The driving factors continue to be mine supply concerns from South Africa related to energy generation and load shedding. Continued tightening emissions standards in China are also playing a big part. Platinum has not been able to match gold and palladium, but it did record gains this week. It has risen less than 1 percent year-to-date after reaching a decade low last year. Analysts contend that gold will motivate the platinum price over the coming year. Silver could also benefit from gold’s strength and the increase in investor appetites for the whole field of save haven assets.

Energy and Oil

Oil prices are down sharply for the week, lower than where they were before the Soleimani killing. WTI chimed in at a one-month low. With de-escalation on the rise, it appears the geopolitical risk premium has evaporated for the moment. Crude stocks increased marginally over the past week, but gasoline stocks took a quick rise. Gasoline stocks have increased by more than 22 million barrels over the week. EIA data released after President Trump spoke about Iran led the market to interpret the news as an immediate de-escalation. The combination quickly sent oil prices falling. Following the de-escalation, Iran declared that it wants U.S. out of the Middle East. “It is in their interest that they pack and leave voluntarily, not only Iraq but Afghanistan and the Arabic countries,” Brig. Gen. Amir Ali Hajizadeh said on Thursday. The U.S. is considering its position in Iraq as the country’s parliament and Prime Minister continue to voice open support for expelling American forces from the country. In more domestic news, the EPA has tightened pollution on trucks initiating a process to limit emissions of nitrogen dioxide from heavy trucks. The industry supports it, as analysts say the move could head off stricter state-level standards in California. Natural gas spot prices rose at most locations this week. The Henry Hub spot price rose from $2.05 per million British thermal units (MMBtu) last week to $2.08/MMBtu this week. At the New York Mercantile Exchange (Nymex), the price of the February 2020 contract increased 2¢, from $2.122/MMBtu last week to $2.141/MMBtu to this week. The price of the 12-month strip averaging February 2020 through January 2021 futures contracts climbed 3¢/MMBtu to $2.319/MMBtu.

World Markets

Stocks in Europe were up as Middle East tensions faded and traders focused on the fact that that the U.S. and China are expected to sign a phase-one trade deal. The pan-European STOXX Europe 600 Index ended the week 0.39% higher, and Germany’s DAX index gained 2.38%, while the UK’s FTSE 100 Index slipped 0.76%. Business activity in the eurozone strengthened more than expected for December. Gains in the service sector partially offset a decline in manufacturing as indicated in an IHS Markit purchasing managers’ survey out this week. The eurozone consumer price index rose 1.3% in December from a year earlier, a six-month high, due to strong consumer spending in the runup to Christmas. In Europe’s largest economy, German exports fell by a more-than-expected 2.3% in November and outpaced the decline in imports. The trade resulting surplus narrowed to EUR €18.2 billion from EUR €21.3 billion in October. German industrial production rebounded in November, snapping two months of declines.

China’s markets managed to rise for the sixth week in a row. The benchmark Shanghai Composite Index added 0.28%, and the large-cap CSI 300 Index, which tracks blue chips listed on the Shanghai and Shenzhen exchanges, rose 0.44% for the week. Analysts note that the Shanghai Composite and CSI 300 large-cap indices traded in a range that was extremely narrow in light of the geopolitical news taking place the Middle East and involving the US. Chinese equities also appeared to get a boost from the seasonal strength associated with the Lunar New Year holiday. That falls early this year from January 24 and last for one week.

The Week Ahead

It is the unofficial beginning of the earnings season this week starting with major U.S. banks who will be reporting fourth-quarter results. It is also expected that the U.S./China “phase one” trade deal will be signed this week. The key economic data being reported this week includes inflation, consumer price index, retail sales, housing starts industrial production, and job openings.

Key Topics to Watch

- Federal budget

- NFIB small business index

- Consumer price index

- Core CPI

- Producer price index

- Empire state index

- Weekly jobless claims

- Retail sales

- Retail sales ex-autos

- Philly Fed

- Import price index

- Business inventories

- NAHB home builders’ index

- Housing starts

- Building permits

- Patrick Harker speaks

- Industrial production

- Capacity utilization

- Consumer sentiment index

- Job openings

Markets Index Wrap Up