Stock Markets

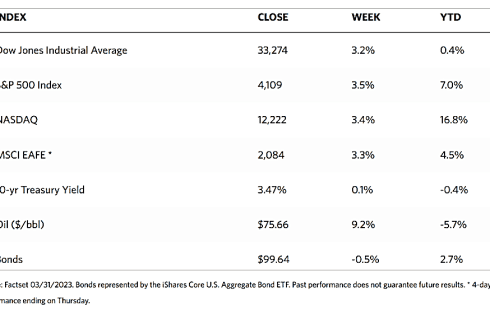

The equities markets ended a positive, albeit volatile, first quarter as weakness in banks was offset by strength in technology stocks. In the week just ended, all major stock indexes posted solid gains, offsetting the losses of the preceding weeks. The Dow Jones Industrial Average ended 3.22% higher and the total stock market ascended by 3.67%. The broad S&P 500 Index rose by 3.48%, the technology-tracking Nasdaq Stock Market climbed by 3.37%, and the NYSE Composite jumped by 4.18%. Risk perception calmed as the CBOE Volatility index lost by 13.98% for the week.

Trading was relatively quiet throughout the week as economic data releases and financial news provided comparatively little motivation for market activity. Small caps outperformed large caps, and value stocks modestly outperformed growth stocks. Making up a significant part of the value indexes are the energy stocks which were boosted by rising oil prices. Rising more than 9% for the week was the U.S. benchmark West Texas Intermediate crude oil which climbed back above the USD 80 per barrel level. For the end of the first quarter of 2023, the technology-heavy Nasdaq Composite surged by more than 16% for the quarter, compared to the broad market S&P 500 Index which climbed by about 7%.

U.S. Economy

A set of new proposed regulations for mid-size banks – i.e., those with assets between USD 100 billion and USD 250 billion – was released by the Biden administration this week. The proposed changes are likely to align the regulation of mid-size banks with the rules governing the country’s largest banks. The new rules are expected to impose more stringent capital and liquidity requirements. They may also require mid-size banks to pass more frequent stress tests under a wider range of scenarios.

More optimistic news has been released regarding inflation. The U.S. core (excluding food and energy) personal consumption expenditure (PCE) price index for February came in at 4.6%, slightly lower than consensus expectations for 4.7%. The Federal Reserve’s preferred inflation metric is the core PCE. The February 2023 reading was below the recent high of 5.4% reached in February 2022, however, it still exceeds the Fed’s long-term inflation target of 2%. The Commerce Department released its final estimate of fourth-quarter 2022 gross domestic product (GDP) growth, which was revised slightly lower to 2.6%.

The U.S. Treasury yields increased but at a slower rate as the market took a respite from the elevated volatility that dominated it for U.S. government debt since the Silicon Valley Bank’s (SVB’s) sudden collapse triggered concerns that the current banking system crisis will eventually lead to a recession. The difference between two- and ten-year Treasury yields became more negative, with short-term rates increasing more than longer-maturity yields, but the yield curve remained less inverted than in early March.

Metals and Mining

The reasons to be bullish on gold remain solidly in place. Count among these the global banking crisis, an impending recession, persistently higher inflation, and now also the possible demise of the U.S. dollar as the world’s reserve currency, although rumors of the latter may be premature. Still, there is a growing global trend that countries are moving towards a multi-currency financial system. Just this past week, China and Russia have agreed to trade in an internationally recognized yuan, a move that is increasingly gaining traction. For many analysts, gold will continue to be the biggest winner in a multicurrency system as the world diversifies away from the U.S. dollar. In 2022, central banks primarily bought a record 1,136 tonnes of gold to diversify their foreign reserve holdings. Central banks may continue to buy gold en masse even if this year might not set another record. Solid support appears to be created at the $1.900 per ounce level this past month, increasingly convincing investors that “strong hands” are holding the asset and creating real value for it in the market.

This week, gold moved from last week’s close at $1,978.21 to the new close at $1,969.28 per troy ounce, slightly correcting by 0.45%. Silver, which ended a week ago at $23.23, closed this week at $24.10 per troy ounce for a gain of 3.75%. Platinum ended this week at $995.22 per troy ounce, appreciating by 1.11% from its previous week’s close at $984.30. Palladium, which closed one week ago at $1,422.00, gained by 2.94% to close this week at $1,463.77 per troy ounce. The three-month LME prices for base metals were mixed. Copper ended this week at $8,993.00 per metric tonne, a correction of 0.42% from last week’s close at $9,031.00. Zinc, which ended the previous week at $2,907.00, closed this week at $2,922.50 per metric tonne for a gain of 0,53%. Aluminum ended the week at $2,413.00 per metric tonne for a gain of 3.74% over the previous week’s close at $2,326.00. Tin, which ended last week at $24,348.00, closed this week at $25,835.00 per metric tonne for a gain of 6.11%.

Energy and Oil

Continuing to provide the impetus for a major pricing upside for oil prices this week was the ongoing tug-of-war over Kurdistan’s oil exports. This situation threatens some 500,000 barrels per day (b/d) of oil at risk of shut-ins after Iraq ordered a halt to all exports. The huge reduction in U.S. crude inventories, driven by stocks in the Gulf Coast, has pushed the gradual return of ICE Brent to the $80 per barrel mark. New U.S. inflation data may pause or stymie that momentum today in a market that appears to respond more sensitively to sentiment rather than supply and demand fundamentals. In the U.S., an oil and gas activity survey published by the Federal Reserve Bank of Dallas indicates that activity stalled in the first quarter of the year, causing the index to plummet from 30.3 in the fourth quarter of 2022 to 2.1 currently amidst rising field costs, higher interest, and plunging gas prices.

Natural Gas

For the report week beginning Wednesday, March 22, 2023, and ending Wednesday, March 29, 2023, the Henry Hub spot price fell $0.09 from $2.04 per million British thermal units (MMBtu) at the beginning of the week to $1.95/MMBtu at the end of the report week. The April 2023 NYMEX contract expired on March 29 at $1.991/MMBtu, down by $0.18 from the start of the report week. The last time the front-month NYMEX contract settled below $2.00/MMBtu was on September 22, 2020, when it settled at $1.834/MMBtu. The May 2023 NYMEX contract price decreased to $2.184/MMBtu, down by $0.12 from March 22 to 29. The price of the 12-month strip averaging May 2023 through April 2024 futures contracts declined by $0.05 to $3.083/MMBtu.

International gas futures price changes were mixed this report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.51 to a weekly average of $12.72/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, rose by $0.33 to a weekly average of $13.47/MMBtu. In the corresponding week last year (i.e., the week ending March 30. 2022), the prices were $34.22/MMBtu in East Asia and $35.16/MMBtu at the TTF.

World Markets

European shares rallied from their previous weeks’ slump as concerns of financial instability faded away. The pan-European STOXX Europe 600 Index closed 4.03% higher in local currency terms. Also posting significant gains were the major stock indexes of the region. France’s CAC 40 Index rose by 4.38%, the Swiss Market Index (SMI) gained by 4.41%, Germany’s DAX added 4.49%, and Italy’s FTSE MIB increased by 4.72%. The UK’s FTSE 100 Index climbed by 3.06%. European government bonds broadly ascended as investors weighed the implications of strong core inflation data and hawkish comments from the European Central Bank policymakers. The yields on benchmark 10-year German government bonds inched up. Easing concerns about the global banking sector also up French and Swiss bond yields as demand dwindled for assets generally seen as havens. In the UK, the yields on 10-year government debt rose above 3.5% and closed proximate to that level on heightened expectations of another interest rate hike in May.

Japan’s stock markets climbed over the week. The Nikkei 225 Index gained by 2.40% while the broader TOPIX Index ended up by 2.46%. Investor sentiment grew optimistic as concerns eased about the recent turmoil in the global banking sector. There were also some expectations that the U.S. Federal Reserve may continue to moderate its monetary tightening. Core consumer price inflation in the Tokyo areas slowed for the second straight month in March. Nevertheless, the reading still came in ahead of expectations at 3.2% year-on-year and continued to surpass the Bank of Japan’s (BoJ’s) 2% inflation target. This furthered speculation that the central bank may adjust its ultra-loose monetary policy under incoming Governor Kazuo Ueda, who ascends to office on April 9. On this basis, the yield on the 10-year Japanese government bond (JGB) rose to 0.32%, from 0.29% at the end of the previous week, but remained well below the 0.50% level at which the BoJ caps JGB yields.

Chinese stocks rallied on the back of strong economic data coupled with supportive comments from Beijing, thus boosting confidence in the country’s growth outlook. The Shanghai Stock Exchange Index rose by 0.22% and the blue-chip CSI 300 increased by 0.59% in local currency terms. In Hong Kong, the benchmark Hang Seng Index ascended by 2.43%. The country’s No. 2 official who ascended earlier this month, Premier Li Qiang, reinforced China’s commitment to open its economy and deliver reforms that can stimulate consumption and international business. During a speech delivered at the Boao Forum for Asia, a four-day summit for business and government leaders, Li pledged that China’s recovery would deliver new momentum to the world economy despite challenges in the geopolitical environment.

The Week Ahead

Scheduled for release in the coming week are the important economic reports regarding personal credit and employment and unemployment rates.

Key Topics to Watch

- Louis Fed President Bullard speaks

- S&P final U.S. manufacturing PMI

- ISM manufacturing

- Construction spending

- Fed Gov. Cook speaks

- Factory orders

- Job openings

- Cleveland Fed President Mester speaks

- ADP employment

- S. trade balance

- S&P final U.S. services PMI

- ISM services

- Initial jobless claims

- Continuing jobless claims

- Louis Fed President Bullard speaks

- S. employment report

- S. unemployment report

- Average hourly wages

- Average hourly wages (year over year)

- Consumer credit

Markets Index Wrap Up