U.S. equity indexes closed lower Wednesday, but ended off the session’s worst levels, weighed down by selling in the energy, materials and information technology sectors.

Investors also were digesting comments from Federal Reserve officials about when the central bank should ease monetary programs as the most severe impact of the COVID pandemic recedes.

How did stock indexes trade?

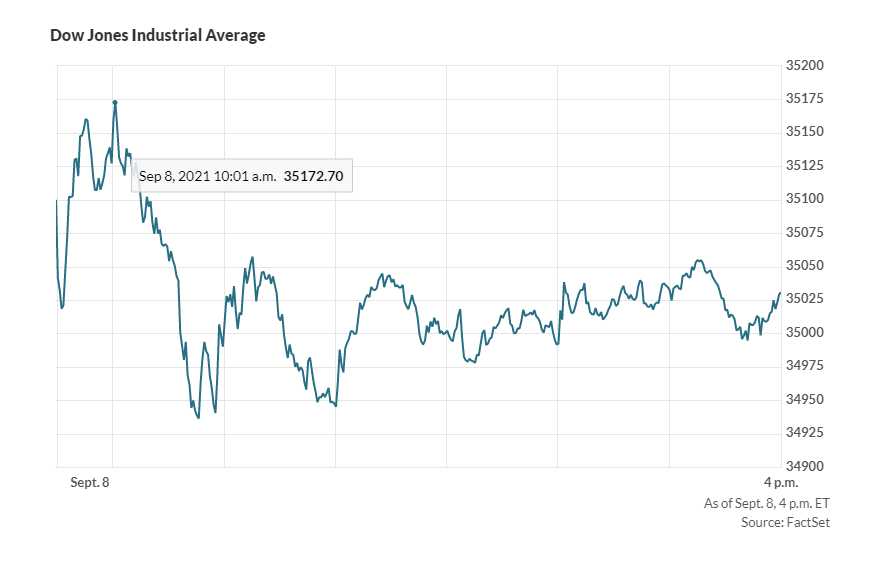

- The Dow Jones Industrial Average DJIA, -0.20% fell 68.93 points, or 0.2%, ending at 35,031.07, after touching an intraday nadir at 34,925.61, representing the lowest level for the blue-chip gauge since about Aug. 20, FactSet data show.

- The S&P 500 index SPX, -0.13% shed 5.69 points, or 0.1%, finishing at 4,514.07.

- The Nasdaq Composite Index COMP, -0.57% dropped 87.69 points, or 0.6%, closing at 15,286.64.

- The small-cap Russell 2000 RUT, -1.14% underperformed, shedding 1.1%.

On Tuesday, the Dow industrials fell 269.09 points, or 0.8%, to finish at 35,100, the S&P 500 slipped 15.40 points, or 0.3%, to end at 4,520.03. The Nasdaq Composite gained 10.81 points, or 0.1%, to finish at 15,374.33.

What drove the market?

Stocks ended lower Wednesday in relatively light trade, following the Labor Day holiday, where markets were closed on Monday, and the end of Rosh Hashana, which concludes at sunset on Wednesday.

Traders sold shares in the information technology, energy and materials sectors as uncertainty grows about the outlook for stocks after a strong second-quarter earnings period. Doubts also have emerged about the persistence of supportive monetary policies, credited with fueling record gains for stocks, now considered richly valued.

“I think markets are becoming a bit more defensive over the past couple of days,” said James Ragan, D.A. Davidson’s director or wealth management research, in a phone interview.

“We’re seeing some outperformance in traditionally defensive sectors, including utilities and consumer staples, and less participation from the tech sector, even though that’s holding up relatively well.”

Ragan attributed the “mild pullback” and “mild rotation” to some fears about economic growth in light of the delta variant of the coronavirus, but also to concerns about inflation, tapering and rancor in Washington over spending, taxes and the budget.

A clutch of Wall Street banks, including Goldman Sachs, have cut U.S. growth targets in the wake of weaker-than-expected jobs figures.

The Federal Reserve’s Beige Book on Wednesday showed that economic growth slowed to a moderate pace in early July through August, while noting that safety concerns tied to the delta variant of COVID-19 prompted a pullback in dining out and travel, which weigh on the greater economy.

On top of that, Treasury Secretary Janet Yellen said in a letter to congressional leaders Wednesday that the department could run out of room next month to keep paying the government’s bills unless Congress steps in to suspend or raise the federal borrowing limit.

“A delay that calls into question the federal government’s ability to meet all its obligations would likely cause irreparable damage to the U.S. economy and global financial markets,” Yellen wrote.

New York Fed President John Williams said Wednesday that the U.S. labor market hasn’t seen the “substantial” progress necessary for the central bank to slow down its massive $120 billion in monthly bond purchases, but he expects reduced monthly purchases to start later this year.

St. Louis Fed President Bullard also reiterated in a Wednesday interview with the Financial Times that he expects tapering to start later this year and to end sometime by the first half of next year.

In other economic data, job openings rose to a record 10.9 million in July, the Labor Department said Wednesday, marking the fifth straight all-time monthly high and exceeding forecasts for a rise of 10 million. Job hires, however, slipped by 160,000 to 6.7 million in July. Separations rose 174,000 to 5.8 million.

While some strategists remain optimistic about the outlook for markets, investors also have been advised to be more discerning.

“The best days of cyclical value may be behind us, but it’s too early to turn fully to defensive themes. We are sticking with the reflation trade, but with a focus on identifying companies likely to experience upward earnings revisions,” wrote Lauren Goodwin, economist and portfolio strategist at New York Life Investments in a note published Wednesday.

“We favor a global allocation, with an overweight to international developed equity. Value and small cap equities, with a focus on quality companies, should continue to thrive,” the strategist wrote.

Which companies were in focus?

- Spectrum Brands Holdings Inc. SPB, +17.79% soared 17.8% after the branded consumer brands company announced an agreement to sell its hardware and home improvement business for $4.3 billion in cash to Sweden-based ASSA ABLOY.

- Coinbase Global Inc. shares COIN fell 3.2%, after the crypto exchange said Wednesday that a U.S. regulator intends to sue it in court if it launches a planned program letting users earn interest on lending crypto.

- Meme stock GameStop Corp. GME, -0.10% is slated to report quarterly results later Wednesday. Shares closed down 0.1%.

- NIO Inc. NIO, -6.04% shares fell 6% after the Chinese electric-car company announced plans to sell up to $2 billion in fresh U.S. shares.

How did other assets trade?

- The yield on the 10-year U.S. Treasury note TMUBMUSD10Y, 1.329% slipped nearly 3.7 basis point to 1.333%. Yields move in the opposite direction of prices.

- The ICE U.S. Dollar Index DXY, -0.10%, a measure of the currency against a basket of six major rivals, rose 0.2%.

- Oil futures rose, with the U.S. benchmark CL00, 0.74% advancing 1.4% to close at $69.30 a barrel on the New York Mercantile Exchange. Gold futures GC00, 0.30% fell 0.3% to settle at $1,793.50 an ounce.

- European equities closed lower, with the Stoxx Europe 600 SXXP, -0.43% down 1.1% and the FTSE 100 UKX, -1.16% ending Wednesday’s session off 0.8%. The European Central Bank will meet Thursday, and economists expect a modest reduction in the rate of bond purchases.

- In Asia, the Shanghai Composite SHCOMP, +0.49% rose 1.5%, while the Hang Seng Index HSI, -2.30% slipped 0.1% and Japan’s Nikkei 225 NIK, -0.57% advanced 0.9%.