GE expected to swing to a profit in the second quarter, with results due out before Tuesday’s opening bell

General Electric Co. investors were upbeat Monday, as they got set for the industrial conglomerate’s latest earnings report due out the next morning.

The stock GE, +1.65% gained 1% in afternoon trading. It has now bounced 7% since it slumped 4.4% on July 19 to close at a five-month low, as part of a broad-market selloff.

GE is slated to release its second-quarter results on Tuesday, before the opening bell.

Investors may be taking comfort in the fact that GE management had plenty of opportunity to warn them about a potential shortfall since first-quarter results were reported, and full-year guidance was provided, in late-April. GE participated in no less than six conferences hosted by brokerages, as well as the Paris Air Show last month and hosted the annual general meeting in May.

And although fellow aerospace company Lockheed Martin Corp.’s LMT, -3.34% second-quarter profit came up a bit shy of Wall Street projections, it appeared to result from a company-specific issue in its aeronautics business rather than disappointing industry demand.

Lockheed said it had to book a $225 million, or 61 cents-per-share loss, during the quarter in its aeronautics business related to performance issues experienced on a “classified” program. To assure investors that this was a temporary issue, Lockheed boosted its full-year profit outlook.

If there is a concern, it could be more tied to valuation, rather than earnings results or any updates to its outlook.

The stock has been in a holding pattern that past several months, and most recently tested the downside of that trading range with last week’s broad-market-induced selloff. That holding pattern followed a 53.4% rocket ride up in 2020, the biggest one-year gain 37 years, and then a 22% further bump up over the first three months of this year.

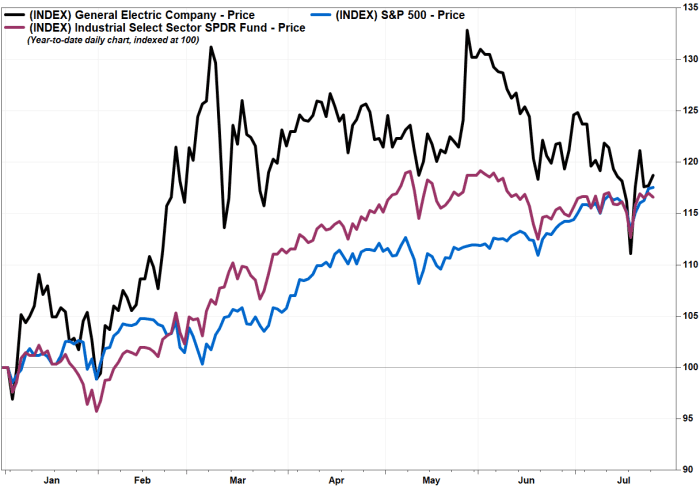

Overall, the stock has run up 18.9% year to date, to outperform the SPDR Industrial Select Sector exchange-traded fund’s XLI, -0.05% 16.6% rally and the S&P 500 index’s SPX, +0.24% 17.6% advance.

UBS analyst Markus Mittermaier acknowledged that there was some risk that margins in GE’s aviation business could miss expectations, but he said that would largely be “a backward-looking effect” resulting from noncash margin review and has nothing to do with his forward-looking call on improving free cash flow.

“If there was weakness of the stock on this, we would consider this a buying opportunity,” Mittermaier wrote in a note to clients our Friday.

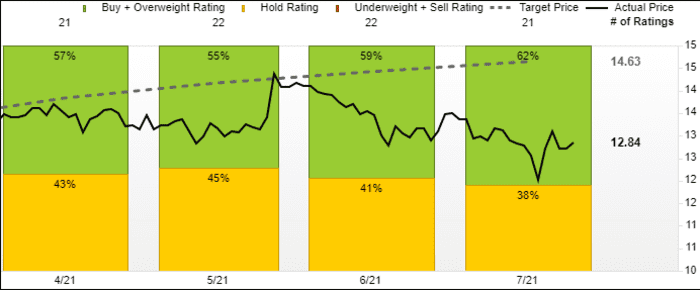

He reiterated the buy rating he’s had on the stock since December 2019, and kept his price target at $17, which implies a gain of about 32% from current levels.

Meanwhile, Edward Jones analyst Jeff Windau maintained the hold rating he’s on GE since August 2019, while reiterating his $13 price target, which is just over 1% above current levels.

Windau said that airline traffic and plane orders have been improving, but shifts in industry growth expectations amid recent uncertainties over the COVID-19 pandemic could cause some near-term volatilities in the stock price. He’s also cautious regarding what other liabilities may be coming from its GE Capital business down the road and how GE’s power business will make out in the current environment.

“Aircraft demand has been improving, and GE maintains a solid position in health care imaging equipment,” Windau wrote in a recent note. “However, our outlook is balanced by a depressed power equipment market and our caution on potential future finance business liabilities.”

In all, of the 21 analysts surveyed by FactSet who cover GE, 13 have the equivalent of buy ratings on the stock and eight are neutral. There are currently no analysts who recommend selling.

The average price target is $14.63, or about 14% above current levels, with a range of as low as $5 to a high of $21.

What Wall Street is expecting

Earnings: The average estimate of the analysts surveyed by FactSet is for GE to swing to adjusted earnings per share of 3 cents for the second quarter from a loss of 15 cents in the same period a year ago. That’s exactly what the consensus was after GE reported first-quarter results were reported on April 27.

Estimize, a crowdsourcing platform that gathers estimates from buy-side analysts, hedge-fund managers, company executives, academics and others, is for a slightly higher EPS of 4 cents.

Revenue: The FactSet consensus is for revenue of $18.14 billion, up from $17.75 billion a year ago, and just slightly above the $18.11 billion Wall Street was projecting at the end of April. The Estimize revenue consensus is at $18.21 billion.

Among GE’s business segments, the FactSet revenue consensus is $5.16 billion for Aviation, $4.30 billion for Healthcare, $4.09 billion for Power and $3.87 billion for Renewable Energy.

Industrial free cash flow: The average estimate for free cash flow (FCF), a measure that is closely watched by GE investors, is negative $338.3 million for the second quarter.

In late April, GE provided full-year 2021 guidance ranges for adjusted EPS of 15 cents to 25 cents, organic industrial revenue growth in the “low-single-digit” percentage range and industrial FCF of $2.5 billion to $4.5 billion.

Stock reaction

GE’s stock slipped 0.6% after first-quarter results, as the company beat profit and FCF expectations but fell a bit short on revenue.

The stock has gained ground on the day after six of the past 12 quarterly reports were released. The average gain on the up days over that period was 7.5%, while the average decline on the six down days was 3.7%.