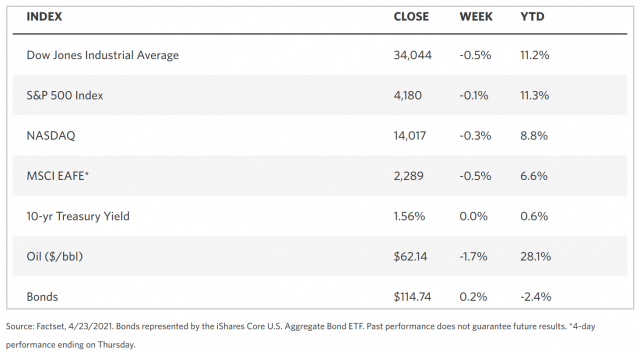

Stock Markets

Overall, during the week, stocks changed little on very light trading volume, the lightest daily volumes so far for 2021. The small caps slightly outperformed the large caps while the Nasdaq Composite Index marginally trailed the broad market. Expanding our perspective. on April 16, the U.S. stock market was poised at a record high. The reasons for the rally appear to be well supported by the robust economic recovery, increase in reported corporate profits, and the release of the new Federal Reserve stimulus. There were some signs of investor anxiety as the S&P 500 dropped during three of the five trading days, although this may be seen as a reasonable correction given that the market has descended only 1.2% from its recent peak. The rapid and steady gains over the past year may be the cause of some jitters at the slightest volatility in the market. Over the past year, the stock market has dropped by more than one percent during only 28 daily trading sessions. There have been only three 5% corrections and none over 10% during the same year. It is therefore possible that a major correction might be forthcoming.

U.S. Economy

While it seems that the bull market will continue in the longer term, there are some challenges that the economy faces as the country moves forward for the remainder of the year. Three factors may continue to create some volatility in the financial markets.

- Tax hikes are likely to occur in the coming months as the government struggles to meet its ambitious spending plans with appropriate sources of funding. President Biden proposes to hike the capital gains tax which has created some ripples in the equity market over the past week. The proposal aims to raise the tax rate to 39.6% over the present 20% for those earning $1 million per annum. This is joined by a proposal to raise the corporate tax rate to 28% from the current 21%, reversing in part the tax cut instituted in 2018.

- Inflationary pressures continue to exist, although it is not expected to reach the inflation levels of the seventies. Although the current inflation trend is flat, the combination of supply-chain disruptions and rising demand will likely tend to pull consumer prices higher. The occasional spikes that are bound to take place will not catch the market off-guard, however. After a temporary jump, the market will adjust due to the year-on-year comparison period. What is likely to take place is that inflation will subside as a result of the more sustained economic reopening, a return of supply in the services sector, and a developing slack in the labor market.

- So far, three asset bubbles show signs of developing, in particular Reddit stocks, cryptocurrencies and non-fungible tokens of NFTs. Sudden surges in the prices of these assets have attracted investor attention, causing prices to rise further. These packets of market interest have so far been supported by excess liquidity. Past bubbles involving the dot-com stocks resulted from overvaluations and unsustainable price acceleration throughout the stock market. This does not appear to be the case presently, and it is doubtful that the potential bubbles in these assets will spark another widescale shock in the financial markets.

Metals and Mining

Gold continued onto its third straight week of gains particularly as the rallies by the US 10-year Treasury yields and the American dollar lost steam and entered into consolidation. Further fueling the rise of gold prices were concerns over U.S. President Biden’s planned tax hike and the scheduled meeting of the U.S. Federal Reserve. Gold reached a four-week high of $1.796.50 per ounce by Wednesday, April 21, from $1,775.90 the week prior. Thursday saw a price pullback to $1.780, leading to a Friday close at $1,772.47. The metal may resume its uptrend should inflationary pressures continue to firm up.

Silver likewise followed the volatility of gold prices, with silver impacted by the movement of Treasury yields and currency fluctuations. It rallied to $26.62 per ounce on Wednesday from $25.84 on Monday, then retracing to end the week at $25.88. Silver is expected to register gains by the year’s end, according to the annual World Silver Survey. Palladium rose to an all-time high on Friday at $2,875 per ounce but corrected to $2,762, while platinum closed the week at $1,223 per ounce.

Base metal prices moved sideways for the week. Copper prices remained flat for the week, beginning at $9,415 per tonne and closing the week at $9,475.50. Nickel succumbed to some pressure throughout most of the week. While rising demand appeared to be pushed by electric vehicle manufacturing and stainless steel production, additional production from Indonesia may reduce the impact of the added demand. Nickel traded at $16,009 per tonne by the close of the week. Zinc and lead likewise shed some value, with zinc closing on Friday at $2,805 per tonne and lead at $2,017.

Energy and Oil

Oil prices continued sideways for the week, buoyed by the growing optimism in the US and European markets but pressured downwards by the downside risks that prevail particularly in India. The massive sub-continent posted record-setting Covid-19 cases day after day, setting off speculations that demand for fuels may plummet by 20% in April as a result of the lockdowns extending anywhere from a few weeks to two months.

In other related news, U.S. President Joe Biden pledged at the climate Summit on Thursday to cut down greenhouse gas emissions by 50-52% by the year 2030. Canada raised its target from the previous 30% to 40-45% cut while Japan also raised its commitment to 46% cut from a previous 26%. In the meantime, oil supermajors have committed to making billions of dollars in low-carbon energy investments and pledged to realize net-zero goals over the next ten years. Their shed assets are however being snapped up by smaller oil and gas companies.

Natural Gas

The residential and commercial demand for natural gas increased significantly week-over-week, pushing the price of natural gas in most markets upwards. From April 14 to 21, the Henry Hub spot price increased by $0.05 from $2.60/MMBtu to $2.65/MMBtu from a weekly high of $2.69/MMBtu on Tuesday. The residential and commercial sectors continue to lead to an increase in U.S. natural gas consumption.

Globally, the demand for natural gas was weaker than expected based on the forecast for industrial demand and the onset of warm weather. This has led to month-end inventories at 1.78 trillion cubic feet which exceeded the anticipated level, erasing the inventory deficit relative to the five-year average. However, despite the lull in demand, it was observed that there is an ongoing ramp-up in the production of natural gas after an 18-month slowdown. This is according to proclamations by Rystad Energy and the Bank of America, predicting strong production gains over the next three years.

World Markets

The European stock market dipped on concerns of an increased coronavirus case load and the chances that the anticipated economic recovery will be impeded. The dismal sentiment overshadowed the strong corporate earnings reports. The pan-European STOXX Europe 600 Index ended moved slightly southward for the week by 0.78%, even as major benchmark indices followed suit. Italy’s FTSE MIB registered the largest dip at 1.45%, followed by Germany’s Xetra DAX Index at 1.17% down, and France’s CAC-40 Index at 0.46%. The UK’s FTSE 100 Index likewise pulled back by 1.15%.

The core eurozone bond yields initially rose early in the week on optimism regarding the rollout of the vaccines. The sentiment shifted, however, when Christine Lagarde, president of the European Central Bank, announced that it was preemptive to withdraw the stimulus. This resulted in a fall in the UK gilt yields, mirroring the U.S. Treasury yields. The movement in the Fed yields coincided with volatility in the equity markets and the presidential announcement that taxes will be raised on higher-income earners.

In Japan, worries about the coronavirus continued to weigh on the markets. A brief rally on Thursday was overtaken by negative sentiments that dominated throughout the week and across all sectors. The Nikkei 225 Index lost more than 650 points for the week, briefly breaking down below the 29,000 mark before it somewhat recovered and finished at 29,020.63, 2.2% lower than the previous week’s close. The broader TOPIX Index also closed lower. The yen lost ground to the U.S. dollar, transacting at slightly below JPY 108 on Friday. The yield of the benchmark 10-year Japanese government bond proved to be more resilient, ending the week at 0.069% lower than last week’s close. The coronavirus concerns were spurred by the report of nationwide daily infections exceeding 5,000 for the first time in three months, prompting Japan’s Prime Minister Yoshihide Suga to declare a state of emergency in several prefectures.

On the Chinese front, the CSI 300 Index that tracks large-cap issues rose by 3.4% for the week, and the benchmark Shanghai Composite Index went up by 1.4%. Beginning Monday, Chinese stocks advanced steadily even as mainland equity markets received inflows from Hong Kong via Stock Connect totaling $2.5 billion. This was the third-largest single-day inflow from Hong Kong investors. The positive investor sentiment is credited to the issuance of new rules from China’s financial regulators. After the close of the market on April 16, the country’s Security Regulatory Commission (CSRC) announced the adoption of several new market reforms. One of these reforms is a commitment to curb the unregulated expansion of fintech firms. Amendments were also made to the requirements companies have to fulfill to qualify for listing on Shanghai’s Star board, China’s equivalent for the Nasdaq exchange.

The Week Ahead

Next week, important economic reports scheduled to be released include GDP, the inflation deflator, and personal income and expenditure.

Key Topics to Watch

- Durable goods orders

- Core capital goods orders

- Case-Shiller home price index (year-over-year)

- Consumer confidence index

- Homeownership rate

- Trade in goods, advance report

- Federal Reserve announcement

- Fed Chair Jerome Powell press conference

- Initial jobless claims (regular state program)

- Gross domestic product (SAAR)

- Pending home sales index

- Employment cost index

- Personal income

- Consumer spending

- Core inflation

- Chicago purchasing managers’ index

- Consumer sentiment index (final)

Markets Index Wrap Up