It’s all looking one way for commodities, Goldman Sachs analysts say in a note to clients.

Analysts led by Jeffrey Currie said there is the beginning of a new structural bull market, with every market but cocoa and zinc in structural deficit.

“Lockdowns have driven a wedge between the consumption of services and goods, generating additional demand from both households and governments looking to stimulate activity while minimizing the virus spread,” they said. They use the acronym REV to describe what’s going — Redistributional policies, Environmental policies, and Versatility in supply chain initiatives.

The Goldman analysts said the bull market is being driven by demand, not supply. They said there is a change in the way governments interact with the economy, citing the passage of $950 billion in stimulus from the lame-duck Congress, the European Union’s green initiatives, the acceleration of a Chinese restocking cycle, and progress on the $1.9 trillion coronavirus-relief plan from the Biden administration.

Both China and the U.S. have moved to accelerate a retrenchment of key supply chains, with China looking at limiting rare-earth exports while the White House ordered a review into U.S. supply-chain vulnerabilities after automobile makers ran low on microchips, the analysts added.

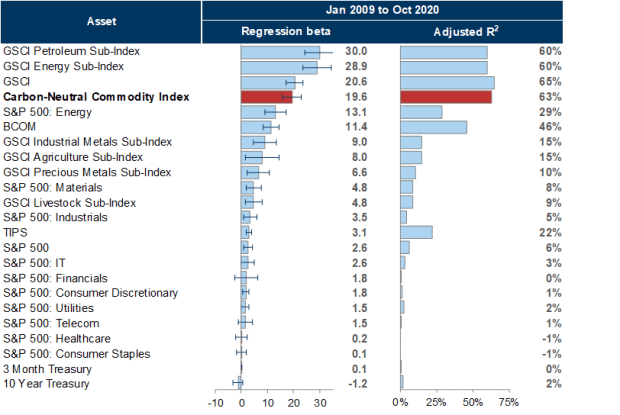

“We see supply across all of these markets chasing demand higher but not catching up, leading to demand pull inflationary pressures, even in oil. Moreover, commodities are the crucial link between growing demand, a weaker dollar and inflation, which is why they have been statistically the best hedge against inflation,” they said.

Through Tuesday, crude-oil futures CL.1, 0.99% have surged 25% in 2021, copper HG00, -2.01% futures have gained 17%, and natural gas NG00, -0.31% has gained 9%. Agricultural commodities including wheat W00, -1.16% also have gained ground.

Gold GC00, -1.16% is the exception, shedding 9%. The WSJ dollar index BUXX, 0.19% has gained 1%.