U.S. weekly jobless claims rise to 3-month high

U.S. stock indexes finished mixed Thursday as rise in weekly jobless benefit claims and few signs of progress on another fiscal stimulus package in Congress were offset by hopes for an imminent rollout of a coronavirus vaccine to support the economic recovery.

How are stock benchmarks performing?

On Wednesday, the Nasdaq saw its worst daily decline in six weeks.

What’s driving the market?

U.S. stocks pared early losses to end mixed Thursday, with the Nasdaq Composite booking gains, despite a report on employment signaling labor-market weakness amid a resurgence of coronavirus cases.

New applications for U.S. unemployment benefits leapt in early December to a near three-month high, likely due to an increase in layoffs as coronavirus cases surged. Claims totaled 853,000, rising from the 716,000 a week ago, the Labor Department reported Thursday. State continuing jobless claims rose 230,000 to 5.76 million in late November.

“These types of data points are pretty challenging for the near-term picture for equities, and calls into question the recovery we’re seeing,” said Matt Forester, chief investment officer of BNY Mellon’s Lockwood Advisors, in an interview.

Chris Larkin, managing director at E-Trade Financial said the claims numbers provided “a stark reality of shutdowns across the country which could fuel volatility in the weeks ahead,” but noted that the jump in jobless claims “may reignite negotiations.”

In other U.S. economic news, the consumer-price index rose 0.2% in November, and core CPI, excluding volatile food and energy, was up 0.2%

Negotiations in Congress on another financial-aid package for workers and businesses, as well as legislation to fund government operations, have thus far sputtered in Washington. A plan is needed before year-end to prevent about 12 million Americans from losing unemployment benefits and stop families across the country from getting evicted from their homes, but after months of talks there is little sign of agreement between the Republican controlled Senate and the Democrat led House.

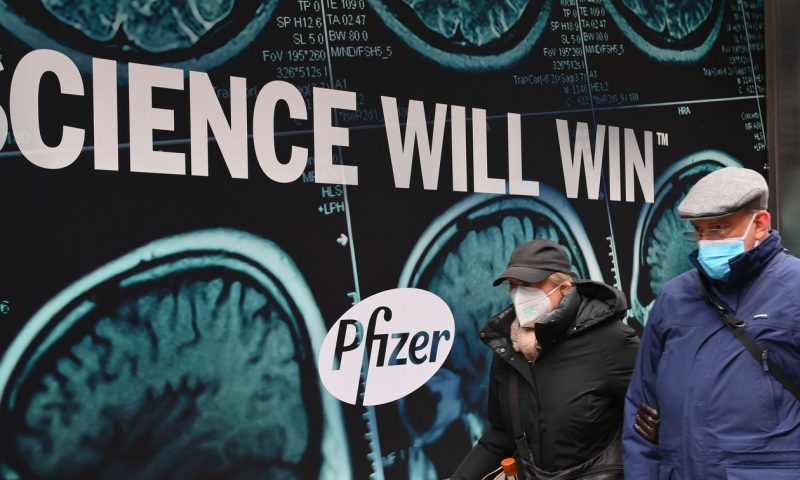

However, the U.S. Federal Drug Administration is holding a meeting of its Vaccines and Related Biological Products Advisory Committee Thursday to weigh the risks of BioNTech BNTX, +5.48% and Pfizer Inc.’s PFE, -0.29% experimental COVID-19 vaccine before voting on whether the FDA should authorize the vaccine. A similar meeting for Moderna Inc.’s MRNA, -0.57% vaccine candidate has been scheduled for Dec. 17.

The global tally of confirmed cases of the coronavirus that causes COVID-19 rose to 68.9 million on Thursday, according to data aggregated by Johns Hopkins University, while the death toll rose above 1.57 million. The U.S. has the highest case tally in the world at 15.4 million and on Wednesday set a record of more than 3,000 deaths, according to a New York Times tracker.

“In the meantime, the vaccines haven’t arrived and we’re experiencing the worst death rates since the beginning of the crisis,” said Forester.

Markets also were considering the ECB decision to boost the size of the pandemic emergency purchase program by €500 billion and extend its targeted longer-term refinancing operation for banks.

In Brexit developments, the U.K. and EU extended talks till Sunday after a three-hour dinner between Britain’s prime minister Boris Johnson and European Commission President Ursula von der Leyen, in Brussels Wednesday night.

Johnson warned the U.K. should be prepared to leave the European Union without a trade deal in hand.