Stock Markets

Stocks brushed off the uncertainties around the economic recovery and finished the week higher on hopes that Congress will reach a deal on another coronavirus-relief bill. Attention turned back to the virus and its effects after news that President Trump and First Lady Melania Trump have both tested positive for COVID-19 and that they will be going into quarantine. On the economic front, the U.S. economy added 661,000 jobs, marking a slowdown in the pace of job gains, but the unemployment rate came in better than expected at 7.9%. Analysts believe that the economic recovery is entering a slower phase, but a gradual improvement in the labor market, along with low interest rates and fiscal stimulus, should provide support.

US Economy

The political environment seemed to play a large role in driving sentiment over the week. Investors kept a close eye on conflicting signals on stimulus negotiations between Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi, with reports surfacing Tuesday that Republicans were willing to approve a fourth coronavirus stimulus package totaling as high as USD 1.6 trillion—somewhat closer to the Democrats’ latest USD 2.2 trillion proposal. On Wednesday, Pelosi said that she was “hopeful” a deal would be reached, and Mnuchin said there would be “one more serious try.”

Metals and Mining

The gold price rallied above US$1,900 per ounce early on Friday following news that US President Donald Trump and the First Lady have both tested positive for COVID-19. Markets experienced a flurry of activity in the wee hours on Friday after Trump’s Twitter announcement, with the Dow Jones Industrial Average shedding 304 points. Volatility is expected to be muted if the president is asymptomatic, or conversely could ratchet up if his condition deteriorates. The positive diagnoses pushed safe havens higher, with gold breaking past US$1,900 in the hours after. The yellow metal could draw more appetite in the coming weeks if senior cabinet members or other high-ranking officials who work alongside POTUS also test positive. The author of “Why Gold? Why Now?” sees the asset breaching US$2,500 by the end of the calendar year, motivated by government stimulus, inflation and the devaluation of the US dollar. Silver moved higher early in the week, hitting US$24.28 per ounce on Tuesday ahead of first presidential debate. Volatility sent the white metal back below US$24 on Wednesday and Thursday, but Tucker sees the white metal breaking the US$40 mark this year, propelled by many of the same catalysts as sister metal gold. Silver was trading for US$24.05 at 11:12 a.m. EDT on Friday. For its part, platinum experienced a sharp price fall mid-week. Climbing to US$883 per ounce on Tuesday, recovery pressure forced the metal 2.9 percent lower a day later. While platinum struggled this session, palladium spent most of the period edging higher. On Monday, the metal was priced at US$2,153 per ounce, but by Wednesday its weekly high of US$2,251 had been achieved. On Friday, platinum was priced at US$874, while palladium was at US$2,207.50.

With markets around the globe reacting the president’s COVID-19 test results, base metals were pushed lower, prompting concerns that a larger decrease may be in store if prices follow the drop in equities. Copper prices, which began slipping in mid-September, regained some lost ground on Monday and had broken past US$6,600 per tonne by Wednesday. The red metal continued a modest increase on Thursday. Copper was selling for US$6,614 on Friday morning. Zinc performed a similar mid-week rally, hitting US$2,418 per tonne for its five-day high. Unable to sustain its momentum, the metal pulled back, falling sharply to its Monday trading range. Zinc was valued at US$2,365 on Friday. Nickel was less volatile for the first week of October but could face challenges ahead. “Broad risk-aversion across the LME base metals complex emerged on Thursday afternoon, when US House Representative Nancy Pelosi and Treasury Secretary Steve Mnuchin failed to strike an agreement on a fiscal stimulus package to continue the United States’ fight against Covid-19,” said Metal Bulletin. This could be further challenged by the US leader’s newly reported COVID-19 status. Nickel was priced at US$14,430 per tonne on Friday. Lead fell to a four-week low on Wednesday but managed to hang in above US$1,800 per tonne. Lead started the last day of trading for week valued at US$1,809.

Energy and Oil

Crude prices fell on Friday following news that President Donald Trump tested positive for the coronavirus. Broader equities also tumbled. As of midday trading, Brent was down more than 4 percent, dipping below $40 per barrel. A Wall Street Journal analysis found that the median pay for executives of U.S. oil and gas companies rose for four consecutive years to $13 million in 2019, up from $9.9 million in 2015. Over that time period, median shareholder returns fell 35 percent. Energy was the worst-performing sector in the S&P 500, but shale CEOs received larger raises last year than in all but two of the 11 major industries analyzed. A combination of legal challenges to natural gas pipelines, policies aimed at reducing emissions, and public scrutiny over natural gas could lead to a “measured reduction” in natural gas demand over the next two to three decades, according to a new report from Moody’s Investor Relations. “We’re raising the flag,” Ryan Wobbrock, vice president and senior credit officer at Moody’s Investors Service Inc. and the lead analyst on the report, told E&E News. “We’re talking about a multidecade horizon of risk.” The highly volatile U.S. natural gas benchmark prices are set to trend higher in the coming months amid lower domestic production, higher demand in the winter, and recovering global gas prices in Europe and Asia. Henry Hub prices have been volatile over the past few weeks, but have firmed up at around $2.50/MMBtu, sharply higher than levels from just a few months ago.

Natural gas spot prices fell at most locations this week. The Henry Hub spot price fell from $1.74 per million British thermal units (MMBtu) last week to $1.63/MMBtu this week. At the New York Mercantile Exchange (Nymex), the October 2020 contract expired Monday at $2.101/MMBtu, down 2¢/MMBtu from last week. The November 2020 contract price decreased to $2.527/MMBtu, down 27¢/MMBtu from last week to this week. The price of the 12-month strip averaging November 2020 through October 2021 futures contracts declined 7¢/MMBtu to $2.901/MMBtu.

World Markets

Shares in Europe rebounded as investors snapped up beaten-down stocks, especially in the financials sector. News that President Trump and his wife had tested positive for COVID-19 eroded some of the market’s gains. In local currency terms, the pan-European STOXX Europe 600 Index ended the week 2.02% higher, with major indexes also posting gains. Germany’s Xetra DAX Index rose 1.76%, France’s CAC 40 gained 2.01%, and Italy’s FTSE MIB climbed 1.96%. The UK’s FTSE 100 Index added 1.78%.

Core eurozone bond yields declined overall. The 10-year German bund yield fell markedly as worries resurfaced over the effect of a second coronavirus wave on the economic recovery as well as low inflation. Uncertainty in U.S. politics following an acrimonious first presidential debate and President Trump testing positive for the coronavirus also put downward pressure on yields. Peripheral eurozone bond yields also fell on the week.

Chinese stocks rose slightly in a holiday-shortened week, lifted by several economic readings showing that the recovery was on track, but they ended September with their biggest monthly loss since May 2019. Technology shares outperformed, and Shanghai’s tech-focused STAR 50 Index rose 4.0% ahead of the initial public offering of Chinese fintech company Ant Group, which could raise up to USD 30 billion in a Hong Kong-Shanghai dual listing set to happen in the coming weeks. China’s stock markets are closed from October 1 to October 8 for a national holiday. In fixed income markets, the yield on China’s 10-year sovereign bond edged up four basis points and ended at 3.17%. The yuan strengthened 0.4% against the U.S. dollar and ended the week at CNY 6.79 per dollar.

The Week Ahead

Economic data being released include the ISM services index on Monday, JOLTS job openings on Tuesday, and the September Fed meeting minutes on Wednesday.

Key Topics to Watch

- Markit services PMI

- ISM services index

- Trade deficit Aug.

- Job openings Aug.

- FOMC meeting minutes

- Consumer credit

- Initial jobless claims (state program, SA)

- Initial jobless claims (total, NSA)

- Continuing jobless claims (state program, SA)

- Continuing jobless claims (total, NSA)

- Wholesale inventories

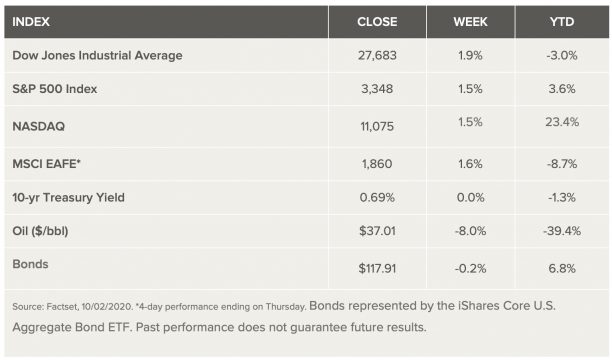

Market Summary