Society’s mood has turned negative, lessening Trump’s chances

The stock market is a more powerful presidential re-election indicator than gross domestic product, inflation and the unemployment rate combined. That was the key finding of a 2012 paper by our team at the Socionomics Institute. And it is currently bad news for Donald Trump.

Our study examined every presidential reelection bid going back to George Washington’s run for a second term in 1792. Regardless of whether we studied elections from the 18th, 19th, 20th or 21st centuries, the stock market remained a reliable, powerful and significant indicator of presidents’ fates at the ballot box.

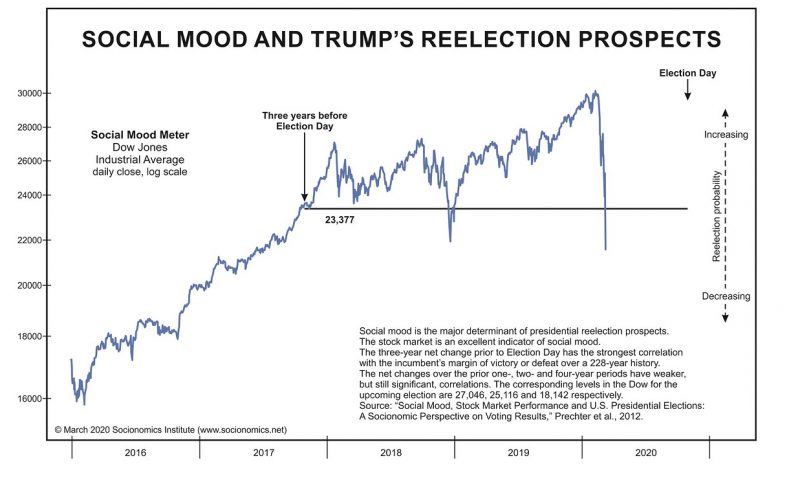

Specifically, we found that the net percentage change in the stock market in the three years leading up to Election Day had a significant correlation with the incumbent’s margin of victory or defeat. The market’s net percentage changes over the one, two and four years prior to the election were weaker, but still significant, re-election indicators.

As of its close on March 12, the Dow Jones Industrial Average DJIA, +9.36% was lower than its levels one, two and three years before Election Day.

Social mood

You might think that the results indicate that voters vote their pocketbooks — or at least their portfolios. But we found differently. Almost no one owned stocks in the 1700s, 1800s or even early 1900s, yet the stock market remained a reliable re-election indicator.

We used Robert Prechter’s socionomic theory to explain our results.

The theory proposes that waves of social mood regulate the ups and downs in the stock market as well as other social attitudes and actions, such as voters’ propensity to retain an incumbent. As social mood becomes more positive, society sends stock prices higher and becomes more inclined to re-elect the leader, and vice versa.

Thus social mood, not the stock market per se, regulates society’s inclinations to keep the incumbent or throw the bum out.

An interesting example of this causality is the experience of Richard Nixon, who was re-elected in a landslide in 1972 in a positive-mood environment near the top of a roaring stock market rally. He was then hounded from office less than two years later in a negative-mood environment, near the end of what was then the greatest stock market slide since the Great Depression.

Nixon resigned before he could be impeached, as the stock market tanked. Trump, on the other, survived impeachment proceedings and the Senate’s trial with his presidency intact, as the stock market soared.

Now, the market has headed in the opposite direction and so have the president’s chances to win another term.

Improbable doesn’t mean impossible

Yet a falling stock market doesn’t guarantee an incumbent defeat, nor does a rising stock market guarantee an incumbent win. Rather, rises and falls in the market signal corresponding shifts in the probability of the incumbent’s re-election. As we all know, in politics improbable doesn’t mean impossible. Each individual election may have features untracked by our social-mood model.

What about Trump’s election win in 2016? We found that in elections that feature no incumbent candidate, such as the one in 2016, there is no reliable historical relationship between the stock market and the performance of the incumbent party’s candidate. The same result held when we used GDP, inflation and unemployment as re-election indicators.

As we explained in the paper, “When no candidate in a presidential election is the recognized leader whom voters have unconsciously credited or blamed for their mood, they appear to base their voting decisions substantially on other factors.”

The chart shows the level of the stock market three years prior to Election Day 2020 relative to its current level. While the stock market’s level presently suggests the odds are shifting against the president, a lot can happen between now and Nov. 3, 2020. Stay tuned. We should be in for a wild ride.

Matt Lampert is the director of research at the Socionomics Institute. He is a graduate of the University of Cambridge and has spoken about socionomic theory throughout the U.S. and Europe.