An annual report charts the growing wealth and inequality around the world.

Despite an economic slowdown and facing increased tariffs from a trade war with the United States, China has surpassed America in having the highest number of residents in the top 10% of the world’s wealth. That is according to the 2019 Global Wealth Report, put together by Credit Suisse Group, a Swiss multinational investment bank and financial services company.

The report shows both the growing wealth and the rising inequality around the world and particularly in China, the world’s second-biggest economy. Public anger over inequality has helped fuel protests around the world this year.

“However, inequality has risen considerably since the year 2000,” say the authors of the 10th edition of the Credit Suisse wealth report. “China now has 4.4 million millionaires and achieved another landmark this year with 100 million members of the global top 10%, overtaking for the first time the 99 million members in the United States.”

In addition, the Chinese account for nearly half of the people considered to be in the middle class, with the Asian nation having managed to lift more than 850 million people out of poverty in the past 40 years.

China “was one of the few countries to avoid the impact of the global financial crisis,” say the experts from Credit Suisse. “China’s progress has enabled it to replace Europe as the principal source of global wealth growth and to replace Japan as the country with the second-largest number of millionaires.”

Although the country started from a much lower position at the beginning of the 21st century, China has seen accelerated economic growth and developed wealth faster than other nations. During this century, total household wealth in China has risen seventeenfold, from $3.7 trillion to $63.8 trillion, more than triple the rate of the majority of nations.

“The global financial crisis caused a small setback, but wealth growth soon resumed and, unlike most other economies, China came close to matching its pre-crisis pace, at least until 2014,” notes the report. More importantly, neither the debt level, nor the current trade conditions are seen as affecting China’s consistent growth in the upcoming years, the experts from Credit Suisse report.[

Among other findings in the analysis:

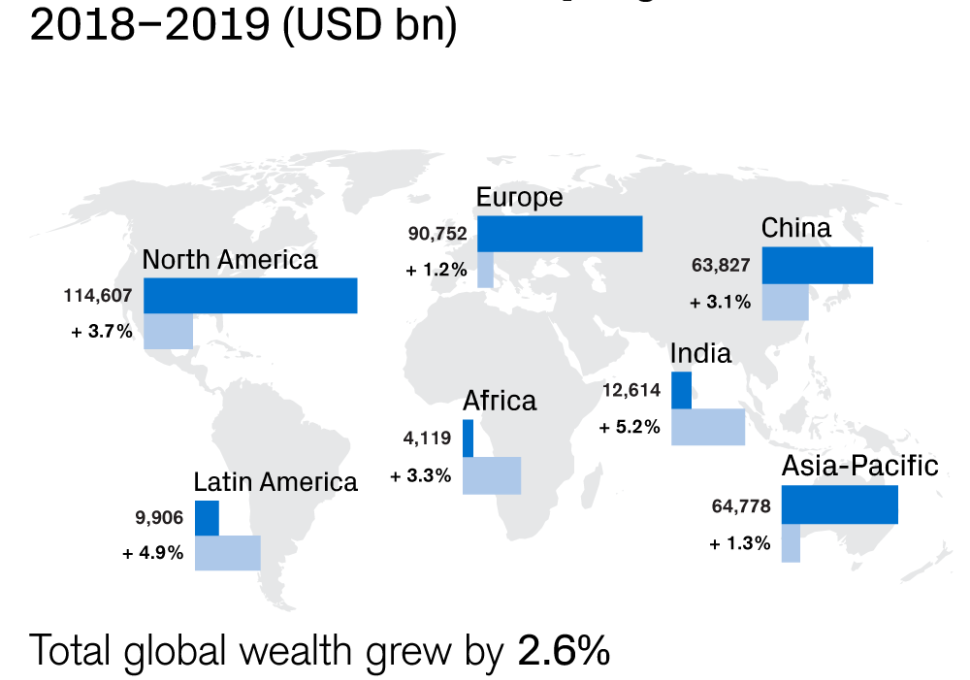

- Global wealth reached $361 trillion in 2019. There are currently 47 million millionaires in the world, representing 1% of adults who collectively own 44% of all wealth.

- By total household wealth, China is behind only the U.S., buoyed by a strong property market, say the report’s authors. “The proportion of household assets in non-financial form rose from 43% in 2015 to 53% in 2019.” By international standards, China’s debt ratio is still low.

- The number of very wealthy people in the United States is still the highest in the world. The United States has the most members in the top 1% of wealth, and holds 40% of the world’s millionaires. Americans with wealth above $50 million are about four times more numerous than the same socio-economic category in China.

- Switzerland tops the list of nations with the highest average wealth per adult, at $564,650, followed by Hong Kong ($489,260) and the U.S. ($432,370).

Other countries are also growing in wealth. India has seen consistently better numbers after a setback in 2008 during the financial crisis. Wealth has steadily increased, reaching a peak in 2017 of $15,000 per adult. As of mid-2019, average wealth per person in the country was $14,569.