Synlogic Inc (NASDAQ:SYBX) – Equities researchers at Jefferies Financial Group cut their Q3 2019 EPS estimates for shares of Synlogic in a report released on Tuesday, August 20th, according to Zacks Investment Research. Jefferies Financial Group analyst C. Howerton now forecasts that the biotechnology company will post earnings per share of ($0.74) for the quarter, down from their previous estimate of ($0.62). Jefferies Financial Group also issued estimates for Synlogic’s Q4 2019 earnings at ($0.74) EPS, FY2019 earnings at ($2.46) EPS, FY2020 earnings at ($1.36) EPS, FY2021 earnings at ($1.25) EPS, FY2022 earnings at ($1.36) EPS and FY2023 earnings at ($0.31) EPS.

A number of other brokerages have also issued reports on SYBX. Wedbush restated an “outperform” rating and issued a $20.00 target price on shares of Synlogic in a research note on Friday, August 9th. Piper Jaffray Companies set a $10.00 target price on Synlogic and gave the stock a “buy” rating in a research note on Wednesday, September 4th. Oppenheimer lowered Synlogic from an “outperform” rating to a “market perform” rating in a research note on Tuesday, August 20th. HC Wainwright restated a “buy” rating and issued a $13.00 target price on shares of Synlogic in a research note on Monday, September 9th. Finally, ValuEngine upgraded Synlogic from a “sell” rating to a “hold” rating in a research note on Thursday, August 1st. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and six have given a buy rating to the stock. The stock presently has an average rating of “Buy” and a consensus target price of $15.22.

Shares of SYBX traded down $0.04 during midday trading on Friday, hitting $2.59. 73,093 shares of the company’s stock traded hands, compared to its average volume of 325,112. The stock has a market capitalization of $82.47 million, a price-to-earnings ratio of -1.28 and a beta of 2.60. The company has a current ratio of 14.43, a quick ratio of 14.43 and a debt-to-equity ratio of 0.13. The firm’s fifty day moving average is $4.12 and its 200-day moving average is $7.12. Synlogic has a 1 year low of $2.31 and a 1 year high of $14.59.

Synlogic (NASDAQ:SYBX) last issued its quarterly earnings data on Thursday, August 8th. The biotechnology company reported ($0.45) EPS for the quarter, beating the consensus estimate of ($0.49) by $0.04. Synlogic had a negative return on equity of 34.75% and a negative net margin of 1,844.96%. The firm had revenue of $0.35 million during the quarter, compared to analyst estimates of $0.96 million.

Institutional investors and hedge funds have recently made changes to their positions in the business. Bank of Montreal Can grew its position in Synlogic by 5,743.1% during the 1st quarter. Bank of Montreal Can now owns 12,738 shares of the biotechnology company’s stock worth $97,000 after purchasing an additional 12,520 shares during the period. Parametric Portfolio Associates LLC acquired a new stake in Synlogic during the 2nd quarter worth about $195,000. Charles Schwab Investment Management Inc. grew its position in Synlogic by 11.1% during the 2nd quarter. Charles Schwab Investment Management Inc. now owns 37,208 shares of the biotechnology company’s stock worth $339,000 after purchasing an additional 3,708 shares during the period. Bank of New York Mellon Corp grew its position in Synlogic by 12.1% during the 4th quarter. Bank of New York Mellon Corp now owns 56,774 shares of the biotechnology company’s stock worth $398,000 after purchasing an additional 6,129 shares during the period. Finally, Alps Advisors Inc. grew its position in Synlogic by 4.5% during the 1st quarter. Alps Advisors Inc. now owns 61,466 shares of the biotechnology company’s stock worth $467,000 after purchasing an additional 2,658 shares during the period. 64.90% of the stock is currently owned by institutional investors.

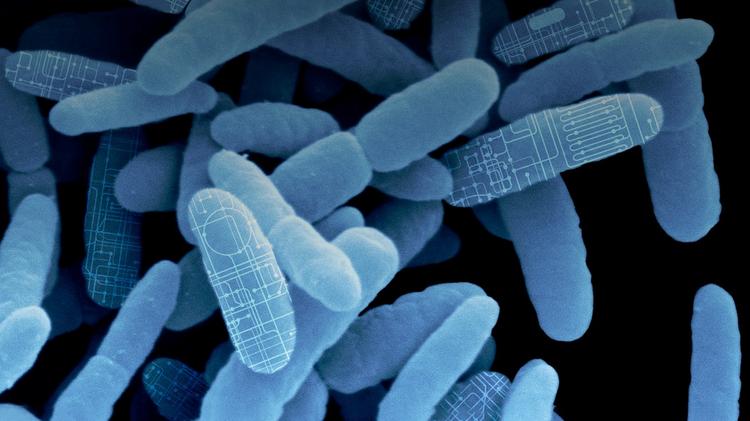

Synlogic Company Profile

Synlogic, Inc a clinical-stage biopharmaceutical company, focuses on the discovery and development of synthetic biotic medicines to treat metabolic, inflammatory, and cancer diseases in the United States. Its lead therapeutic programs include SYNB1020, an oral therapy for the treatment of hyperammonemia, which includes patients with liver diseases, such as hepatic encephalopathy, as well as patients with urea cycle disorders; and SYNB1618, an oral therapy that is in Phase I/IIa clinical trial to treat phenylketonuria.