Gold futures finished lower on Monday, following a four-session streak of gains, pressured by uncertainty ahead of a meeting of the U.S. Federal Reserve that’s expected to offer hints on the central bank’s plan on interest rates.

International trade clashes and a concern over a weakening global economy, however, limited losses for the haven metal.

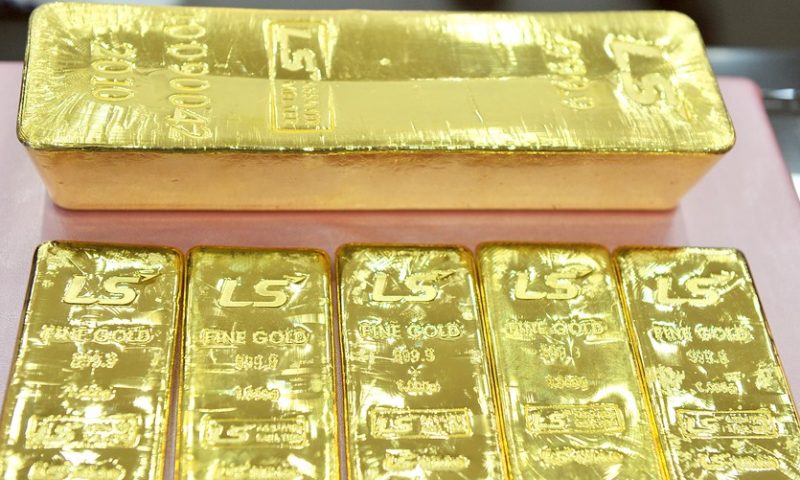

The yellow metal for August delivery GCQ19, +0.46% fell $1.60, or 0.1%, to settle at $1,342.90, after closing Friday action with a weekly loss of 0.1% based on the most-active contract prices, FactSet data show. Prices on Friday had climbed to as high as $1,362.20, the highest since April 2018.

For now, “traders have been quick to sidestep and to put last week Middle East escalation in the rear-view mirror, as a significant military escalation remains unlikely,” said Stephen Innes, managing partner at Vanguard Markets. “Geopolitical risk in Hong Kong faded as the local government shelved the controversial extradition bill buttressing regional risk sentiment.”

Meanwhile, “ambitious U.S. rate cut prognostications have pulled back in the wake of the robust [U.S. dollar] retail sales print” reported Friday, he said.

The Federal Open Market Committee will conclude a two-day policy meeting on Wednesday.

In economic data Monday, the New York Fed’s Empire State business conditions index took a sharp turn for the worse in June, falling into negative territory for the first time in more than two years.

“The Empire Manufacturing data along with NAHB Housing index both showing weakness…is significant; particularly the sharp decrease in new orders from Empire Manufacturing,” said Jeff Wright, executive vice president of GoldMining Inc. “All point to a decrease in Q2 GDP which could dovetail into more significant problems; but I don’t think trigger a recession.”

“The FOMC most likely will not lower interest rates this week; but will pave the way with a change in language in their statement for a rate decrease in July along with more speculation going forward,” he said.

Some commodity strategists say the precious metal could be facing resistance from bearish traders who think prices have climbed too briskly and the metal also is encountering a price point that is has failed to climb above since late June of 2016 when Britain voted to exit from the European Union, jolting global markets.

“In any case, the jump seen in the final part of last week, could represent an important test to the key resistance level of $1,350-1,370, an area which has always stopped the recovery of bullion in the last 4 years, starting from summer 2016, just after the Brexit vote, when the yellow metal stopped its rally in this area (slightly above, at $1,374),” wrote Carlo Alberto De Casa, chief analyst at ActivTrades, in a daily research note.

The Office of the U.S. Trade Representative was due to open seven days of public hearings on the Trump administration’s proposal to raise a 25% levy on $300 billion of Chinese exports, including consumer goods such as mobile phones and laptops.

Worry about the impact of U.S.-led tariff battle have helped to push prices for precious metals, which tend to rise in times of uncertainty, to new highs before values pulled back to end last week’s trade.

In other metals trading, July silver SIN19, +0.21% added 2.6 cents, or 0.2%, at $14.829 an ounce, after ending Friday’s trade with a 1.5% weekly loss.

July copper HGN19, +0.17% settled at $2.647 a pound, up 0.7%. July platinum PLN19, +0.60% shed 1.3% to $794.60 an ounce and September palladium PAU19, +1.37% declined by 0.4% to $1,455.50 an ounce.

Among exchange-traded funds, SPDR Gold Shares GLD, -0.06% edged down by nearly 0.1%.