American Axle & Manufact. Holdings, Inc. (NYSE:AXL) – Research analysts at B. Riley reduced their Q1 2020 earnings estimates for American Axle & Manufact. in a research note issued to investors on Monday, May 6th, according to Zacks Investment Research. B. Riley analyst C. Horn now forecasts that the auto parts company will post earnings per share of $0.62 for the quarter, down from their prior forecast of $0.68. B. Riley also issued estimates for American Axle & Manufact.’s Q2 2020 earnings at $0.81 EPS, Q3 2020 earnings at $0.81 EPS, Q4 2020 earnings at $0.66 EPS and FY2020 earnings at $2.90 EPS.

American Axle & Manufact. (NYSE:AXL) last issued its quarterly earnings data on Friday, May 3rd. The auto parts company reported $0.36 earnings per share (EPS) for the quarter, topping the Thomson Reuters’ consensus estimate of $0.34 by $0.02. The business had revenue of $1.72 billion during the quarter, compared to the consensus estimate of $1.73 billion. American Axle & Manufact. had a positive return on equity of 18.62% and a negative net margin of 1.48%. The business’s revenue was down 7.5% on a year-over-year basis. During the same period in the previous year, the firm posted $0.98 earnings per share.

Several other equities analysts also recently issued reports on AXL. Zacks Investment Research upgraded American Axle & Manufact. from a “sell” rating to a “hold” rating in a research report on Friday, May 17th. Barclays reiterated a “buy” rating and set a $20.00 price objective on shares of American Axle & Manufact. in a research report on Thursday, May 9th. TheStreet downgraded American Axle & Manufact. from a “b-” rating to a “c” rating in a research report on Monday, March 25th. Buckingham Research dropped their target price on American Axle & Manufact. from $16.00 to $15.00 and set a “neutral” rating on the stock in a report on Monday, May 6th. Finally, ValuEngine raised American Axle & Manufact. from a “strong sell” rating to a “sell” rating in a report on Saturday, February 2nd. Two research analysts have rated the stock with a sell rating, four have given a hold rating and six have issued a buy rating to the company. The company currently has an average rating of “Hold” and an average target price of $17.50.

Shares of NYSE AXL opened at $10.62 on Wednesday. The company has a debt-to-equity ratio of 2.41, a current ratio of 1.47 and a quick ratio of 1.14. The company has a market cap of $1.22 billion, a PE ratio of 3.24, a price-to-earnings-growth ratio of 0.53 and a beta of 1.65. American Axle & Manufact. has a 12-month low of $10.13 and a 12-month high of $19.34.

In related news, insider Tolga I. Oal sold 14,876 shares of the business’s stock in a transaction that occurred on Tuesday, March 12th. The stock was sold at an average price of $14.47, for a total transaction of $215,255.72. Following the sale, the insider now owns 97,430 shares of the company’s stock, valued at $1,409,812.10. The sale was disclosed in a filing with the SEC, which is available through the SEC website. 1.30% of the stock is owned by insiders.

Several hedge funds and other institutional investors have recently bought and sold shares of AXL. Norges Bank bought a new position in shares of American Axle & Manufact. in the fourth quarter valued at $24,791,000. LSV Asset Management increased its holdings in shares of American Axle & Manufact. by 110.9% in the fourth quarter. LSV Asset Management now owns 3,634,780 shares of the auto parts company’s stock valued at $40,346,000 after buying an additional 1,910,943 shares in the last quarter. Barrow Hanley Mewhinney & Strauss LLC increased its holdings in shares of American Axle & Manufact. by 17.0% in the fourth quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 6,146,108 shares of the auto parts company’s stock valued at $68,222,000 after buying an additional 892,027 shares in the last quarter. Northern Trust Corp increased its holdings in shares of American Axle & Manufact. by 24.9% in the fourth quarter. Northern Trust Corp now owns 2,501,329 shares of the auto parts company’s stock valued at $27,766,000 after buying an additional 498,684 shares in the last quarter. Finally, Oregon Public Employees Retirement Fund bought a new position in shares of American Axle & Manufact. in the fourth quarter valued at $42,000. 98.64% of the stock is currently owned by institutional investors.

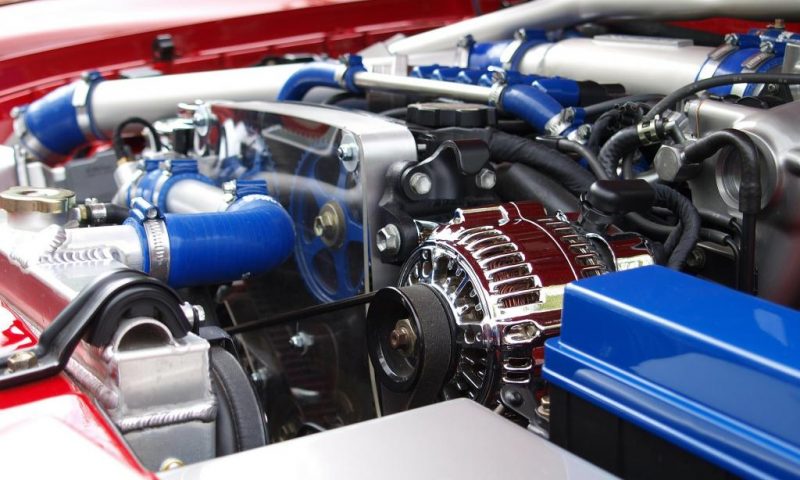

American Axle & Manufact. Company Profile

American Axle & Manufacturing Holdings, Inc, together with its subsidiaries, designs, engineers, validates, and manufactures driveline, metal forming, powertrain, and casting products in the United States, Mexico, South America, China, other Asian countries, Europe, and internationally. The company’s Driveline segment offers axles, drive shafts, power transfer units, rear drive modules, transfer cases, and electric and hybrid driveline products and systems for light trucks, sport utility vehicles, crossover vehicles, passenger cars, and commercial vehicles.