Stocks typically suffer in the weeks after index options expire

Stock market investors are looking forward to a “quadruple witching” Friday, as contracts for stock-index futures, stock-index options, individual stock options and individual stock futures all expire.

According to Charlie McElligott, managing director for cross-asset macro strategy at Nomura, the impending expiration of these options and futures contracts have been a boon for stocks in recent days, but he also warns upward momentum this week could turn into weeks of poor performance as March comes to a close.

McElligot wrote in a Tuesday note to clients that the impending expiration of options contracts is fueling the purchase of those stocks as owning options becomes ever riskier as the expiration day approaches, a process called “rolling out.”

Options-related buying “is syncing up with corporate buyback flows, which typically run at a massive pace this week as well, ahead of going into a ‘blackout’ by next week,” McElligot wrote, referring to a period of when companies and corporate insiders are prohibited from repurchasing their own shares in the month before the release of their quarterly results.

“This demand double-whammy” are the “two largest catalysts” for the stock market’s upswing this week, he added.

Indeed, the historical performance of stock markets during the week of March’s quadruple expiration event supports McElligot’s thesis. Jeff Hirsch, editor of the Stock Trader’s Almanac and chief market strategist at Probabilities Fund Management, pointed out in a blog post that “March’s option expiration week performance is second only to December’s and has a bullish bias.”

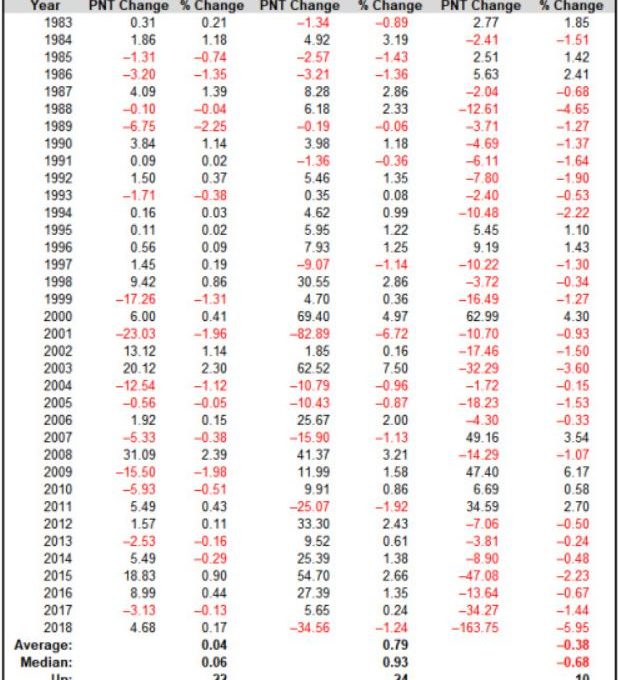

The Dow Jones Industrial Average DJIA, -0.38% and S&P 500 SPX, +0.30% “have recorded weekly gains in better than twice the number of weeks as declines,” he added, noting that the S&P 500 index typically rises 0.9% in the week leading up to March’s day of quadruple witching.

But these technical rallies are often short lived, as Hirsch points out that during the week following the March expiration, the S&P 500 typically sheds 0.7%.

McElligot thinks history will repeat itself this month. He argued that the evaporation of options-related buying, more corporations in a buyback blackout period and the tendency of equity portfolio managers “gross down” — or close out their long positions and cover their short positions toward the end of the quarter — will all put pressure on U.S. stocks in the final weeks of March.

“I continue to see [the convergence of these risks creating] a window for an equities pullback,” he wrote.