Nikkei, Hang Seng advance; indexes in China, Taiwan, South Korea closed

Asian markets traded mixed Monday amid speculation over next steps in the dispute between the U.S. and China over technology development, and trade following meetings in Washington last week.

Markets in mainland China and Taiwan are closed for the week for Lunar New Year celebrations. South Korean markets were closed for a holiday.

American and Chinese negotiators ended two days of talks in Washington last week without word of a deal, though those involved — including President Donald Trump — were optimistic about the road ahead.

Trump said he plans to meet his Chinese counterpart Xi Jinping to sort out contentious issues. “I think when Xi and I meet, every point will be agreed to,” Trump said, without specifying a date or location. A tariffs cease-fire between the U.S. and China is set to end on March 2, and the U.S. is expected to raise import taxes from 10 percent to 25 percent for $200 billion in Chinese goods.

“There is rising optimism on the trade talks between the U.S. and China, although no details have been nailed down. The upside is limited as President Trump also mentioned that if the talks are not successful a new round of tariffs is imminent,” Alfonso Esparza, senior market analyst at OANDA, said in a commentary.

Hong Kong’s Hang Seng index HSI, +0.21% closed up 0.2%. Japan’s Nikkei 225 index NIK, +0.46% advanced 0.46% and Australia’s S&P ASX 200 XJO, +0.48% gained 0.5%. New Zealand’s NZX index NZ50GR, -0.22% shed 0.2%. Shares fell in Singapore STI, -0.13% .

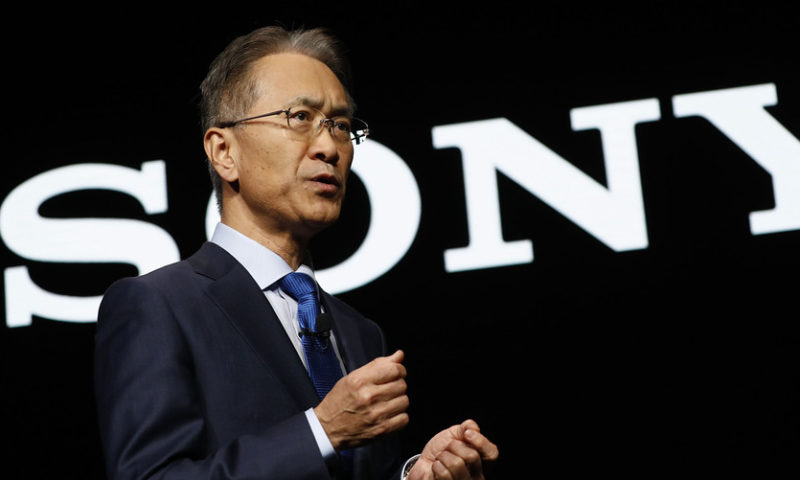

Among individual stocks, Sony Corp. 6758, -8.07% sank in Tokyo trading after the electronics company cut its revenue outlook for the year. Honda 7267, -3.48% and Mitsubishi Motors 7211, -3.41% also fell, while Nintendo 7974, +5.01% and Hitachi 6501, +4.11% jumped. In Hong Kong, insurance company AIA Group rose, but smartphone-component maker Sunny Optical slipped, while AAC Technologies 2018, -1.57% and CSPC Pharmaceutical 1093, -1.62% fell. In Australia, Rio Tinto RIO, -1.03% and Fortescue Metals FMG, -1.88% were down, while Woodside Petroleum WPL, +0.65% and National Bank of Australia NAB, +1.01% gained.

A strong jobs report showing that U.S. employers added 304,000 jobs in January, far more than what analysts were expecting, lifted most major indexes on Friday. But Amazon’s AMZN, +0.22% disappointing revenue outlook caused some traders to steer on the side of caution. The broad S&P 500 index SPX, +0.09% rose added 0.1% to 2,706.53 and the Dow Jones Industrial Average DJIA, +0.26% rose 0.3% to 25,063.89. The tech-heavy Nasdaq composite COMP, -0.25% lost 0.2% to 7,263.87.

A private survey released on Sunday suggested that China’s services activity slowed in January. The Caixin services purchasing managers’ index fell to 53.6 for the month, down from 53.9 in December, likely due to domestic conditions. Numbers over 50 indicate expansion on the index’s 100-point scale. But new export sales grew at the fastest pace in more than a year, in a nod to an easing trade standoff between the U.S. and China.

Benchmark U.S. crude CLH9, +0.42% rose 34 cents to $55.60 per barrel in electronic trading on the New York Mercantile Exchange. It added $1.47 to settle at $55.26 per barrel on Friday. Brent crude LCOJ9, +0.84% , used to price international oils, rose 56 cents to $63.34 per barrel.

The dollar USDJPY, +0.34% strengthened to 109.90 yen from 109.50 yen late Friday.