No single investment strategy stands out as a winner

The top performing investment newsletter in the Hulbert Financial Digest’s 2018 performance scoreboard is fully invested in stocks. The second-best newsletter, in contrast, is 75% in cash, convinced that the stock market’s near-term trend is down.

There’s a surprising range of opinions among the best stock-market newsletters. It’s actually good news that the top performers pursue widely disparate strategies. If there were only one road to riches, it would quickly become overcrowded and stop being worth following.

Consider first the top-performing newsletter in the Hulbert Financial Digest rankings for last year, among the couple of dozen for which there’s data. It is the Investor Advisory Service, edited by Douglas Gerlach, with a 2018 return of minus 1.7%, versus minus 6.8% for the Wilshire 5000 index.

Gerlach’s fully invested posture does not necessarily mean that he is overwhelmingly confident about the direction of the stock market in 2019. Like everyone else, he sees many storm clouds on the horizon. But he does not engage in market timing. “Owning quality, growing companies trading at reasonable-to-attractive valuations is the best recipe for long-term success,” he recently wrote to clients. “The market always provides special opportunities to selective investors who keep their eyes peeled for good growth at a fair valuation.”

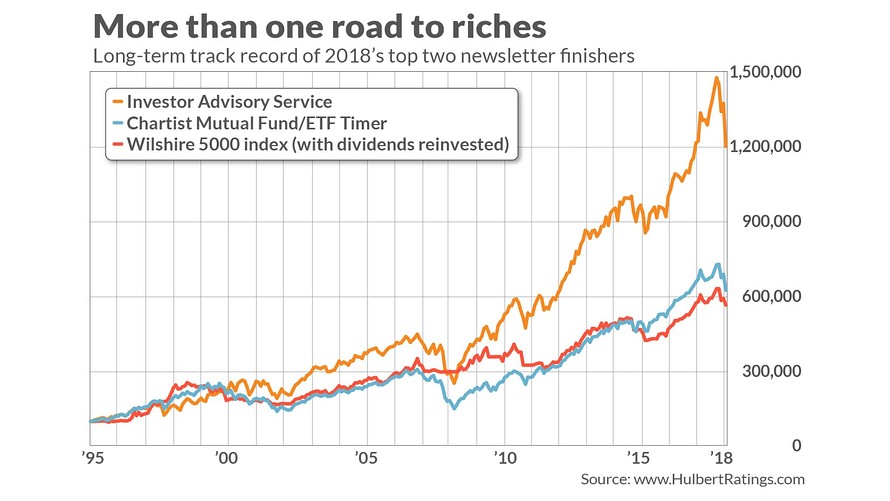

By the way, Gerlach’s approach has acquitted itself over the long-term, in addition to 2018, as the chart below shows. Since the beginning of 1996, according to Hulbert Financial Digest calculations, Investor Advisory Service has topped the Wilshire 5000 by an annualized margin of 3.1 percentage points.

The second-best performer in the Hulbert Financial Digest 2018 rankings was the Chartist Mutual Fund/ETF Timer, with a loss of 2.4%. Editor Dan Sullivan beat the market last year by moving to a 50% invested posture in late October and a 25% invested posture in December.

One reason Sullivan is keeping 25% invested in equities is that he believes the market’s longer-term outlook is more favorable. “While the near-term trend is bearish, the fact remains that despite the barrage of selling, our long term model is still positive… No question the market is attempting to carve out a bottom.”

Like Gerlach’s service, Sullivan’s newsletter also has beaten the market over the long term. His long-term record is particularly impressive on a risk-adjusted basis, since he has made more money than the market with significantly less volatility (or risk). That’s a winning combination.

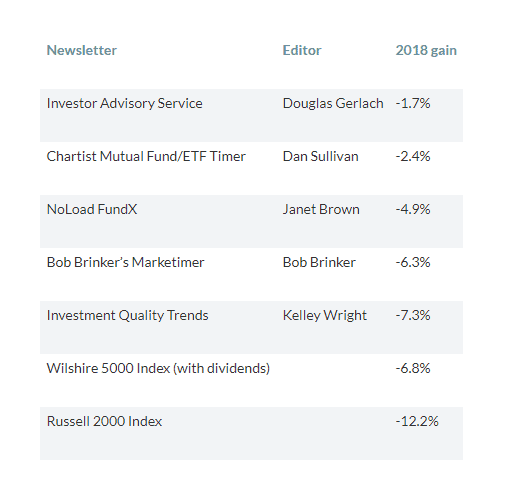

It’s not a fluke that the top performers pursue disparate investment strategies. On the contrary, it has been a commonplace occurrence over the four decades of my performance tracking. For example, among the newsletters that round out the top five for 2018 performance (see table below), we have another stock market timer and another that eschews it.

How should investors react to the broad approaches pursued by the top timers? My recommendation is not to attempt to devise a consensus strategy that combines each of their approaches. Instead, divide your portfolio into however many segments as there are top performers, and invest each segment according to the advice of its assigned newsletter. Otherwise, you risk losing the investment discipline that a top performer can provide.

Below is a listing of the top five finishers in the Hulbert Financial Digest’s 2018 scoreboard: