San Diego-based Illumina has a 90% market share and dominates all competitors

A huge breakthrough is happening in medicine. Doctors and scientists have been waiting on this breakthrough for decades. Yet it has escaped the notice of most investors.

As I said to my RiskHedge subscribers, it will save millions of lives and bring tens of billions in profit to the company achieving it. I’m not exaggerating.

The company with this breakthrough is called Illumina Inc. ILMN, -0.14%

Here’s some background.

Human genome project

The San Diego-based company aimed to “crack the code of life” by “mapping” the 3 billion DNA pairs present in humans. DNA carries your genetic information. Think of it as a set of instructions for your body. Mapping your DNA allows scientists to decipher your body’s unique set of instructions.

Among other things, DNA determines which diseases we’re vulnerable to. Most diseases — cancer, heart disease, diabetes — stem from our DNA. By learning your DNA, doctors can tell what diseases you’re likely to get. This allows them to diagnose them earlier and more accurately.

A total of 12 million Americans are misdiagnosed every year, according to leading scientific journal BMJ Quality & Safety. And with a disease like cancer, an accurate and timely diagnosis can literally save your life.

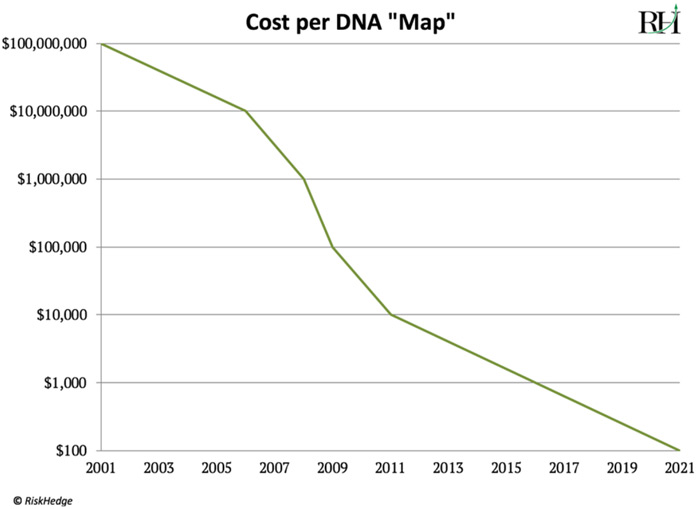

Scientists have known that all along. The problem was that mapping our DNA has been prohibitively expensive. It took scientists 13 years and $3 billion to complete the Human Genome Project. And just 17 years ago, getting your personal DNA mapped would have set you back $100 million. Even as recently as 2011, the late Steve Jobs of Apple AAPL, -0.54% forked over $100,000 to get his DNA mapped.

But this is all changing. Today it costs about $1,000 to map a human’s DNA. And according to Illumina, in two years it will cost only $100.

You can see the staggering plunge in cost right here:

DNA tests to become standard

Don’t be surprised if your doctor asks you to get your DNA mapped soon. As the cost plummets, the usage of DNA mapping in health care is exploding. For example, a new prenatal test based on DNA mapping can detect hard-to-find problems with babies inside a mother’s womb. It’s the fastest-growing medical test in American history.

Earlier this year, Medicare and Medicaid announced they will start reimbursing patients for DNA mapping tests. And medical provider Geisinger Health, based in Danville, Pa., has started including these DNA tests in its routine care.

Illumina (TICKER:ILMN)

Illumina is far and away the world leader in DNA mapping. It has a 90% market share and dominates all competitors. In fact, Illumina’s technology has completed nine out of every 10 DNA mappings ever done. Illumina’s cutting-edge DNA machines are the reason the cost to map a human’s DNA has fallen below $1,000.

When Illumina entered the market in 2006, it cost $10 million to map one person’s DNA. Each new Illumina machine has slashed these costs by millions of dollars. And its latest release will give us DNA mapping for $100.

Most investors haven’t heard of Illumina yet. But as DNA mapping becomes routine, it will be a household name. I expect Illumina to be synonymous with DNA testing — just as folks say “Google” GOOG, +0.56% GOOGL, +1.38% for “search” today.

Rivals lagging

Roche RHHBY, +1.82% the world’s second-largest pharma company, and Thermo Fisher Scientific TMO, +0.39% are its closest competition. Neither can compete with Illumina’s speed of innovation. And neither is a serious challenge to its dominance in DNA mapping.

With 800 patents on its DNA mapping machines, Illumina has an iron grip on this market. And it recently teamed up with health-care giant Bristol-Myers Squibb BMY, +3.16% to help introduce DNA mapping into hospitals across America.

Illumina essentially created the DNA mapping market. It wasn’t cheap. It took billions of dollars and countless man hours to drive mapping costs down to a level where most Americans can benefit from them. Despite this, Illumina has achieved record profits for five years in a row. And it’s on track to beat its record once again this year.

Illumina’s sales mix is the secret to its success. The company is best known for the DNA mapping machines it sells to hospitals and other medical professionals. These cost up to $10 million each. But drill down and you’ll find that two-thirds of its revenue comes from a different source.

To conduct a DNA mapping, a doctor will first take a sample of your blood or saliva. Then she’ll apply chemicals to it to extract the DNA. The DNA gets inserted into one of Illumina’s machines, which spits out a computer file that contains your genetic information.

The chemical part is key. These specialized chemicals are consumed with each mapping. So, hospitals and doctors must continually buy more. In fact, Illumina’s chemical sales have more than tripled in the past five years. This model gives Illumina a big financial advantage. Its ongoing chemical sales allow Illumina to collect a steady stream of cash every month.

As I’ve always said to my RiskHedge subscribers, the best investments are disruptive businesses with big, predictable cash flows. I call these “Autopilot Stocks” for their ability to generate consistent profits, month after month, as if on autopilot.

Even through Illumina drives the costs of DNA mapping into the ground, the company is achieving record profits. Illumina is truly a disruptive company that’s set to dominate an exploding industry. If it can maintain its 90% market share as I expect, its sales should triple over the next three years.

This should send its stock soaring to double its current stock price.