Investors more reluctant to leave despite continued underperformance, analysts say

Recent stock market volatility has slowed the exodus from actively managed mutual funds despite their continued underperformance.

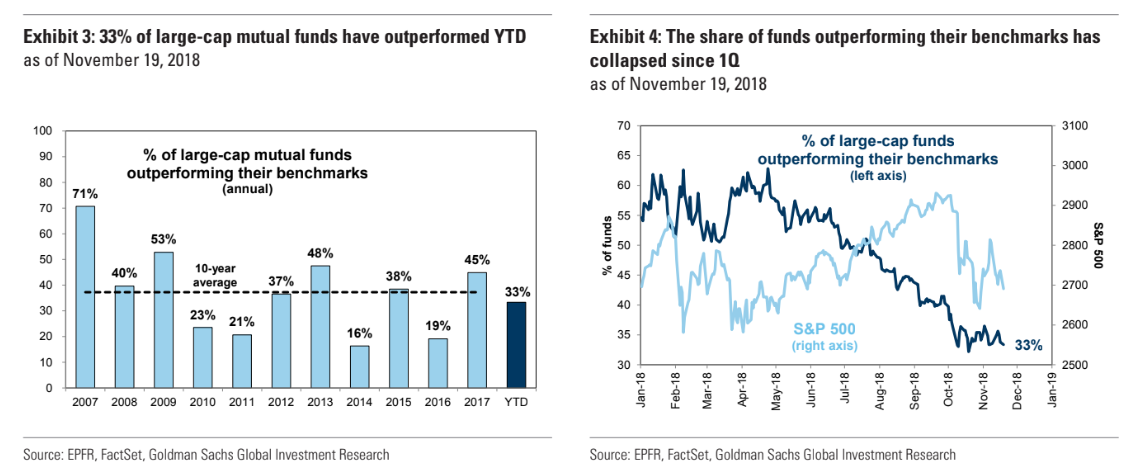

According to data published Wednesday by Goldman Sachs’ Portfolio Strategy Research, the share of large-cap mutual funds outperforming their benchmarks fell from 63% in April to 33% through the end of the third quarter (see chart below).

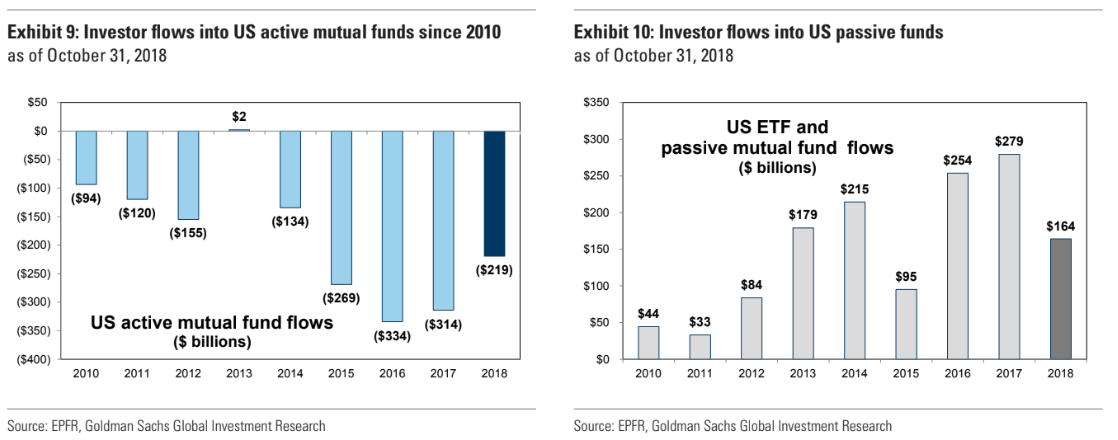

Despite chronic underperformance relative to a passive index strategy, investors have become less likely to pull their money from mutual funds than at any point in more than three years. According to Goldman, outflows from U.S. active mutual funds are at $219 billion, on pace to for the smallest level of outflows since 2014, when active mutual funds lost $134 billion in investor capital.

Meanwhile, passive funds have received $164 billion in inflows through Oct. 31, on pace for their slowest rate of growth since 2015, when $95 billion in capital flowed to passive strategies. However, the long-running trend of outflows from active funds and inflows into passive funds continues (see chart below).

“Elevated risk and uncertainty have likely reduced outflows from active funds this year, given that fund managers have the ability to reduce risk when equity markets fall,” wrote Goldman analysts, led by Arjun Menon. “We expect active fund outflows will be even smaller in 2019.”

In theory, higher volatility in 2018 should play to active managers’ advantage, but in reality, mutual fund performance has lagged that of 2017, when 45% of managers outperformed their benchmarks, during a period of historically low volatility.

Goldman analysts blame this underwhelming performance on active managers underweighting their exposure to information technology firms this year, which despite the recent pull back, have roughly doubled the performance of the broader S&P 500 index SPX, +0.27% More lately, mutual funds have suffered from an underweight allocation to defensive stocks. Consumer discretionary stocks month-to-date, for instance, have outperformed the S&P by more than 100 basis points, according to FactSet data.

Nevertheless, Goldman analysts predict that outflows from active mutual funds will continue to shrink in 2019, as they see it more likely than not that equity returns will be significantly lower than average over the next 12 months.

More foreboding, Goldman analysts “estimate a 30% chance of a of a 10% or more equity market decline by year-end 2019.” With this risk of a significant downturn looming, “the appeal of active management should increase given that funds have the ability to reduce risk when the equity market falls,” they write.

When times get tough, it appears more investors increasingly cling to the idea that active managers can shield them from market turmoil, no matter how they underperform.