ESG criteria in fixed income funds should focus on company’s financial strength, rather than market sentiment

Fund selectors should not treat environmental, social, and governance-integrated bond funds in the same way as they approach equity funds, according to Bluebay Asset Management.

The past year has seen a surge of interest in ESG-incorporated fixed income products. However, My-Linh Ngo, head of ESG investment risk at fixed income specialist Bluebay, argues that fund buyers need to recognise that their analysis of these funds should be fact-and-data-based focused on a company’s underlying financials, rather than driven by market sentiment.

Ngo told Expert Investor that the fixed income asset class only recently came onto the radar in terms of ESG, and that it was still in the educational stage where investors were figuring out what strategies would be appropriate.

She added that because equities had a lot of unique issuers but a limited amount of instruments available to invest in, it was fairly straightforward to decide what ESG strategy was best.

However, for fixed income, there was a smaller pool of unique issuers that had a multiple range of instruments.

“Bond prices are ultimately pegged to ‘is this issuer going to default?’ [Therefore] the analysis is not influenced by sentiment, it’s more factual based by looking at the company’s financial strength.”

“Bonds will have different types of instruments and securities you can invest in with different maturities, different yields, capital structure and levels of protection. This means that in an investment risk point of view it is not a binary decision because there’s not a single risk investment profile, unlike equities,” she said.

Ngo noted that equity was sentiment driven and a company’s share price was potentially more volatile to external shocks such as rumours.

“But when you look at fixed income, because bond prices are more ultimately pegged to ‘is this issuer going to default?’ the analysis is not influenced by sentiment, it’s more factual based by looking at the company’s financial strength,” Ngo said.

“So, because of those differences in relationships it’s really important to understand the materiality of an ESG risk is not a linear relationship.

“An approach like ESG integration which is looking at investment material ESG risks are particularly relevant and useful as a concept for fixed income. Whereas maybe there are more choices in other investment strategies for equities.”

She said there were characteristics that certain ESG strategies would play out better for emerging market debt versus developed markets, certain strategies would work better for sovereigns v corporates, or high yield v investment grade.

“You’ll also see a lot more differentiation of product offering in the near future,” Ngo said.

Engagement with sovereigns

In terms of ESG engagement, Ngo said that selectors needed to recognise that it was possible to engage with companies and governments but not to the same extent as with equities.

“The ability to engage with a country on human rights may be more difficult than to engage with a company on human rights. The ability to engage and get companies to change their practices in the high yield market may be more challenging than if you’re investing in a company that is investment grade,” she said.

“Investment grade companies tend to be larger, better resourced, so they are more able to respond to investor enquiries and expectations.”

On the sovereign side, Ngo said sovereign analysts did meet with government representatives and officials but it was more challenging than dealing with companies.

“Fundamentally you have to recognise that the government in place has not been elected by investors they’ve been elected by the people,” she said.

“When you engage with corporates it’s more straightforward, and you might see change within a year or two but when you’re engaging on long term labour or social reforms with a country, it’s not necessarily going to come through in six months or a year – it’s going to take a longer time frame. So you’ve got to have a lot more patience.”

Lack of fixed income ESG funds

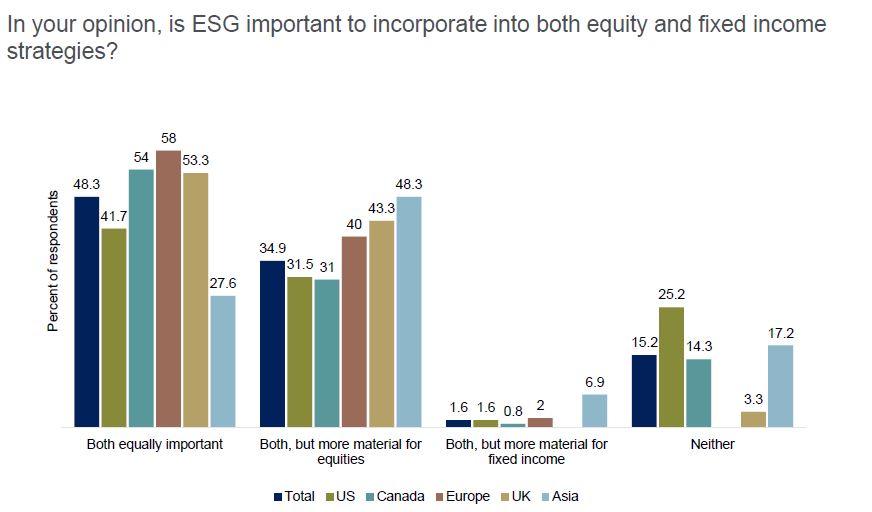

Bluebay’s parent, RBC Global Asset Management’s latest Responsible Investing Survey found that ESG analysis was moving beyond equities with 58% of European institutional investors believing that ESG was important to incorporate into both equity and fixed income strategies.

Another 40% said both were equally important but more material for equities and 2% said both were equally important but more material for fixed income.

Zero European respondents said neither were important, compared to 25.2% of US investors, 14.3% for Canadians, 3.3% of UK, and 17.2% for Asia

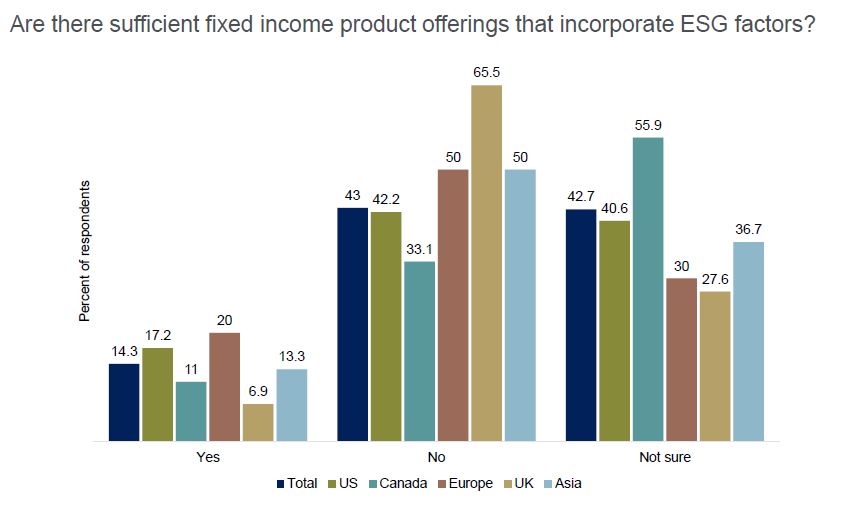

Despite the fact that half of investors believe both were equally important, only 20% of European investors said there were sufficient fixed income product offerings that incorporated ESG factors.

This was the highest response as only 17.2% of US investors felt the same way, followed by 13.3% from Asian investors, 11% of Canadian investors, and 6.9% of UK investors.

However, 50% of European investors said there were not a sufficient amount funds, and 30% were not sure.

“Here, the data points to a particular problem (or opportunity): while institutional investors see value in incorporating ESG into fixed-income strategies, many do not think there is enough product on the market,” the report said.

“Forty-three percent of respondents said there were not enough fixed-income product offerings that incorporate ESG factors, and nearly the same number said they weren’t sure. Just 14% said they thought there was enough product in the market.

“These results were consistent across the world, although more Canadian respondents were not sure. Whether this is truly an issue of available product or merely one of investor perception, it appears there is work to do by investment managers who are active in this space.”

Ngo said that most fixed income products that were tagged as ESG were mostly investment grade bonds and green bond funds but that there was an increasing interest in high yield, emerging market debt and sovereign bonds.

Top performing fixed income ESG funds

Looking at Morningstar data, there were only 141 fixed income funds that were classified as “socially conscious” out of 3442 that were domiciled in either Luxembourg or Ireland.

The data showed that the top fixed income fund that was categorised as being “socially conscious”, Arctic High Return Class B fund, returned 7.4% over the three years to 30 September 2018.

The Norwegian fund has a duration of 0.8 years and yield of 6.1%, according to its fact sheet.

Intermediate Capital Group Total Credit A EUR Accumulation fund came second with a return of 7.2% over the same time period.

This was followed by DPAM L Bonds Emerging Markets Sustainable E EUR fund at 6.1%, Robeco High Yield Bonds DH at 5.98%, and Robeco European High Yield Bonds DH at 5.97%.